- Opposite mortgage loans

- Cash-aside refinancing

1: Opposite mortgages

A different way to make use of your domestic collateral, you can take out an opposite home loan-when you find yourself 62 years of age and you may earlier. (With things, that years normally miss to 55 yrs old and old.) For individuals who own your home downright, or has actually way too much security gathered, you can use a face-to-face mortgage to withdraw a fraction of that guarantee.

If you use an opposite financial, you may want to stop needing to repay the mortgage inside month-to-month instalments, in lieu of a home collateral mortgage or a HELOC; loan providers rather pay your per month as you live in the brand new home. If the debtor dies, deal your house, otherwise movements away, then the opposite real estate loan should be paid down. Of many individuals website the desire to help you retire while the an explanation so you’re able to wade that it station.

2: Cash-away refinancing

Cash-out refinancing ways to improve your most recent home loan with a beneficial huge loan, which has a portion of your home guarantee, taken once the dollars, together with harmony your debt on your established financial. You can utilize bucks-aside refinancing for any reason.

you could probably score a lowered speed towards most of your mortgage, depending on business criteria, and reduce the loan term so you can pay it back shorter. Such factors try unique to dollars-aside refinancing compared to home guarantee fund otherwise HELOCs.

Mortgage brokers and you can family guarantee money mode also because the brand new property serves as security in the two cases. One significant difference ranging from a home loan and property equity loan is the fact that eligible amount borrowed to possess a mortgage is usually around ninety% of your own market price of the home. Getting a house collateral loan, on top of that, you convert the brand new security on your property on money. Payments tend to be costs with the dominant in addition to attract.

How does taking a house guarantee mortgage really works?

Receive a home security mortgage, you’ll earliest must meet the requirements. To decide whether you be eligible for a house security mortgage, their financial will appear within these types of around three factors:

- Your own security

- Your credit score

- The debt-to-income proportion (DTI)

When you’re weakened in another of this type of components-as in, you really have a woeful credit rating, by way of example-you might be in a position to have confidence in another several so you’re able to assist increase potential-and you may qualifications. Why don’t we look closer at each to raised know very well what lenders are searching for.

1: Their collateral

A loan provider will get an assessment on your own home to determine for people who meet the requirements and exactly how far money you happen to be in a position so you can obtain. Put simply, the lender tend to acquisition a house assessment to see simply how much your house is really worth.

Extremely loan providers makes it possible to borrow doing ninety% of the collateral in your assets. You could potentially calculate the loan-to-worth proportion to choose the count you could acquire playing with an effective household guarantee loan. To help you determine your loan-to-worthy of ratio, you deduct the bill of your first home loan off 90% of the appraised value of the home.

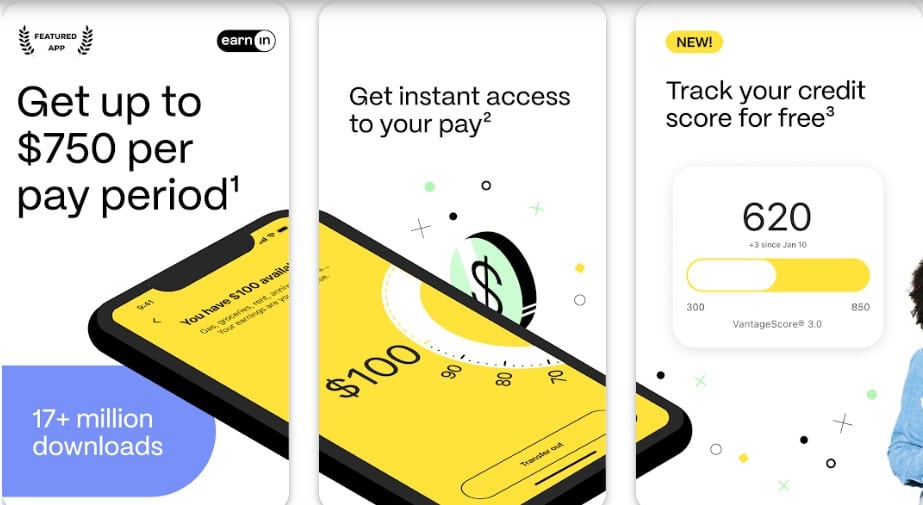

2: Your credit score

Your credit score plays a serious character within the choosing if or not your qualify for a property equity financing, particularly because provides lenders a peek into the credit history. Fundamentally, when you have a top credit score, you will make the short term loans Wewahitchka most of a lower life expectancy interest rate. You’ll have a credit score with a minimum of 620 when the we want to score property security loan. Since there are conditions to that particular laws, you need to search to see whatever you decide and have the ability to be eligible for.