After you look into homeownership, your quickly realize modular and you may are built residential property provides statutes and you can quirks, means all of them except that old-fashioned attributes. If you are each other provide book advantages, understanding how they can fit to your house equity funds can be like navigating a maze at night. This website usually light which roadway, delivering understanding and you may belief at each and every step.

Build and Group – The new Foundations out-of Standard Property

Examining standard residential property is like training a key passageway from the housing sector. Such house split the fresh new shape with factory-situated areas make on your plot such as for instance a sophisticated jigsaw puzzle. What shines on modular homes isn’t just its creative build but exactly how they are categorized. In the place of their relative, the new are built family, modular house usually are viewed much like old-fashioned stick-created households, specifically off capital.

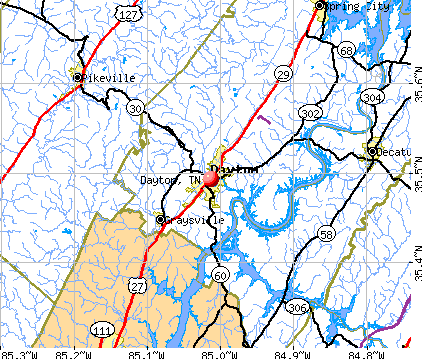

When targeting a house collateral mortgage, just how their modular residence is classified and created requires cardiovascular system stage. Loan providers tend to peek trailing the brand new blinds to see if the modular home is permanently secured to help you its base – a giant checkmark getting mortgage eligibility. The fresh adherence so you can regional strengthening requirements and you will quality of structure plus weighing greatly to your benefit. When your standard household ticks this type of packages, https://www.elitecashadvance.com/personal-loans-tn/portland you’ll likely have the ability to talk about loan options.

The fresh new Appraisal Puzzle – Valuing a modular Household

Appraising a standard house is not your day-to-day valuation task. It is reveal procedure where some issues come into play, framing the very last contour. The grade of framework is a big bit of so it secret – how good the latest sections of your residence is actually pieced to each other is also significantly influence its market value. Nevertheless story will not stop here.

The standard house’s place is even an option user. A property inside a looked for-just after society you are going to pick its worthy of go up, same as a classic domestic. The true property market is instance a river, usually moving and you may altering. It lingering flux has an effect on how property, particularly modular and are manufactured of them, is actually respected. If you have an ever growing need for standard property, you might find the property’s value operating so it revolution from prominence. Yet not, when the modular land will still be a novel style close by, this may reflect in a different way throughout the assessment.

Focusing on how appraisals to have modular residential property vary from conventional land is actually extremely important. Valuing these types of residential property surpasses just their bodily design. It requires admiring the mixture of imaginative structure, new appeal of the venue, and how they can fit with the market style. This information is key into the navigating the fresh new modular against are manufactured house landscaping, especially when given property equity financing.

Decoding the newest DNA regarding Are produced Home

Are built land usually rating lumped as well as mobile home, but they’ve been their reproduce. It is such as for example mistaking a beneficial wolf to have a good husky – comparable however, worlds apart. This type of home are available completely within the a manufacturing plant then directed on the final asleep lay. Why are them type of is the framework excursion and you may compliance with the new federal HUD password, in place of their mobile cousins that go after local strengthening requirements.

This type of differences be a little more than trivia proper eyeing a property security mortgage. They might be the fresh new crazy and screws of just how loan providers examine your house. On standard vs are produced house discussion, the latter can occasionally face more difficult financing tracks. Lenders will have a look at all of them in a different way, compliment of her construction and group. For many who very own a made family, you really need to prepare for different questions and you can standards when trying to get a loan.

The borrowed funds Landscape – Searching for Debt Complement

Obtaining financing into the a created house is a search filled with information and you will nuances. It requires a keen eyes and you will an intensive comprehension of just what produces this type of home unique in the financing business. One to key factor ‘s the base particular. Will be your family forever attached towards the soil, or is it nevertheless with the wheels? This is a make-or-break outline to have lenders. A unique aspect is the chronilogical age of the home. More mature are designed home will most likely not usually obtain the environmentally friendly white having financing, since the lenders will often have bookings regarding their longevity and value maintenance.