Whenever inquiring home loan businesses because of their cost, it is all having fun with quantity up to it direct you the great faith imagine. 5% when you are a separate will receive mortgage loan off 3.9%. What the financial to the lower price have a tendency to don’t speak about instead searching higher is that the doctor obtaining financing are most likely paying for things on their home loan.

- Paying affairs are an easy way to pay money up front to own a diminished interest. It scarcely works out on your side.

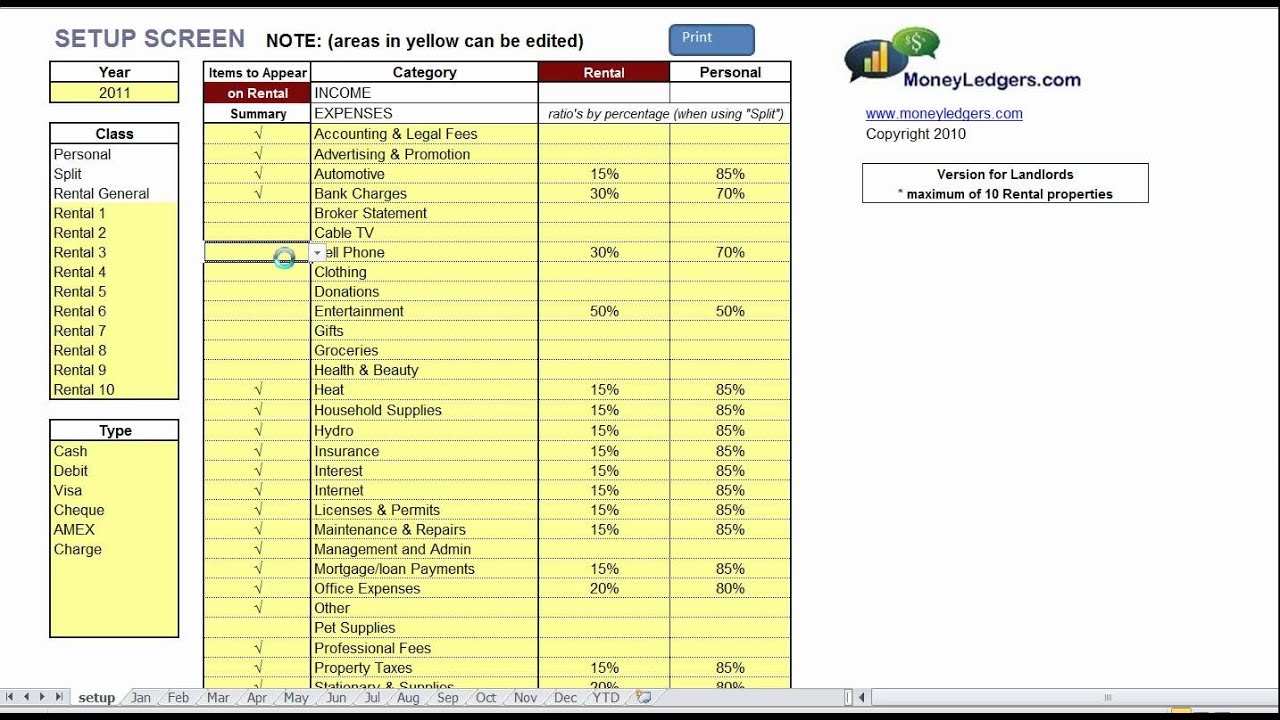

Good-faith estimates demonstrably number aside interest levels, fees of the bank, and you may 3rd part charges (for example examination, survey, or any other expected documents the customer is look around to own).

Until you find a good-faith imagine, new percent speed is probably simply a teaser to draw you within the. Sometimes a low stated price is not necessarily the most affordable loan alternative due to the fact charge could be extremely high.

Cannot Expect Grand Deals

Immediately following looking at good-faith quotes, there’s the exact same thing that we did. For every company https://paydayloancolorado.net/ramah/ more or less got comparable will cost you.

Shortly after bidding the good faith prices up against each other, However found the lowest bidder. Finally, We wound up protecting $700 by shopping six more mortgage organizations. When you shape you to check of the property may work with $five hundred and other fees is actually next to $5,000, the latest deals check quite brief. I became expecting much more version when you’re to shop for a property getting really into six rates. Home loan rates are set as there are a great deal race already you to everything you pay out-of lender to help you lender might maybe not are different from the a huge amount.

You are Nevertheless Paying PMI

DI, otherwise private mortgage insurance coverage. How the financial becomes doing PMI will be to improve fees otherwise passions costs sufficient to merge the PMI on the longevity of the borrowed funds. In effect, you are however using PMI, only it could never ever go-away. It might be here with the longevity of the mortgage, and make a health care professional financial a probably more expensive home loan over the long term.

Consider an arm

Varying speed mortgages (ARM) obtained a good amount of negative publicity as much as 2008-nine from inside the financial meltdown. Now, many people are scared to locate an arm because of all the the newest crappy publicity.

I would argue that a doctor mortgage simply can be an effective finest applicant getting a varying price financial (ARM). Which assumes on that the doc will continue practicing, has just finished out-of residence otherwise fellowship, and certainly will prevent too much expenses. Here are the good reason why We possibly advocate to have a supply to own medical practitioner finance

- Mortgage costs usually typically have all the way down appeal costs as compared to 30 season fixed.

- Really brand new gonna medical professionals (and you may non doctors) will not stay static in the first household more than 5 to help you seven years.

- Secure employment market. Even if a doctor will get laid off out-of a group due so you can a takeover. There are usually locum tenens or any other work that with ease be found. This is often untrue with other marketplace in which they can take annually or even more discover a similar job..

Before anything else a typical example of pricing that we received in the same lender. Allows suppose a good $440,000 purchase price having 5% down. The 2 offers was indeed:

- step 3.4% appeal on the a beneficial eight/1 Arm

- 4.4% notice on the a thirty seasons repaired

- Charge towards Case mortgage was in fact actually $step 1,000 less expensive than 31 seasons fixed.

On Case loan the doctor would-be using $63,100 the theory is that and $93,138 towards the focus over eight age before mortgage speed resets. Overall kept balance on financing during the 7 many years try $336,900