Think your dream household. Now let us allow it to be an actuality! Bluish Eagle Borrowing Connection also provides versatile home loans to support their construction demands. Whether you are moving into the first house or need update your latest put, you can find the mortgage you would like right here.

Tap into your residence’s equity to fund highest, initial and you may specific costs. These types of loans, known as second mortgages (or sometimes the second home loan), is ideal once you already fully know just how much you’ll want to spend since the you get a lump sum payment simultaneously. A few of the most popular uses away from repaired rates domestic collateral funds is to try to consolidate obligations, pay money for college tuition, crisis costs such as automobile repairs, or house resolve fund to pay for a certain endeavor or provider. « , « button »: < "buttonText":>, « imageId »: « 60d9eff8592c4d25f4e92b98 », « mediaFocalPoint »: < "x":>, « imageAltText »: « Wrench and hammer icon », « image »: < "id":>, « colorData »: < "topLeftAverage":>, « urlId »: « 29obsbbeipvfa7iagymxrho1acqabe », « title »: « », « body »: null, « likeCount »: 0, « commentCount »: 0, « publicCommentCount »: 0, « commentState »: 2, « unsaved »: false, « author »: < "id":>, « assetUrl »: « », « contentType »: « image/jpeg », « items »: [ ], clickcashadvance.com installment loans no credit check direct lenders only « pushedServices »: < >, « pendingPushedServices »: < >, « originalSize »: « 2350×450 », « recordTypeLabel »: « image » > >, < "title":>

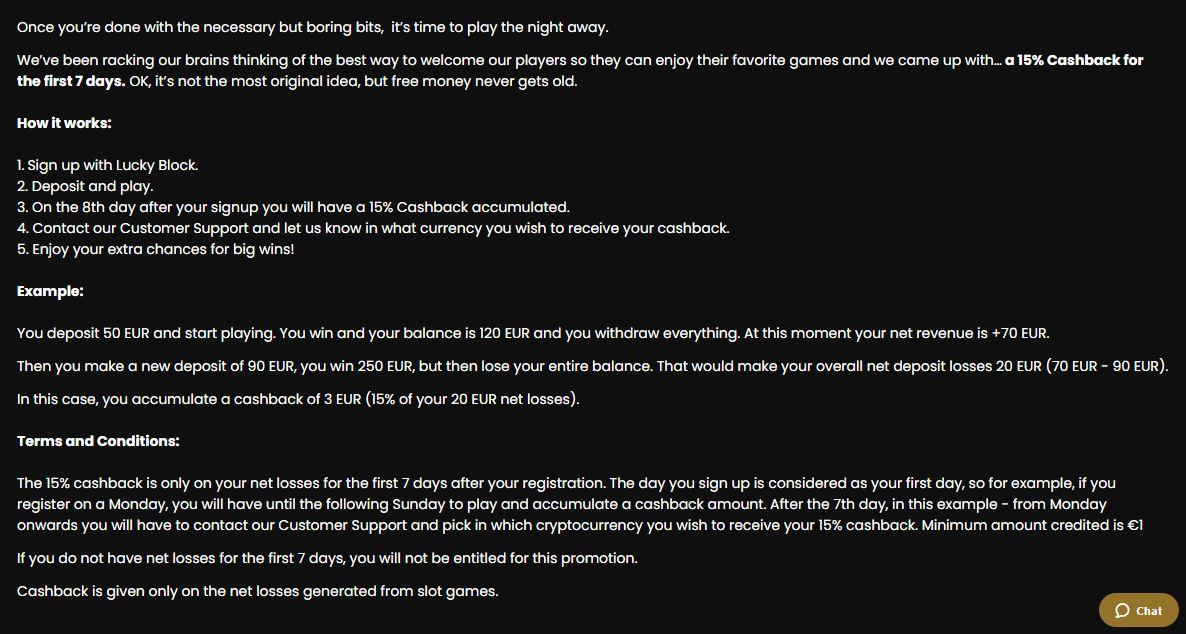

Make your home your favorite place to be. « , « spaceBelowSectionTitle »: < "value":>, « sectionTitleAlignment »: « left », « isSectionButtonEnabled »: false, « sectionButton »: < "buttonText":>, « sectionButtonSize »: « large », « sectionButtonAlignment »: « left », « spaceAboveSectionButton »: < "value":>> » data-media-alignment= »left » data-title-alignment= »left » data-body-alignment= »left » data-button-alignment= »left » data-title-placement= »center » data-body-placement= »center » data-button-placement= »center » data-layout-width= »full » data-title-font-unit= »rem » data-description-font-unit= »rem » data-button-font-unit= »rem » data-space-between-rows= »60px » data-space-between-columns= »60px » data-vertical-padding-top-value= »3.3″ data-vertical-padding-bottom-value= »3.3″ data-vertical-padding-top-unit= »vmax » data-vertical-padding-bottom-unit= »vmax » >

Household Security Fixed Speed

Tap into your home’s equity to pay for large, upfront and specific expenses. These loans, also known as second mortgages (or sometimes a second home loan), are ideal when you already know how much you’ll need to spend since you’ll receive a lump sum at once. Some of the most common uses of fixed rate home equity loans is to consolidate debt, pay for college tuition, emergency expenses like car repairs, or home repair loans to pay for a specific project or service.

House Collateral Credit line

Rating those home improvement tactics going that have a property guarantee range regarding borrowing from the bank (HELOC). An effective HELOC can offer benefits and you can liberty giving you availableness to financing funds when you’re ready to liven up your area, pay for holidays, wedding parties, and much more. You could draw borrowing from the bank since you need since initially financing closing is accomplished, it is therefore a great financing alternatives when strategies aren’t finished every at the same time or you you prefer unexpected advances.

While trying refinance your current household, purchase your basic house, upgrade to a more impressive home, or downsize given that the new students have remaining the nest, you can rely on we’ll assist you in finding best financial. All of our apps can complement all the costs, credit scores, and you may loan amounts.

Make your home your favorite place to be. « , « spaceBelowSectionTitle »: < "value":>, « sectionTitleAlignment »: « left », « isSectionButtonEnabled »: false, « sectionButton »: < "buttonText":>, « sectionButtonSize »: « large », « sectionButtonAlignment »: « left », « spaceAboveSectionButton »: < "value":>> » data-media-alignment= »left » data-title-alignment= »left » data-body-alignment= »left » data-button-alignment= »left » data-title-placement= »center » data-body-placement= »center » data-button-placement= »center » data-layout-width= »full » data-title-font-unit= »rem » data-description-font-unit= »rem » data-button-font-unit= »rem » data-space-between-rows= »60px » data-space-between-columns= »60px » data-vertical-padding-top-value= »3.3″ data-vertical-padding-bottom-value= »3.3″ data-vertical-padding-top-unit= »vmax » data-vertical-padding-bottom-unit= »vmax » >

Mortgages

If you’re trying to refinance your family, buy your first domestic, enhance so you can more substantial home, otherwise downsize since the fresh high school students have left the brand new colony, you can rely on we shall support you in finding the best mortgage. Our very own programs is also complement all spending plans, fico scores, and you will mortgage quantity.

Property Fund

Do you get the perfect destination to belongings and want an excellent homes financing? It’s unusual to get a city lender willing to create residential property finance, however, Bluish Eagle Borrowing Commitment possess the back! If you are having problems searching for your ideal household, and you’re trying make, let us chat! We provide funds getting vacant home-based package instructions and you may belongings to have recreational use.

Why don’t we get something moving! When you really need smoother mortgage selection, competitive prices and you may expert information, arrived at Bluish Eagle Credit Partnership. We have huge amount of money so you’re able to give to suit your the latest otherwise 2nd home and you will beneficial info to find a very good provider to suit your unique condition, whether you’re a first-date homebuyer or investing even more attributes. We now have and married which have Associate Virtue Financial to make sure a full list of financial issues to fulfill one needs. Not sure how to start? We can help with one to, view here and let us influence their homeownership requires.

Collection Will set you back: You invest in pay all costs out of event the quantity you are obligated to pay lower than that it Arrangement, and additionally court will cost you and you will sensible lawyer charges.

Later Costs: Whether your payment is more than fifteen those days due your are expected to spend a belated charges of 5% of payment matter.

Apr = APR1. The brand new Annual percentage rate gotten would-be from inside the diversity revealed more than. The interest rate depends on every member’s creditworthiness, identity of your financing, and cost out-of security offered compared to number of financing. Excite inquire about the rate which you ple: $20,000 getting sixty days from the 5.75% Apr = $ payment per month. Does not include loans safety. Used/The Motorcycle Fee Example: $fifteen,000 having sixty weeks at the six.75% Apr = $ payment per month. Doesn’t come with personal debt cover. ple: $fifteen,000 to possess 84 months during the eight.25% Annual percentage rate = $ monthly payment. Personal loan Fee Analogy: $eight,500 to possess 48 weeks within nine.00% Annual percentage rate = $ payment. Doesn’t come with obligations safeguards.dos. Lowest Fee: The new fee on the Overdraft Credit line will be a beneficial minimum of $20 monthly.3. Offers Protected: Pledged Funds have to be during the a bluish Eagle Borrowing Relationship Coupons Account. Discounts Safeguarded Percentage Example: $5,000 having three years on 5.25% Annual percentage rate = $ monthly payment4. Apr is based on the top rates as well as a beneficial margin and you may try at the mercy of change monthly.5. Need look after adequate insurance. Minimum loan amount having term out of 96 months are $25,000. Not all the candidates tend to be eligible for a reduced rate.six. Lowest loan amount to have HELOC and Domestic Security is $ten,000. HELOC possess draw age 25 years, fee lies in fifteen seasons thought title. Fixed The guy Fee Example: $50,000 to have 180 weeks in the six.00% ple: $25,000 to have 180 weeks in the 8.00% ple: $ to summarize can cost you according to $25,000 loan amount.