Since software program is complete and also the paperwork recorded, the process is now out from the borrower’s hands. Every records registered and you can closed up until this aspect is submitted and run through an automatic underwriting system become accepted.

Some files will be sent to a keen underwriter having guidelines acceptance. The borrowed funds officer then gets the assessment, needs insurance recommendations, dates a closing, and you can directs the loan document to the processor chip. The latest processor may demand considerably more details, if necessary, getting looking at the mortgage acceptance.

Particular home loan borrowers would be entitled to bodies-supported financing, such as those insured of the Government Construction Management (FHA) or even the U.S. Agency out-of Seasoned Circumstances (VA). This type of fund are considered non-traditional as they are prepared in a manner that makes it much simpler to have qualified visitors to purchase land. They often element all the way down qualifying ratios and you can a smaller or no deposit, therefore the origination processes can be somewhat smoother consequently.

Example of Origination

What if a customer desires get its first household. They put in an offer toward a home together with supplier accepts. Both people signal a contract and you can agree to a buy price of $2 hundred,000. The consumer enjoys a maximum of $50,000 saved up, which means they want to borrow $150,000 to pay for left balance.

The buyer goes to its bank, ABC Lender, to see if it pre-qualify. Once they create, ABC Bank asks these to fill out a formal software and you can present support documents, together with their proof of earnings, taxation statements, financial statements, and you can approval to own a credit assessment. The program and records try delivered to the newest underwriting company off ABC Bank to evaluate if the borrower try a suitable applicant into the financial.

Immediately after 30 days, the lending company approves the mortgage, relationships new borrower, and you will arranges a time for you indication the documents. Brand new debtor was informed of your interest rate and you can financing terminology and get agrees to expend the loan origination payment of 1% or $step one,five hundred. This will be either deducted throughout the financing balance (evoking the disbursement out-of $148,500), pay they upfront, otherwise feel the seller shell out they in their mind.

How does financing Origination Performs?

Financing origination is the method lenders use to evaluate and you can agree debtor programs for different types of personal debt. They’ve been financing and you may mortgages. Originations move from the original app to have borrowing from the bank as a result of underwriting and you may the latest recognition process. So as that the procedure working, consumers have to sign up and extra papers, including taxation statements and you can pay stubs. Lenders typically ask you for, which is a small percentage of your equilibrium, to pay them to the really works involved in looking at and you may giving the applying.

Most financial institutions, loan providers, and you may lenders costs a keen origination payment for the sort of financing as a form of payment for the financing procedure. This can include personal loans, debt consolidation reduction funds, mortgage loans, household guarantee finance, while others. Fees generally may include 0.5% to a single% of the mortgage balance, so if you’re asking for good $100,000 mortgage, a 1% payment could well be $step 1,000. Particular loan providers tends to be willing to negotiate the price tag, that’s subtracted about loan disbursement or paid upfront. Understand that you pay the fee when you find yourself approved.

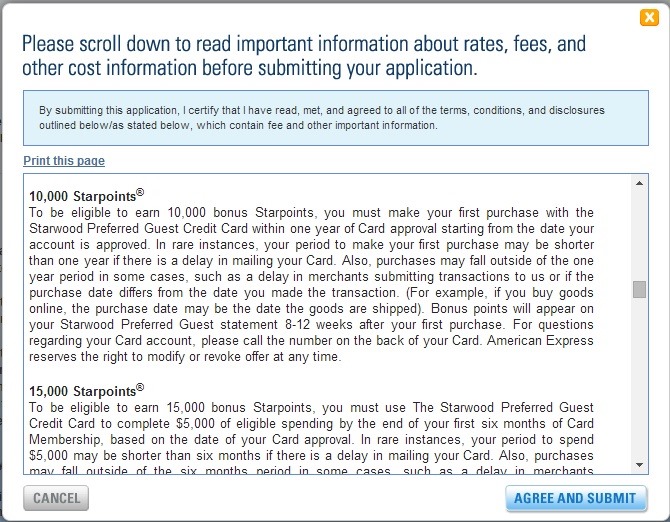

The applying and you will approval process to possess a charge card is not as thorough since it is for a financial loan. Quite often, the fresh new origination regarding a charge card involves completing a credit card applicatoin and obtaining a credit check complete, and you can be recognized in a matter of a few months to some days. Loan providers try not to charges a keen origination payment having handmade cards however they need a security put if you’re simply setting-up the borrowing from the bank or who’s got a bad credit score.