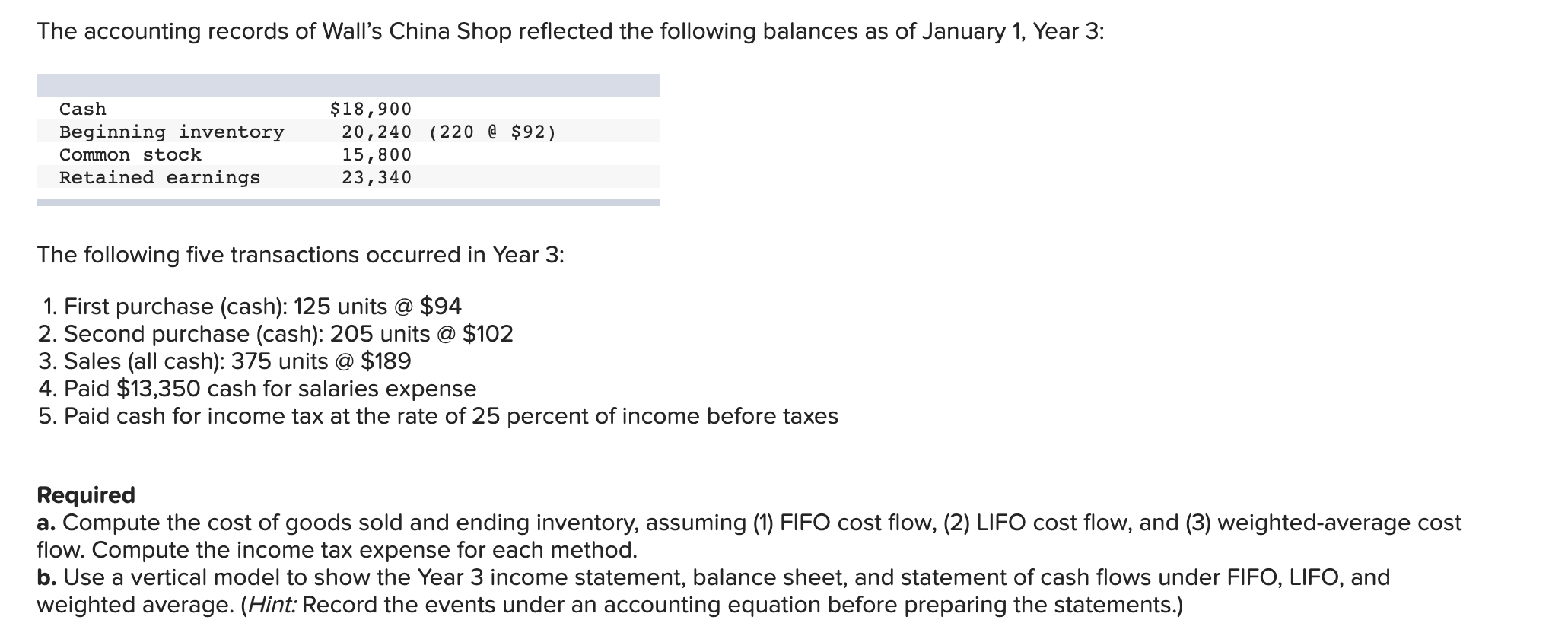

Note: You will find exceptions into the Zero Bad Guarantee Be certain that. On Gateway, the fresh Zero Negative Collateral Ensure will not implement if perhaps i determine one to a debtor provides fraudulent otherwise issue misrepresentation when it comes to its Contrary Real estate loan prior to, throughout or following contract are situated. Minimum restoration requirements are needed to be satisfied to possess a great borrower so you’re able to be eligible for the new No Negative Equity Guarantee.

Exactly what do an opposing Home loan be taken getting?

An other home loan may be used in the same way due to the fact any other home loan, to cover higher you to definitely-of commands, or it can be utilized given that an additional money stream to have typical everyday sales. Some traditional uses for contrary mortgages is:

Domestic home improvements https://www.availableloan.net/personal-loans-tx/lubbock Of a lot retirees play with a reverse mortgage to help you upgrade their house so you’re able to ensure it is more comfortable for the old-age. They could put a share and you can backyard amusing city or build a grandma flat during the their child’s house for if go out concerns downsize. If you really need to change your home with increased entry to has or need to add some beauty products inform, a contrary financial will help arrive!

Vacations Given that you may be retired it is the right time to enjoy life a lot more! Whether you’re heading to European countries on the dream travel or need for taking out-of in australia to possess an old grey nomad excitement, an opposing home loan can fund your vacations which help you will be making the essential of your own senior years.

Medical expenses Unforeseen medical expenses may have a devastating influence on finances circulate, particularly when you’re on a rigorous budget. If your authorities your retirement doesn’t log off far area so you can manoeuvre, a contrary financial can also be release extra money to fund scientific will set you back.

An other mortgage can give her or him accessibility to $step one,100,000 that can be used to cover present debts and you will restructure the money.

Satisfaction Life will puts unforeseen will cost you from the you. With a gentle cash buffer can supply you with assurance in the case of unplanned medical expense, home fixes, court fees or whatever else existence brings your way.

Supplement your retirement money According to in your geographical area in australia and how far your have when you look at the savings, big brother your retirement may not defense all your cost of living. An opposing financial can also be enhance big brother your retirement that assist your match daily living will cost you. Note: the Opposite Home loan may perception the retirement payments. Read more about this below.

- Well being Pension are going to be a time of relaxation and you will pleasure. A face-to-face home loan can provide the caliber of lifestyle one to need, with additional currency to expend into the dining out, planning to situations, travelling and you can anything your center wishes.

Should i seek legal advice before obtaining a Contrary Mortgage?

Sure, just be sure to seek independent legal advice before applying having a face-to-face Mortgage. We highly recommend you seek a professional economic advisor whom can explain the aspects of a face-to-face Home loan and its own effect on your own overall financial situation. Opposite Mortgages aren’t a one-size-fits-all solution and it may not suitable option for your. I plus highly recommend you consult with your household and you can any beneficiaries of home just like the a face-to-face Home loan commonly change the heredity it discover regarding the ultimate business of your possessions.

Create I need to getting retired to obtain usage of an excellent Reverse Financial?

Zero, you don’t have to become resigned to get into an opposite Financial, although not, you must be aged more than 60 years of age while have to own your own house.