- An urgent situation fund, or backup, to protect against unforeseen large can cost you:

Brand new rainy time financing is oftentimes at least 5% added to your budget, and also make the construction mortgage greater than the fresh new budget. The theory isnt to expend which contingency. It’s just an emergency loans, a safety net to ensure their successful achievement. Which overage can be obtained, however, to have improvements, for example a share, at the conclusion of design.

- Indicating a cash set aside out-of seven-10% of construction funds:

Their construction financing and a funds need to safeguards framework can cost you, backup, property payoff and you can settlement costs. Within the design, cash is king. BGCH recommends that you maintain some liquid assets for money move motives while in the framework. The financial institution will fund the development from the amounts following work inside each stage is performed. Which have very few exclusions, the bank will not cash advance funds through to the subcontractor ends for every stage. Like, your day the fresh slab was stream, your finish the records into the slab draw. Following the bank mark inspector visits your website, and you can transforms in the draw examination declaration, the bank commonly loans cash advance Gadsden reviews this new assigned slab mark to your account. It essentially takes dos-three days. Then you certainly spend the money for contractor for the slab. Except for a potential very first delicate draw, you should use borrow money in the bank simply just after done really works, not just should you decide may require otherwise want it. Any functioning monies required in the fresh meantime must are from new smooth draw or your very own financing/credit lines.

- Obtaining trick companies whom give borrowing terms and conditions, up on certification, to help you BGCH clients:

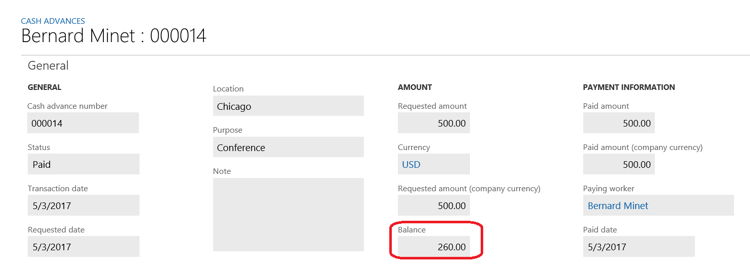

People vacant portion of the framework financing isnt taken away from the lending company, which means the borrowed funds could be below the construction financing

This provides you the owner builder generally speaking around 30 days to cover content, with respect to the day out of get. You to supplier now offers several day zero attract, zero payment borrowing terminology. This will help to with cashflow need once you get to your framing stage.

100% Success

Area of the percentage you have to pay BGCH would be to take on the risk and back your upwards at the lender to the design loan. BGCH mitigates the chance of the:

- Mindful considered and budgeting, including obtaining bids of top quality builders for the majority building phases:

Most of the design have to be completely allocated and you can assumes you are with most of the works done-by accredited builders. The fresh new finances should provide money to do the development, whatever the. When you do some of the works on your own, you only do not purchase and don’t draw the quantity assigned on the cover you to definitely stage. Consequently the finances are frequently higher than the final prices.

- An emergency finance, or backup, to protect up against unexpected high will cost you:

The latest wet time finance is sometimes at the very least 5% added to your allowance, and work out their build loan higher than the finances. The theory is not to expend it backup. It is simply an urgent situation money, a back-up to ensure their winning conclusion. That it overage can be acquired, although not, for updates, such as a share, at the conclusion of framework.

- Recommending an earnings set aside regarding seven-10% of your design funds:

Their framework loan along with your very own money need to cover framework costs, contingency, home rewards and you may settlement costs. When you look at the build, money is queen. BGCH advises which you retain some liquid assets for the money move intentions during construction. The bank usually financing the building by the grade after the functions inside the for every stage is accomplished. Which have hardly any conditions, the lending company doesn’t cash loan loans until the subcontractor closes each stage. Such as, a single day new slab was put, your complete the files with the slab mark. Pursuing the lender mark inspector check outs the website, and you can turns in the mark assessment statement, the financial institution will fund the newest designated slab draw for you personally. This basically requires dos-3 days. You then pay the contractor to your slab. Apart from a possible very first flaccid draw, you should use borrow money on bank just shortly after complete work, not simply should you decide might require or need it. People performing funds needed in the fresh meantime need come from the fresh new flaccid draw otherwise a fund/credit lines.