- People

- Professions

- Mass media Library

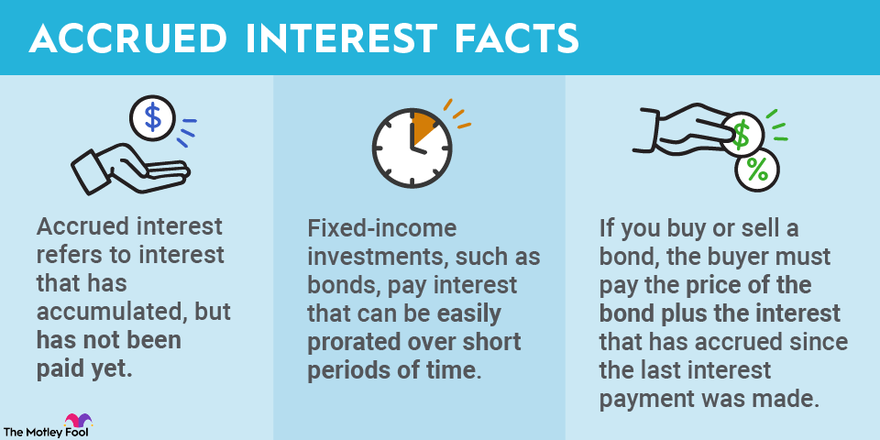

- Financials

- Financing & Properties

- Feeling Reports

- Strategic Package

- Yearly Reports

- Effect Map

Greet Home loans

This is why i authored Greet Home loans – for folks who want the protection away from residing their unique family towards the land that will not getting out of stock regarding around them.

Welcome Lenders is fixed-price, long-title traditional mortgage loans for the purchase of this new and you can pre-owned manufactured land in citizen-had groups (ROCs) otherwise on the land brand new homeowner owns or perhaps is buying inside The Hampshire.

Buy a different sort of Manufactured Family

Picture on your own inside yet another are made family. You have chosen the newest cupboards, this new colors, together with layout, that it looks great. You plus selected good ROC to live in, or belongings to place your new house into.

All of our Their Turn homebuyer guidelines helps make one sight an easily affordable facts for those whoever house income is actually lower than a precise top. Your Change even offers an additional $thirty-five,000 financing to cover down payment and you may closing costs for the the brand new Times Superstar land.

Get an excellent Pre-Possessed Are created Household

A pleasant Financial can be used to buy a current are built family inside a good ROC otherwise towards the homes new homebuyer has or is purchasing. On top of that, we offer $fifteen,000 inside the down-payment and closure cost assist with buyers whoever home money is less than a defined level.

Unmarried Father, Seasoned, and you can This new Homeowner

The city Mortgage Finance made me express what you and place me personally able to purchase, John [our home visitors] says.

Brand new Residential property Create Thriving People

Because the package rents was ROCs’ merely revenue stream, placing residential property towards the those plenty turned a top priority off Versatility Village’s volunteer board.

Their Basic House, Near to Family

Its a cool feeling. We have never been pleased with me, however, I could never be far more proud of me nowadays, Antonicia says.

Start off

Comment the method less than to know the big picture in the event it relates to applying for a welcome Financial, and buying and setting up your residence.

Request The Loan Originators

Contact us within (603) 224-6669, option step one having approaches to the questions you have also to consult with financing originator. We’ll review this new regards to your financing (if you have you to) and look at if you qualify for any deposit direction applications.

Prequalify

You happen to be in a position to prequalify for a pleasant Financial by completing a one-page function and you may faxing otherwise mailing they to help you united states. Without having a computer otherwise access to a great printer ink, delight call us at the (603) 224-6669, option step one, in order to schedule americash loans Essex Village an interview.

To get an empty Package

I lend to manufactured-home buyers who will be establishing their houses into the ROCs or to your their unique property. Check our very own a number of ROCs to find one in your area.

Pick a home

Be sure the full prices to make the house move-in in a position is within the amount you prequalified having. The merchant need to play the role of the brand new standard specialist on the domestic setting up. We only disburse money on retailer, therefore the work and you will product to discover the domestic circulate-from inside the able must be on the offer. Including sitework, utility contacts, and stairways otherwise decks.

Investigate Exacltly what the Home Lot Demands

Whenever you are to shop for an item of homes (otherwise have you to definitely), do you want to developed a good septic tank and you may better? We simply disburse to a single entity, very that which you within the financing, like the cost of running electronic with the web site, people creating functions (eg forest reduction), hookups in order to urban area drinking water and you will sewer, and you may finally loaming of webpages must be noted on the brand new retailer’s contract.

Give us the latest Retailer’s Suggestion

The fresh proposition should include the home’s floors bundle, features listing and you can, in the event the position property in your house, the brand new fully carried out land price.

Apply for a loan

Just after researching a suggestion regarding the store, we’re going to email your a link to an on-line app webpage. Please make sure to in addition to fill out supporting documentation.

Understand the Schedule

Whenever we have your completed software and purchase agreements, the audience is no less than forty five days out of closing on your own loan. You will need to rating from the store the time period from your closing to in the event the house might possibly be mailed throughout the warehouse and mounted on your internet site.

We Buy Mortgage Assessment and you can Label

We shall acquisition these two even as we receive the assessment commission in addition to borrower’s signed Intent to Proceed mode. The appraiser upcoming check outs the house site and you can uses the ground bundle featuring record to search for the well worth, as if the house has already been done.

Complete Closure Info

We help you to gather people products that are needed just before closure the mortgage. At the closure, you, the financial institution, additionally the household store comment and you may signal the building loan records.

Close and then have a certificate out of Occupancy

At financing closing the master of the new property (in the event that relevant) gets almost all their proceeds. The merchant will get the earliest 10% disbursement. You will want a lot more files between if your financing shuts and you can when you get a certification off occupancy.