- HUD allows around a keen 85% Loan To help you Worth into dollars-out re-finance

- Virtual assistant allows as much as 100% Loan In order to Worthy of toward dollars-away re-finance

- Federal national mortgage association and Freddie Mac succeed to a keen 80% cash-out refinance mortgage on the antique fund

Individuals who require in order to be eligible for home financing having a mortgage organization licensed from inside the multiple claims without financial overlays into authorities and you will traditional fund, excite contact us at Gustan Cho Partners at 800-900-8569. Individuals is email address us during the otherwise text message us to have a quicker response.

Gustan Cho Partners concentrate on permitting individuals be eligible for an FHA and you can/or Virtual assistant financing within the Chapter 13 Bankruptcy payment plan. Gustan Cho Couples specialize in guidelines underwriting. There is no wishing months following the Chapter thirteen Case of bankruptcy launch date. I have a nationwide reputation of without having any bank overlays towards government and you can conventional fund. Borrowers is also current email address us within Gustan Cho Associates is available seven weeks per week, evenings, weekends, and you can holidays.

Virtual assistant Refinance loan Alternatives for People

Virtual assistant finance are the best financing program in the us. Va finance feel the reasonable financial cost than just about any almost every other authorities and/otherwise traditional loan. not, just eligible veteran consumers can also be be eligible for Va financing. There are numerous advantages of Virtual assistant refinance finance while in the today’s booming housing industry that have historically low cost. On this page, we are going to discuss and you can defense Va Re-finance Finance and using Virtual assistant funds to refinance in the modern very hot housing marketplace.

General Guidelines for the Virtual assistant Re-finance Finance

In the present in love financial sector, the audience is researching about phone calls from your nation’s pros asking regarding the refinancing recommendations. This is an enjoyable experience getting a veteran to-do an excellent refinance transaction. Extremely phone calls we discovered are questions about the brand new Virtual assistant rate of interest prevention refinancing loan (IRRRL) together with installment loan Colorado Virtual assistant bucks-out re-finance guideline questions. Gustan Cho Lovers concentrate on Va mortgage money. Contained in this site, we’ll outline several guidelines to have Virtual assistant refinancing and how to try to get an excellent Virtual assistant refinance with our company.

What exactly are Virtual assistant Re-finance Financing

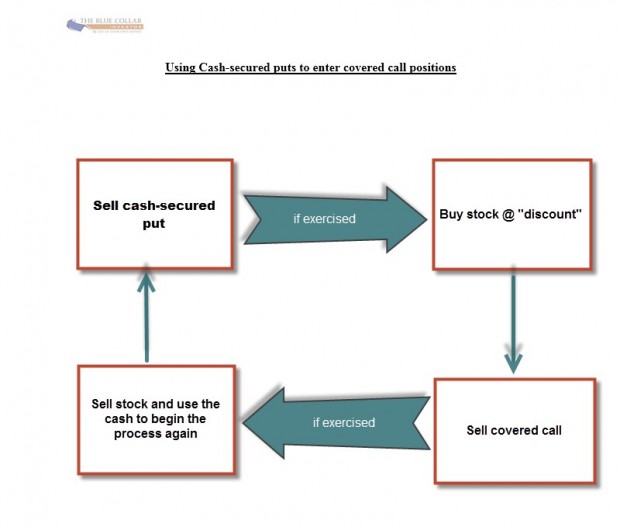

Earliest, let us see several principles. What is actually a beneficial Virtual assistant refinance? A Va refinance is many one thing. The fundamental definition is actually a great Virtual assistant refinance mode you only pay regarding your current home loan and begin a separate Virtual assistant home mortgage. There are a few other purchase brands available. You could potentially over a speeds and you will identity re-finance, cash-aside re-finance, otherwise mortgage loan prevention refinancing loan.

Rate And Name Virtual assistant Refinance Funds

A performance and you will term re-finance simply re-shed your existing mortgage on the fresh words. Definition you may progress from a 30-12 months repaired financial in order to a great 15-12 months repaired home loan. You are able to disperse into title and you can resume a thirty-12 months mortgage to lessen your current monthly payment. An effective Virtual assistant rate and you will title refinance isnt a very common types of purchase. But it’s a beneficial opportunity to save money having the present historically lower-interest rates.

Va Bucks-Out Re-finance Mortgage loans

Va bucks-out refinancing try a very popular home loan program. This permits a veteran to utilize this new collateral in their home to other motives such as paying debt, renovations, or financing ventures. An experienced are permitted every collateral in their home and can cash-out doing 100% of one’s worth of their residence.

Many financing establishments simply enable it to be a veteran to utilize a cash-out deal doing ninety% mortgage so you’re able to well worth. But not, that’s a keen overlay and never a guideline.

Please recall if you are going to go a lot more than 90% loan to well worth, there’s a bump throughout the interest rate. Definition your own rate of interest would-be straight down for folks who remain at 90% financing to well worth or less than. A finances-away re-finance pays out of your financial immediately after which include for the amount borrowed and make use of you to a lot more add up to render your bucks or pay other costs.