Typically, money spent mortgage costs will normally feel no less than 0.50% to 0.75% higher than number one home loan prices.

Lenders consider funding features to get riskier than just owner-filled property, as individuals will default on the money spent funds. Remember that talking about standard assistance, and you may prices can differ somewhat off bank in order to financial and you may out of debtor to borrower.

Nevertheless, despite highest costs, investing in home is normally an excellent a lot of time-term suggestion. This is how much you certainly will spend today to invest in you to definitely future income.

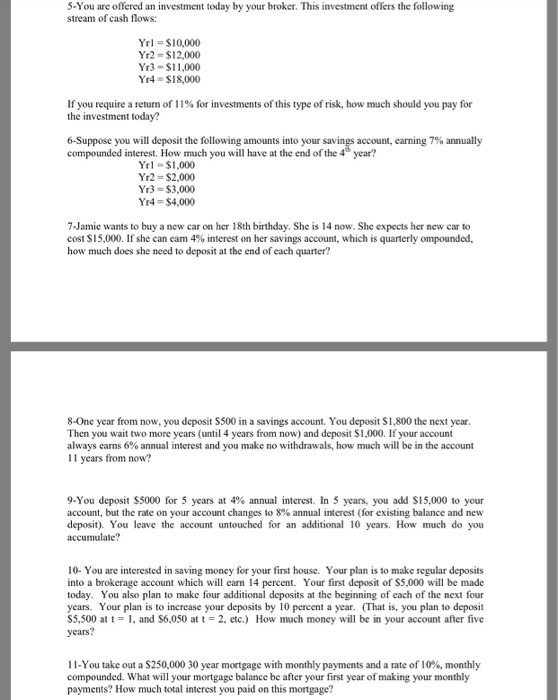

- Current interest levels

- Money spent costs

- Just what impacts rates?

- Ways to get a lesser rates

- Money spent funds

- FAQ

Most recent money spent home loan rates to have

Cost are given of the our partner community and may even maybe not echo the market. Your own rates would-be different. Click to possess a customized rates quote. Come across all of our rates assumptions right here.

Note that the present average money spent interest levels are based on a prime borrower profile with a credit score of 740 and you may an excellent forty% down payment. For those who have straight down credit or an inferior down payment, your own interest rate will likely be greater than everything you select said.

That is why average prices should only be used once the a standard. Your investment assets rates will disagree, so make sure you evaluate rates away from a few loan providers and you will find the best price to you.

Preciselywhat are investment property home loan prices?

An investment property financial rate ‘s the interest rate on the an effective loan intended to buy otherwise re-finance a residential property, which is one that the new borrower does not intend to play with as his or her number one house.

Exactly how much large is investment property mortgage rates?

The specific means to fix that matter hinges on the kind of investment property, your creditworthiness, along with your downpayment. But usually of thumb, we provide the pace on your investment assets to help you feel at the very least 0.50% to help you 0.75% higher than the pace on your top financial.

Exactly how lenders set investment property interest levels

Behind the scenes, the pace you have to pay actually completely doing your own mortgage lender. Banks frequently to evolve their investment property home loan pricing in line with Federal national mortgage association and you can Freddie Mac recommendations.

For a twenty five% down-payment, an investment property mortgage usually has fees between 2% in order to 5% of your own loan amount. Very borrowers choose for a top interest rate in lieu of spending this type of charges initial, which generally contributes 0.5% to 0.75% towards the price.

Getting duplexes, assume an extra step 1.0% during the charge or a good 0.125% in order to 0.250% price increase.For the greatest cost, you should put at least twenty five% off. A suitable mortgage-to-really worth proportion to possess financing purchases try 75% otherwise quicker, suggests Jon Meyer, loan professional.

Other factors you to definitely impact money spent financial rates

Fannie mae and you can Freddie Mac recommendations are not the only points influencing investment property mortgage cost today. Yours profit additionally the market rate gamble a serious part too.

It’s loans in New Haven hard to leave high rates having money characteristics. However, there are ways to make sure you get a knowledgeable contract you’ll.

Ways to get a decreased investment property home loan rates

It’s hard to flee large rates of interest for financial support features. However, it is possible to ensure you get an educated contract you can easily.

Following these procedures, you could potentially alter your likelihood of protecting good money financial cost and you may optimize your long-title yields. Think about, non holder filled financial rates were large, very making the effort so you can negotiate and you may check around is significantly work for your investment method.