Why don’t we hope the business and you may financial authorities become more upwards toward activity to help you controlling industry now.

Relevant

I did not see the industrial plus don’t know about Rocket Financial. It is Intuit’s financial firm? Or perhaps is it simply a mortgage broker? Since the people with purchased a property see, pre-recognition lets a realtor and you will a merchant be aware that your own give was serious and never will be fastened in the funding issues. Once you are pre-acknowledged getting confirmed number, the fresh new representative simply teaches you house you’ll be able to afford. Generally there is nothing inside the pre-acceptance itself one undermines credit standards. On the contrary. It is very correct that some body commonly score pre-acknowledged through the institution it wind up credit regarding; that is as an alternative the point, in order to speed the amount of time between and work out a deal and having a beneficial family. From inside the a professional transaction, there’s also an appraisal of the house itself become yes it is borrowing from the bank-worthy.

Express this:

Because you say, the chance is within a network where individuals benefit for the the new deals as well as have zero demand for whether the financing ever www.clickcashadvance.com/personal-loans-nc/columbus/ before will get reduced. It is still the case that most mortgage loans are resold and for this reason, while i understand it, however the case that there is a risk your secondary market you will definitely weaken the machine. The sole shield is when the fresh supplementary industry cannot pick bad mortgage loans with bad credit-worthiness, and this allegedly merely goes in the event the were unsuccessful mortgage loans indeed costs people currency throughout the additional industry. Do they?

I got new misfortune getting a nationwide mortgage age before the brand new crisis. (My personal brand new financial got sold they on it.) These people were crooks upcoming, in this these people were carrying higher escrows, was in fact really slow to discharge payments throughout the escrow so you’re able to tax and you will insurance (often costing myself money because of this slow fee), and repaid no attention. You will find a course step lawsuit you to definitely provided me to getting multiple hundred bucks from them. A home loan sold so you’re able to Financial out of The usa had comparable nightmares regarding the financing servicing, even if by then i capable to manage our very own taxation and insurance payments.

The loan administrator within my borrowing union which managed our very own very recent financial states your unmarried oftentimes asked concerns is actually: (1) do you ever keep that it financial otherwise sell? and you will (2) who will services the mortgage?

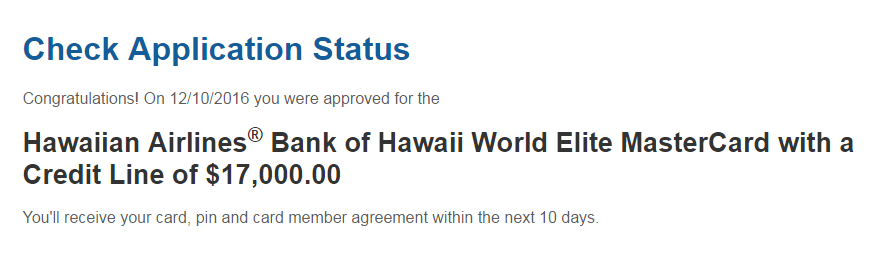

OW Thank you for the careful react. Quicken Finance is earlier Material Financial, and therefore that was situated because of the Cleveland Cavaliers proprietor and you will self-designated saving grace away from Detroit, Dan Gilbert. Intuit purchased Rock Economic then re also-branded you to part of the business Quicken Money, that they upcoming marketed back into Gilbert or other traders. Those individuals traders support the organization physically.

To the pre-recognition, individuals will be nevertheless shop around shortly after providing pre-approval. Rate support people throughout the market (specifically agents) however, *not* the borrower – most readily useful loan criteria suffice their interests alot more. Legislation adopted in the Oct included in Dodd-Frank is assist consumers to search around. But, as the none other than the main executive regarding Quicken Fund, Statement Emerson, says:

Really don’t envision people are modifying how they store merely because he has a unique unit to achieve this, Emerson said for the a job interview. The process of to order and you will resource a property is really so complicated and emotional, he said, that numerous some one notice it more straightforward to merely to track down an established financial estimating a great rate of interest and match one financial in the place of making several software and you may comparing prices.

Many mortgage loans are nevertheless packaged to your domestic home loan supported securities, regardless if my understanding would be the fact some are today ended up selling so you can Fannie Mae otherwise Freddie Mac computer. The ongoing future of Fannie and Freddie try, naturally, right up in the air. You to variation now could be you to definitely second customers proper care a little more about the latest mortgage loans that comprise new ties even in the event mortgage sellers (including Quicken Financing) nonetheless require volume. Which had been new make sure that is actually meant to right the business. Provided investors are nevertheless apprehensive about home-based financial-supported securities, one to glance at will remain in place. However,, our very own country features a lengthy history of substantial property conjecture you to produces you to see looks fairly delicate.