Usually do not suppose things, just continue performing good things for the borrowing along with your off percentage. That is constantly advice, even if the financial goalposts flow beyond what you can handle. Ultimately, it is going to disperse additional way right after which you are in an effective a standing to track down what you want. And you will yes, I finalized back at my household just after the start of it pandemic. Actually, I did not also discover my house up until immediately following my town closed down. I experienced the new records already been just before up coming, however, We hadn’t discover a home I needed.

Almost every other information

I’ve created widely throughout the paying designs into a new Matter, therefore i wouldn’t incorporate they right here. This is rather a lot of time because it’s.

Know bringing a property isn’t a fun otherwise simple procedure. You’ll likely become selecting documents for days on end, perhaps alot more. I’m sure they took me a long time initially I taken out a mortgage. Which was on the per year just before I attempted they once again earlier this year. (Section of one a lot of time story I mentioned before.) Regardless if I’d all documents receive the first date, I nevertheless had to get a whole bunch alot more the next big date.

And, realize it doesn’t matter how a good a home you get, there clearly was probably a bunch of repairs that require complete. Any of these would-be done, or perhaps taken care of, by supplier. The agent should be able to make it easier to figure it aside. However, dont put your savings with the down-payment. I have invested thousands of dollars carrying out fixes, upgrades, tidy up, substitutes, and more. About 50 % of what I’ve over is believed a lot of, nonetheless they make household a lot more of a house to me.

Simply understand that you will find things that you want to alter and you can spend money on when you get into set, thus spend less for the go out. And don’t spend « an excessive amount of » on that content. We have used off my personal disaster finance because of providing too keen with my changes. I additionally enjoys a dozen partly completed plans been and need to do all of them ahead of We start new ones, not to mention spend more on upcoming plans. I am indicating balance towards deposit and your coupons for after closure to the house.

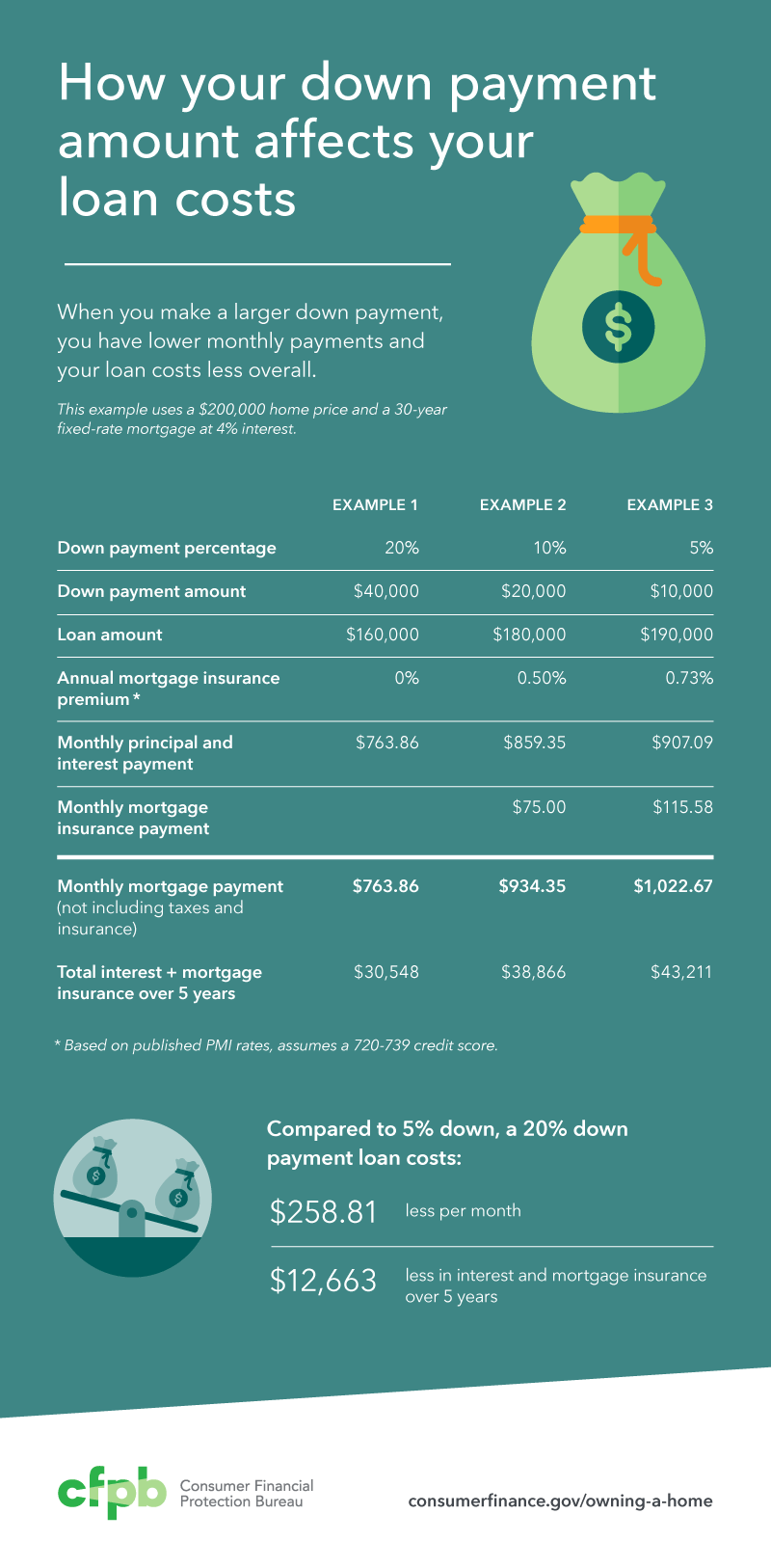

Possessions taxes, domestic user’s insurance policies, and you can HOA charges will differ according to the domestic plus the urban area. Just like the our company is merely creating a price, we are able to play with national averages. Average monthly assets taxes is $190 and you can average month-to-month house user’s insurance policy is $100 that’s $290 complete. I’ll alter one so you can $285 because helps make the math very. HOA charges would enhance that should you see an excellent house with an enthusiastic HOA. Subtract those of what is actually kept while get

That you don’t bring facts about the finance (such as payment amounts) however your obligations to income ratio has to be around an effective specific count that will vary because of the lender and may also adversely effect the rate. You to web site claims you to debt-to-money proportion is the #1 reason that mortgage applications is actually denied. A top count to have debt to help you income, which is the complete of all your loan repayments is 35% however lenders is certainly going higher.

At the 23, you more than likely do not have good credit. This is just by small amount of time you’ve had borrowing from the bank. It is not « ageism », it is simply a fact. I am within my early 40’s and you will my borrowing try negatively inspired because of my relative small credit rating. Your credit score is actually a mix of what borrowing you had in earlier times and you will reduced, including what borrowing you are already still paying on. When i got my personal home loan earlier this year, We simply got a car loan out of dos-3 years back at my statement, therefore i is actually hampered by one to. We have a complete much time 20+ seasons history of scholar and private financing that’ve started paid, but you to definitely failed to work with myself doing this new brief car finance has worked up against me personally.

Veteran’s Gurus

Your job could even evaporate on upcoming days. That it pandemic possess brought about an abundance of uncertainty, and with you are a beneficial « the newest get », they may treat you initially or even the whole team might just turn off up until the trojan becomes down. You will get fortunate and start working from home such as certain you https://paydayloanalabama.com/riverside/, but that’s maybe not a hope, both.