Therefore, to overcome the difficulty out-of the very least credit history, maintaining a wholesome borrowing from the bank behavior, clearing their a fantastic costs, and to stop late repayments can develop a good credit score, easing the FHA mortgage procedure.

Credit rating

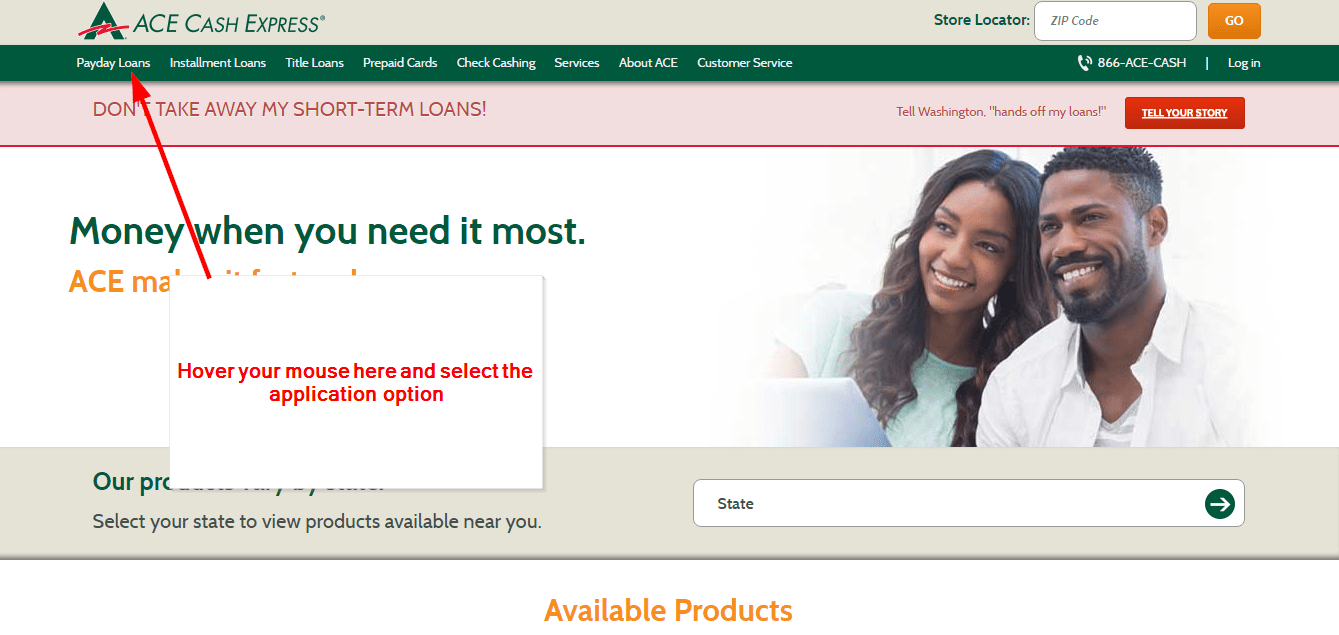

payday loans Ardmore no bank account

Mastering the crafting out-of a strong credit score having FHA money is paramount. Your own commission background and you may in charge borrowing from the bank conclusion is tall in the protecting the loan.

Talking about credit score inaccuracies try inevitable. Easily pinpointing and rectifying mistakes on the credit history can increase your odds of FHA loan recognition.

Debt-to-Income Proportion

Understanding the personal debt-to-income ratio is important on the FHA Financing process. It metric, measuring your total monthly expenses facing their disgusting month-to-month earnings, normally somewhat influence the loan recognition chances.

Enhancing your monetary reputation to own a great loans-to-money proportion comes to a-two-flex approach – broadening earnings otherwise reducing loans. This can lessen particular demands regarding getting an FHA financing.

Figuring DTI

Deciding your debt-to-Money (DTI) proportion is vital in order to protecting FHA fund. Its calculated by splitting the full monthly debt by your terrible month-to-month money. It numerical worthy of indicated because a percentage support lenders evaluate your power to perform monthly installments.

Misunderstandings regarding the DTI calculations often cause confusion and you can diminished odds of mortgage recognition. DTI is not just on the credit card bills or mortgages; additionally boasts student otherwise auto loans, alimony, and youngster help.

Opt for a beneficial DTI ratio below 43% to change your own FHA mortgage qualifications. Down ratios mean that you really have an acceptable earnings to cope with existing debts and you may a possible home loan, causing you to more appealing in order to lenders.

Beware of brand new myth that a premier earnings negates a top DTI. Despite substantial money, a premier DTI stands for prospective difficulties dealing with more mortgage money. Constantly focus on a balanced DTI to possess a smoother FHA loan recognition process.

DTI Limitations

Your debt-To-Income (DTI) proportion limit is actually a serious difficulty into the FHA fund; it determines the brand new proportion of your full monthly obligations toward terrible monthly money. It metric is vital when you look at the comparing a great borrower’s capacity to reimburse the mortgage.

Losing in short supply of the new DTI restriction? Adopting an inventive service eg paying small debts otherwise incorporating a life threatening other people’s earnings to the app is also simplify the compliance on the FHA’s DTI assistance.

Property Standards

Property requirements into the FHA loans realize strict assistance based by the Government Houses Management. Your own adherence to the standards can also be skyrocket your chances of mortgage approval. All of our complete book decodes this type of conditions, paving your path so you can possessions ownership.

Cruising owing to FHA mortgage possessions criteria is overwhelming, having its great amount out-of hurdles. You are helped by us browse this type of demands, making sure an easier excursion to your fantasy real estate investment.

Assessment Compliance

Unlocking the new gifts out-of FHA mortgage appraisal conformity relieves potential mortgage obstacles. Past currency and you can credit scores, land need to food really significantly less than rigorous FHA appraisal. Accepting this, savvy borrowers be certain that attributes satisfy agency requirements.

Assessment compliance presents a familiar challenge into the FHA loan procedure. Yet not, surpassing that it complications requires an insight into just what valuers focus on. The latest appraiser’s eye depends on your own prospective property’s security, shelter, and you may structural soundness.

Assessment compliance was an unexpected ace in the FHA mortgage maze. A certified property facilitate not just in financing recognition however in negotiating fair costs, also. Invest time in reading and navigating compliance; it’s worth the restored reassurance and you may monetary safeguards.

Evaluation Criteria

The newest FHA mortgage evaluation procedure guarantees the house or property is actually habitable and you will safer. The latest inspector, an expert approved by the Department regarding Property and Urban Invention, studies brand new property’s outside and interior for architectural stability.