That have easy access to financing through individuals money helps you see urgent need and you may complete your targets. All financing come with their eligibility standards, an unsecured loan to pay for healthcare or a married relationship, a home loan to become a resident or a corporate mortgage to improve your firm’s development.

So you’re able to one another be eligible for a loan and also have they on the aggressive words, your credit score try a variety you simply cannot ignore. A credit rating above 750 reflects an effective financial health and expands your odds of taking an affordable sanction toward versatile terminology.

How does your credit rating matter if you find yourself seeking take that loan

Your credit rating shows your own creditworthiness and you can allows the bank so you can court the job due to the fact a potential debtor. It is a summary of your credit rating and exactly how sensibly you may have taken care of borrowing from the bank prior to now. Your credit rating reflects your dependability whilst takes into account things such as punctual cost regarding EMIs, their borrowing from the bank utilisation, your own borrowing inquiries, as well as your current loans. A good credit score shows your lender that you’re financially steady and responsible that have borrowing from the bank.

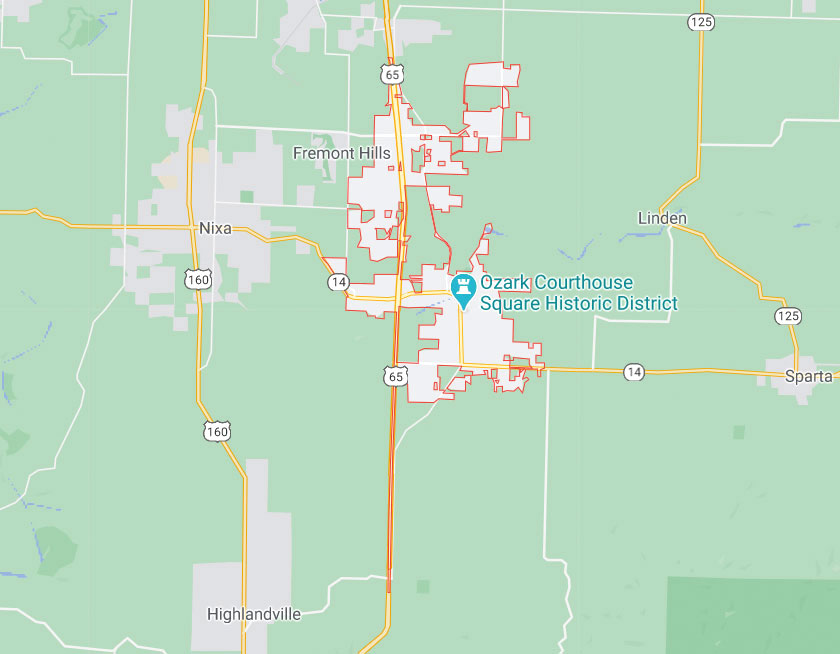

not, do remember your credit score isn’t the merely standards undergoing qualifying for a loan and you may getting acceptance in your application. Other variables like your income, city of household, current personal debt, workplace, etcetera., in addition to are likely involved.

While you are a good credit score is important no matter what the kind off capital you are searching to avail, here are the most readily useful results that can help you score a greatest price on the loan.

Best credit history so you’re able to avail a personal bank loan

Your credit rating is a huge basis deciding the qualifications getting a consumer loan because it is a collateral-100 % free financing. Minimal CIBIL get to have a personal bank loan is actually anywhere between 720 and you will 750. With it get setting you are creditworthy, and you can loan providers tend to agree your application for the loan quickly. They ount on an affordable attention.

While you can still be capable of getting a personal bank loan that have a credit score between 600 and 700, the low your own get, the reduced their acknowledged loan amount might be. A credit score less than 600 is regarded as useless for personal finance in most cases.

Best credit score so you’re able to avail a corporate mortgage

If you’re making an application for an equity-100 % free team financing, that have a credit rating of 700 or more is most beneficial. If you find yourself making an application for a protected business mortgage, your loan app are approved with a lower credit rating, say between 600 and you can 700 as well. Both these circumstances are real if you’re applying for an excellent team mortgage given that just one, whether it’s a personal-working elite group particularly a california or professional or doc or self-employed low-top-notch particularly a trader otherwise company.

Yet not, when you find yourself trying to get a business loan since the an organization, should it be a collaboration, Limited liability Partnership, Individual Limited, otherwise a directly kept limited providers, your online business credit rating issues other than your very own credit score. In these instances the CIBIL review otherwise Equifax providers credit score try checked from the financial.

Most readily useful credit history having lenders

Home financing was installment loan Florida a guaranteed financing since the domestic you are to find acts as brand new guarantee. And this, you’ll get a home loan although your own credit score is gloomier than 750. Particular loan providers approve home loans in case your credit score is approximately 550 or more.

You will need to remember that the low your credit rating are, reduce the amount borrowed would be approved toward acceptance. That is why applying for a large loan amount if your credit rating is actually reasonable is not a good idea. Sometimes, lenders offer just 65% otherwise less of the required loan amount in case the credit history was lowest. It will be best to improve your credit history before applying to own a home loan.