- Home loan Posts

- Upsizing Your property

The Self-help guide to Upsizing Your home

Around australia, there’s a known ilies develop sizes. Into the instances such as, upsizing might be an important circulate.When you find yourself considering upsizing, there are professionals and you may drawbacks that you ought to thought. The first thing to remember is that upgrading with the a larger domestic can come on a critical cost. Apart from that, you’ll find a bunch of what you should discuss before generally making the major circulate.

What is actually Upsizing?

Attempting to upsize and you will being forced to upsize are a couple of different things. If a tiny repairs and you may renovation can solve the difficulties your enjoys with your most recent house, upsizing isn’t the answer. Yet, if your family unit members continues to grow and you are ready to change your lifetime with a more impressive financial, that is in the event that importance of upsizing arises. Estimate your position and make sure you think of a couple of things before you could search next.

The place to start

- Make sure Along with your Lender: When you upsize, chances are an abundance of guarantee from your home will be accustomed improve circulate. Their deposit, together with your purchase price, will go upwards. This means you might be able to find a larger financial from the bank than just you currently have.

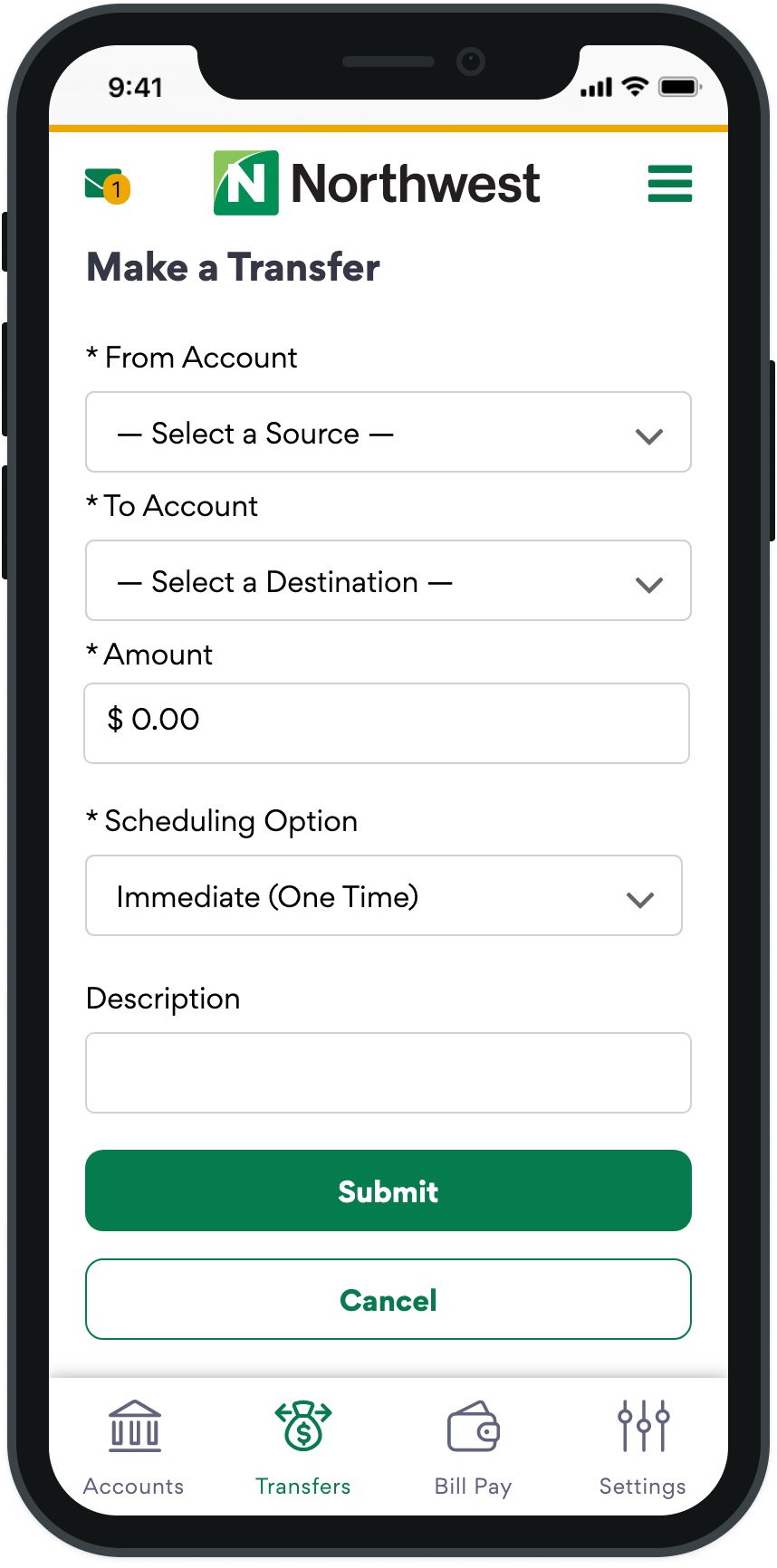

Sharing these products along with your lender as well as asking for a great pre-recognition might possibly be useful. Communicate with our brokers right now to assist you with getting pre-approved.

Determine whether You could potentially Deal with A more impressive Home: Ask yourself so it concern: Create We have long, currency and info to keep this large home? When you find yourself already having difficulty looking after your most recent home, you might want to think about what you don’t such doing and possess a property that takes away you to definitely issue. Do you really Get Or Offer Earliest?: Just after some body decide it is time to enable them to upsize, they often times is actually not sure throughout the whether to get very first or offer basic. Advantages say the better way to go would be to offer your own old household before buying yet another that. This is exactly to ensure that you enjoys fund in a position out of your purchases getting if you decide in order to go ahead. You will also have the ability to lay more money in your home loan, and certainly will stop the past and you can forward anywhere between a few mortgages on once.

1. What’s My Cause for Upsizing My house?

Manage I wanted more room to possess an increasing family? Am We trying to update my existence? Solutions to such issues will not only reveal if or not you is always to upsize your home immediately, but will make you a picture of what you would like on your own brand new home. We strongly recommend performing a list of what you want and do not want to book oneself and your representative during your lookup.

dos. How much Ought i Use?

Understanding your you’ll be able to financial can cost you in advance can help you be more clear on what kind of assets you would like. Confer with your bank and determine simply how much you could acquire for property revise. This can including help you check if you should re-finance the loan or if perhaps the current home loan performs merely right. Get a harsh estimate of your credit stamina using our very own mortgage calculator.

step 3. Do i need to Protection The expenses Out of Upsizing?

What are the costs associated with upsizing? Answer: maybe a great deal more than you are taking into account today. These can cost you potentially cover a large stamp obligation costs and you can Loan providers Mortgage Insurance policies if you’re considering credit more than 80% of the house worthy of. Will set you back of swinging the anything in the new home are also inside.

4. Should i Afford the Better Constant Costs?

Kept in believe you to upsizing usually includes a surge inside expenses, compared with your earlier in the day home. Moving into a larger set setting large electric bills, higher repairs and you will repair costs, and the significance of more homeowners’ insurance coverage so you’re able to finest everything. Before conversing with a specialist regarding the upsizing, estimate this type of expenses and find out if you find yourself economically effective at and also make costs.

5. What exactly are My personal A lot of time-title Arrangements To own My Brand new home?

Thinking of moving a bigger house is a large partnership. It decision shall be established purely into the where you wanted on your own as well as your family unit members to be in the near future. Eg, if you are planning so it as the history avoid prior to senior years, make sure that all your valuable need to haves’ is ticked away from. Selling a larger household is generally more difficult because the few are looking to purchase a more impressive place. Staying that it in mind, try using their enough time-term plans with your new place prior to bidding inside it.

Achievement

With lots of facts to consider when thinking about upsizing your property, its essential you feet this choice on plenty from research. Upsizing needs a well-balanced co-ordination ranging from attempting to sell their dated domestic and purchasing an alternative that. This action can be daunting and needs to get timed accurately to store will set you back manageable. Heaps of legitimate and never-so-legitimate point online makes anything far more confusing. It’s always best if you get in touch with a professional to aid your comment the money you owe before making a decision. The professionals can help you score a crisper picture of exactly what their mortgage situation needs. Call us into 1300 889 743 to speak to just one out of the Experts or submit which online investigations form to help you provides us get in touch with you.