Existence in the united kingdom are a day-desire to of many. Nevertheless would be an actuality for you! An excellent USDA mortgage, among the government’s least-recognized mortgage direction programs, may get your around!

The brand new You.S. Institution of Agriculture is enabling generate property http://clickcashadvance.com/installment-loans-ar/oakland/ the possibility to have low- so you can reasonable-earnings family towards extra one to an influx of new residents can assist outlying organizations restore and you may/otherwise still thrive.

Just like the 2017, the new USDA mortgage system keeps assisted members buy and you can improve its house by providing low interest with no off money. Full, these types of fund try booked for homeowners trying to live-in rural regions of the country, in certain says, residential district section can also be integrated.

Have you been qualified to receive an effective USDA loan?

Don’t ignore the ability to find out about USDA thinking it is really not to you personally. Qualifications standards to have USDA-backed mortgage loans are based on just a couple of things. The latest USDA financial standards was:

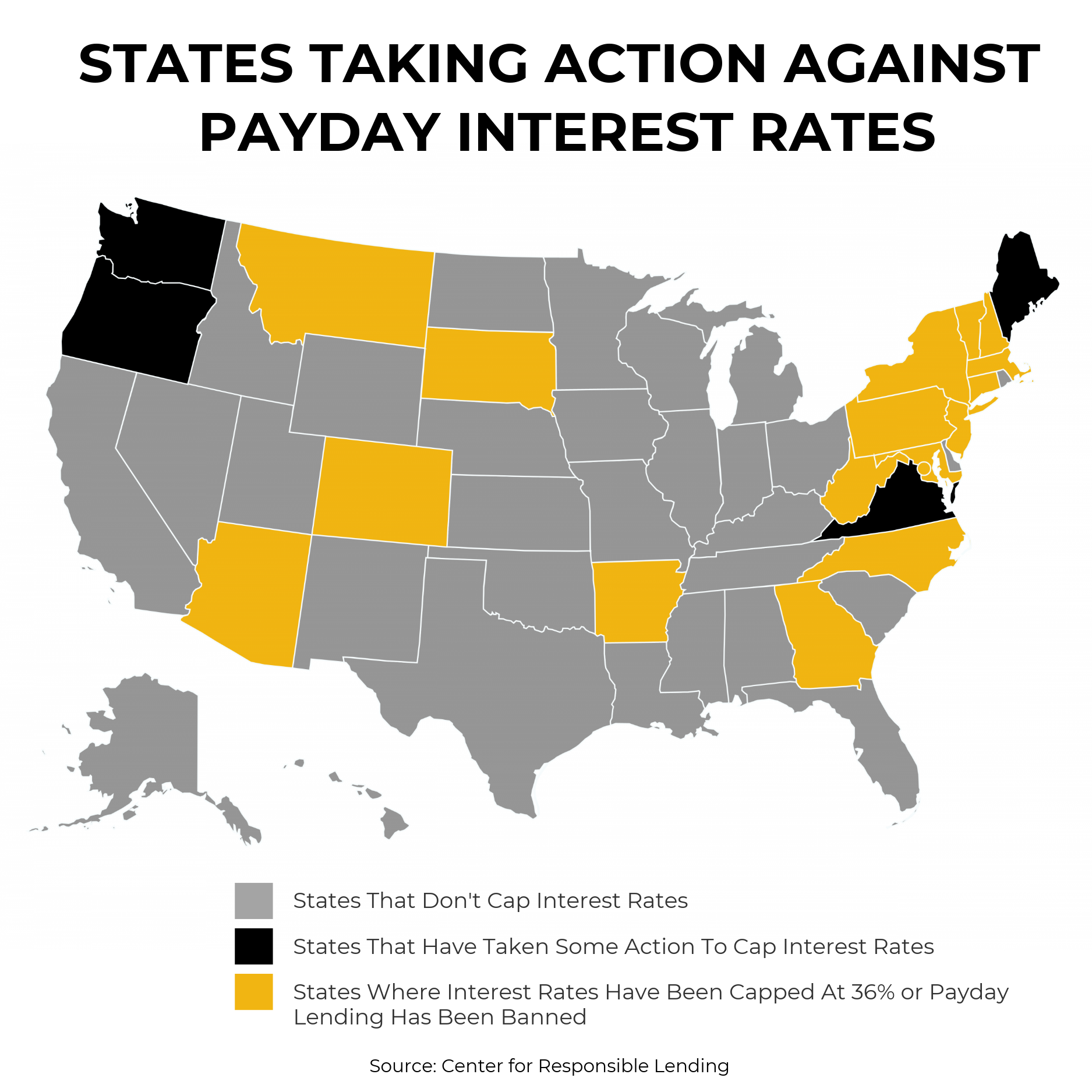

- Location: To track down a good USDA mortgage, the house or property you purchase have to be from inside the good USDA designated outlying area. One feels like it’s all areas and you can farmland, but do not become conned: 97% of the nation is eligible, along with brief cities and several suburbs.

- Income: In the first place available for reasonable- so you’re able to reasonable-earnings earners, the new USDA financing recommendations describe money level to be as much as 115% of your median income into area you are looking to reside in. Which are often a king’s ransom a number of elements of the world, however it is based where you need it. Additionally, a great household’s entire income is recognized as when you look at the software procedure, which will help increase eligibility.

Where to search to have qualified USDA Loan attributes

The brand new USDA home loan map can help you decide in which you can find a qualified property. Knowing which residential property or components meet the requirements commonly shield you from to make an offer toward a home that’s not gonna be acceptable eventually.

In a nutshell, cities try excluded off USDA software, many residential district and ex-urban urban centers provide quite close to the buzz of some faster metropolises. This new chart will help you to ferret this type of elements away. In case you’re looking for the country lifetime, you are in luck. Rural towns are always eligible. Check out all of our latest blog post to help you consider the benefits and you can drawbacks off surviving in the metropolis compared to. the world.

The good news is, the latest USDA map webpages is fairly easy to use and only requires a few presses to get what you’re looking. These tips less than can assist make procedure smoother:

- Just after on the site, just click Solitary Family members Houses Secured and you may take on brand new disclaimer.

- Seek a specific target and you will zoom when you look at the otherwise off to slim during the into the eligible section.

- Heavily inhabited areas could be tinted red-colored, demonstrating they are ineligible. Zoom in more, and find eligible areas in the red areas.

- Once you have recognized a qualified city, interest your residence look in that particular society.

Now confirm the qualifications

To ensure you may be eligible out of a full time income direction, remember that Earnings limitations to own home financing be sure differ by the venue and you will sized your children. Understand that so you can meet the requirements, your children money can not be over 115% of your median earnings towards the region you have in mind. Utilize this graph to see if your qualify.

- You should live-in the home full-time. USDA Funds is finance just holder-filled first houses.

- You need to be a U.S. citizen or provides permanent residence.

- The month-to-month financial obligation money ought not to surpass 41% of monthly income. But not, the latest USDA usually envision high financial obligation percentages for those who have good credit score above 680.

Advantages of an excellent USDA Mortgage

If you think you may be eligible and seeking and also make your primary quarters from inside the a great USDA-eligible zone, upcoming an outlying mortgage may be the right fit for you. Which is very good news due to the fact USDA financing have numerous positives over almost every other financial solutions:

Early

When it comes to USDA money, you will need help navigating what’s needed. However, one to thing’s for sure, you ought to get pre-recognized in advance family hunting. Apply at a movement Real estate loan manager in the region you will be looking to purchase.

Mitch Mitchell try a self-employed factor to help you Movement’s sales institution. He and additionally writes on the tech, online protection, the electronic knowledge area, travelling, and living with pet. He’d wanna alive someplace loving.