This informative guide discusses Federal national mortgage association and Freddie Mac’s percent advance payment conventional loan program having basic-date homeowners. Federal national mortgage association and you can Freddie Mac’s purpose is to buy mortgages out of banks and you may lenders and you will render homeownership.

Fannie and you will Freddie should make homeownership available to an average hard-doing work loved ones which have access to borrowing for homeowners, particularly earliest-day home buyers. The 3 per cent down-payment conventional mortgage program try re also-launched of the Federal Casing Funds Agencies (FHFA) to help you compete with HUD’s 3.5% deposit FHA money.

First-day homebuyers whom haven’t had a house before three years meet the criteria to have a conventional loan having a beneficial step 3% down payment through Fannie mae and Freddie Mac’s 3 Per cent Down Payment Old-fashioned Loan program.

Which initiative, referred to as 97 LTV Conventional mortgage system, specifically goals the difficulty of accumulating the required advance payment for of a lot possible property owners.

Some old-fashioned loan software, like those supported by Fannie mae otherwise Freddie Mac computer, usually support off costs as little as step 3%

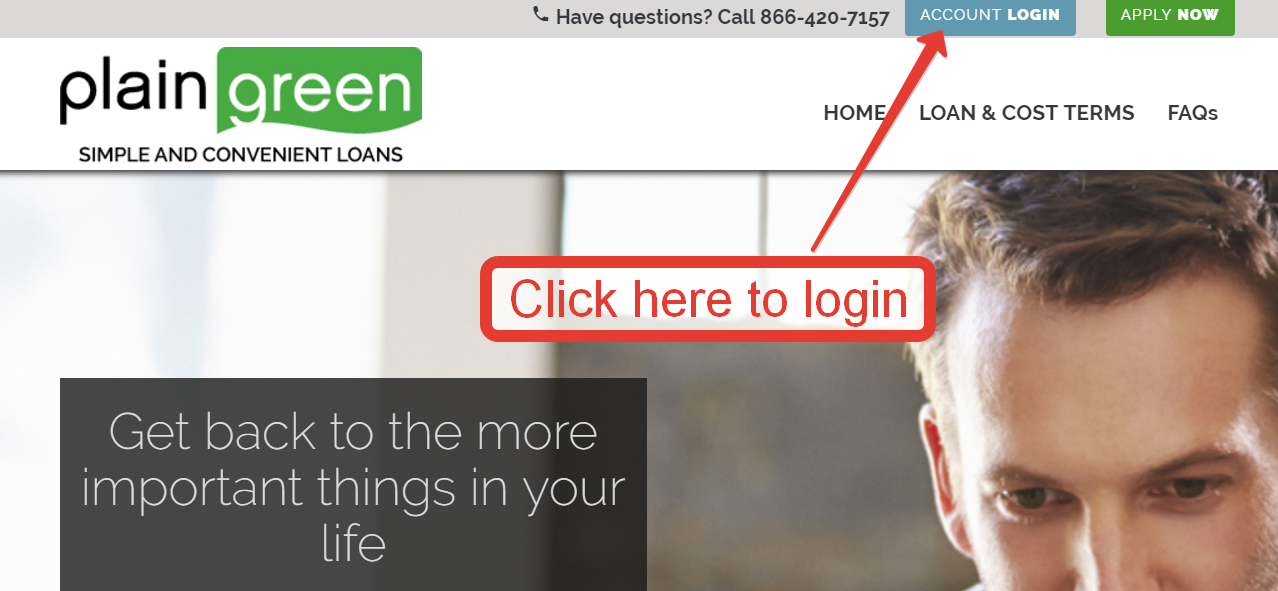

Despite their capability to cope with month-to-month mortgage payments or any other debts, the fresh initial will set you back, for instance the advance payment and you can closure costs, will still be a life threatening challenge as a result of the highest cost-of-living. View here locate 3% down on a conventional financing

Luckily that Fannie mae and Freddie Mac brought the 3 Per cent Down-payment Traditional Loan system to have earliest-big date homebuyers. This program, which had been highly popular one of first-time homeowners, requisite only a beneficial 3 % downpayment. not, Federal national mortgage association and you will Freddie Mac computer abandoned this choice during the 2014.

The very least 5 % down-payment is normally necessary to be considered getting a normal financing. It’s still possible for homebuyers having an excellent 3 % down commission getting eligible for a traditional mortgage, provided it fulfill the traditional credit conditions.

A good step three% deposit is typically sufficient to possess a normal financing, specifically if you thought conforming to financing limits. But not, it is crucial to imagine several points that can determine which.

To begin with, your I) which have a down payment lower than 20%, and therefore grows the month-to-month will cost you if you do not arrived at 20% collateral at home. As well, your credit score and you will debt-to-income proportion (DTI) can impact the brand new regards to your loan, possibly affecting the necessary down-payment.

Consulting with a home loan company is preferred to learn your options clearly based on debt reputation additionally the readily available mortgage software.

What is the Restrict DTI to own a traditional Mortgage?

The most obligations-to-income (DTI) ratio getting a normal mortgage normally utilizes several affairs, like the certain mortgage system, the new america cash loans Bristow Cove lender’s requirements, and your total economic character. However, just like the a broad rule:

- Conforming Antique Funds: This type of loans go after Federal national mortgage association and you can Freddie Mac’s recommendations. The most DTI ratio for those fund often is out-of 43% so you’re able to fifty%. Nevertheless, specific loan providers get create high DTIs if the discover compensating circumstances.

- Non-Compliant Antique Money: Speaking of referred to as jumbo finance and you will go beyond the new conforming financing limits place of the Federal national mortgage association and you will Freddie Mac. Lenders for these fund may have additional DTI requirements, have a tendency to stricter as opposed to those for conforming money.

- Automated Underwriting Options: Of a lot lenders use desktop computer underwriting systems to test loan requests, such as for example Desktop Underwriter (DU) or Mortgage Prospector (LP). If credit scores and you can economic reserves was solid, these assistance may approve large DTIs.

- Guidelines Underwriting: In some cases, if the software does not fit inside automated underwriting guidance, a lender could possibly get by hand underwrite the borrowed funds. This may allow for a lot more liberty for the DTI percentages, specifically if you has actually compensating products particularly a huge off percentage otherwise large cash reserves.