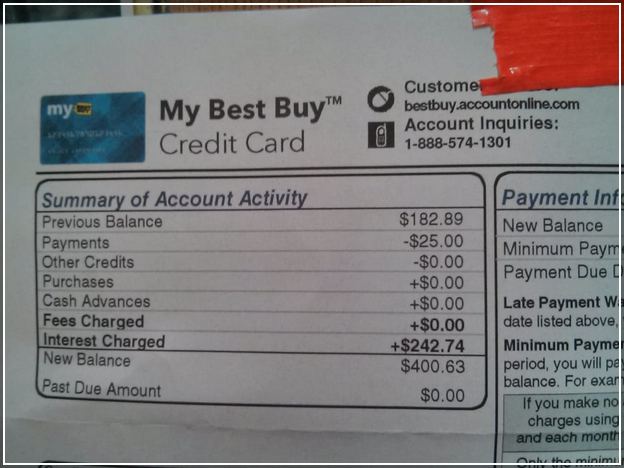

- At the beginning of the entire year, I found myself up against almost $29,000 from inside the borrowing from the bank-cards loans.

- I generated a resources to invest it well inside the eighteen months, but a big endeavor i want to repay most of it in just one to.

- This information is element of « My personal Financial Lifestyle, » a series providing someone alive and you can spend most readily useful.

Whenever December ticked with the January, We knew the time had come to face one thing I have been putting-off: my borrowing-credit loans. As i additional it up, it actually was worse than I’d think. I owed $30,357, and you can my monthly installments by yourself were handling $1,000.

If i was in fact discovering about it happening to help you someone else, I would personally most likely consider, « How performed you to definitely occurs? » The thing is, it absolutely was merely too simple. I wasn’t dining out on a regular basis, shopping impulsively, or carrying out one thing elegant. We racked right up every loans improving my house, that we bought as the a foreclosure wanting really serious fixes. Another type of biggest amount is off a container-number visit to Italy using my sibling and you will cousins having a great relationship.

I didn’t be sorry for sometimes ones one thing, but I found myself beginning to be suffocated. We vowed to repay my personal personal debt once the aggressively when i you can expect to.

I discovered I found myself undermining my personal monetary coverage

I have already been freelancing for more than a decade, and i also faith there’s a lot of occupations protection in becoming a company. If an individual visitors goes around, I will come across a separate. But really at the start of this current year, I scarcely got any works.

So it combined my personal be concerned about my borrowing from the bank-credit personal debt. A major change in my workflow make they impractical to match probably the minimum repayments. This much financial obligation can potentially snowball and overwhelm myself, flattening my plans to own a steady financial future.

For the past 5 years, I’ve struggled to make a stable job – and eventual advancing years – because the an effective freelancer. In my experience, this means being able to buy my likes and dislikes conveniently if you are performing the sort of really works I really like. We save yourself month-to-month for old-age and finances vigilantly getting quarterly taxes. I believed frustrated with myself whenever i understood I was dripping cash on borrowing-credit appeal when it create otherwise help build my defense.

I made a budget and wanted to pay off the fresh new notes in 18 months

My manage try strong, but I became nevertheless overrun by the natural amount of financial obligation. I thought regarding the a property-equity financing, but I did not need certainly to alter personal debt for a financial loan you to definitely set my household on the line.

Rather, We build a spending plan – something I would personally been great about sticking to in the past – and outlined the my personal family costs. With my lowest January money, I might merely meet them. I thought i’d carry out a zero-purchase times, in which I did not pick not essentials – not really java. I avoided with the notes and you will canceled people automatic charges and you can memberships linked to all of them.

I wished to adhere my funds and you will lead any additional earnings towards the my personal debt. I thought it might take myself in the 18 months, and therefore made me wait about how precisely much I really requisite one trip to Italy and/or the brand new floors.

An unexpected enterprise gave me a huge improve

We caught to that particular plan for a couple of weeks out-of the entire year. Next, in the February, I had a huge windfall. A periodic client explained that they had a big endeavor you to definitely requisite to-be accomplished one to day. At first, I was thinking it might be on $5,000 off extra money, and i also is very happy to be able to pay an effective chunk regarding my personal personal debt.

As times went on, your panels ramped upwards instead of postponing, and i also did extended hours daily. We considered fixed to my desktop, but by the end of your own day, I experienced generated nearly $25,000 over when you look at the a consistent month. It all went along to my personal handmade cards.

I’m such as for example I have a flush slate and you may a much better comprehension of my personal economic wants

Delivering you to definitely venture https://cashadvanceamerica.net/title-loans-mn/ felt like something special – a chance to correct unsuitable choice I would generated economically. I got $5,000 during the credit-cards loans kept following, and you may I am following my personal finances to spend one to regarding. One to feels like an even more manageable count, and you can I am capable pay it off this year.

Today, I am calculated to utilize my personal clean record to set up a great good economic coming, none built on obligations. I’m currently likely to increase the amount of money We lay during my retirement plan and you may deal with my kept student education loans 2nd 12 months.

Like any millennials, I will get distracted by the glossy invest-now, pay-later vow out-of playing cards. However, shortly after perception overrun of the all of them being lucky enough so you can escape, I understand that real goal are a future where I’m economically steady enough to match big expenditures to your my personal income, including the traveling and you will home improvements you to nearly took me off.