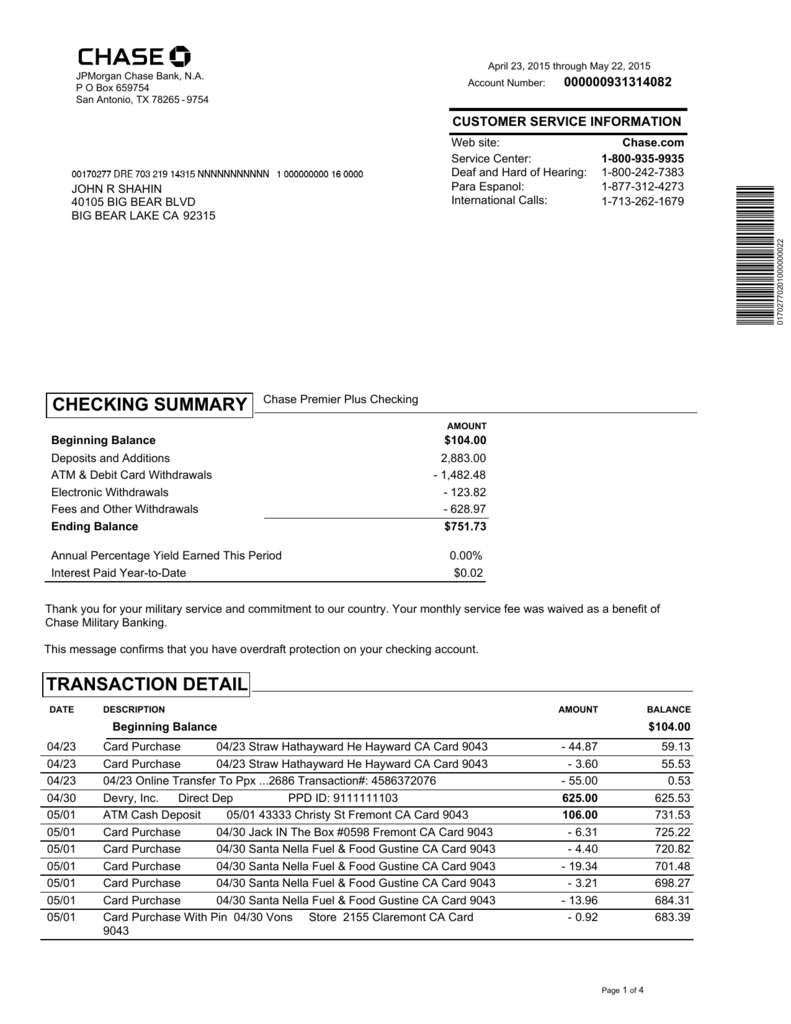

It might be tough to belongings a home loan, but also for specific borrowers with the fresh new bucks businesses privately, bank statements otherwise site letters could well be the records necessary. Photos from the ASHLEY FRASER/Postmedia

Tips be eligible for home financing in case the most recent income does not cut it Back once again to movies

Anybody find pricing coming down; they want to purchase a property – perhaps because they don’t think pricing will remain down for long – even so they can not show adequate income discover home financing.

How to proceed? Better, unless you’re an alternate professional such as a health care professional otherwise dentist, or if you be eligible for rigorous specific niche credit apps, you can also get approved predicated on a significant online well worth, major finance companies will likely direct you the entranceway.

- Personal posts off Barbara Shecter, Joe O’Connor, Gabriel Friedman, although some.

- Each day stuff away from Financial Moments, the latest planet’s best around the world business guide.

- Endless online the means to access discover blogs out-of Monetary Article, National Post and you may fifteen development sites all over Canada which have that membership.

- National Article ePaper, an electronic digital imitation of the printing edition to view into the any tool, show and discuss.

- Private blogs regarding Barbara Shecter, Joe O’Connor, Gabriel Friedman while others.

- Daily blogs off Financial Minutes, the fresh new earth’s best in the world company publication.

- Unlimited on the web access to read posts of Monetary Post, National Blog post and fifteen development web sites across the Canada that have one to membership.

- Federal Blog post ePaper, a digital imitation of print edition to get into toward people equipment, display and touch upon.

Register or Perform an account

Thankfully, larger finance companies cannot totally monopolize Canada’s home loan business. Alternative lenders will often provide your way more according to your overall capability to spend. Which function cannot merely rest in your earnings today.

1. Contributory money

Family relations will chip from inside the to your bills – think about granny residing the newest visitor area or your buddies for the an out in-law room. Such family may possibly not be towards label into the possessions, however, alternative loan providers commonly consider their payments when working out for you meet the requirements to own a mortgage.

Certain loan providers may also is really-recorded region-date otherwise concert money (handyman, Uber driver, etcetera.) rather than requiring common several-seasons earnings background.

Canadians are fantastic at the searching for innovative ways to earn more income due to their family unit members, says Offer Armstrong, head off financial originations at the Questrade Financial Group’s People Believe Organization. While the a loan provider in these cases, we’re finding realistic earnings that shows a https://paydayloancolorado.net/glenwood-springs/ regular pattern and you can can be recorded for the past three, half a dozen, nine or 12 months.

For the majority of borrowers with this new dollars people privately, bank statements otherwise site letters might possibly be most of the paperwork necessary. Try getting you to definitely accepted at the a large lender, specifically if you have a diminished credit rating.

dos. Coming money

Getting positives such as medical professionals, dentists or attorneys, a living surge later is almost certain, and many loan providers are prepared to bet on one.

Non-professional borrowers will also have qualifying coming income, also those pregnant youngster service, alimony, rental otherwise retirement earnings regarding close-name.

Even newbies that have simply revealed a good Canadian business or men and women transitioning out-of a stable paycheque in order to worry about-work discover loan providers happy to give the environmentally friendly light. They simply need to tell you their money load is generated.

step 3. Quick assets

Certain loan providers calculate how much you really can afford to your presumption you could turn the assets to the dollars. If you have extreme possessions, we have programs that may leverage that for another pair years, claims Armstrong.

Bucks, otherwise whatever should be conveniently changed into bucks, may help a loan provider validate exceptions so you can the personal debt ratio limitations (we.elizabeth., the utmost portion of gross income a loan provider makes it possible for housing and you may debt money). Specific loan providers will additionally consider RRSPs in an effort to justify a bigger amount borrowed.

4. Future assets

Consumers that listed an alternate possessions available, keeps a depend on loans future available otherwise anticipate an inheritance throughout the mortgage term all possess coming bucks availableness . Alternative loan providers can sometimes matter a percentage of those assets due to the fact a way of financial obligation servicing otherwise paying off the mortgage.

Certain might envision retained bucks which is sitting in the a corporate membership, as long as it is unencumbered and you’ve got unfettered access to the bucks anytime.

Brand new tradeoff

In daily life plus in financial money, freedom have a tendency to comes with an asking price. Solution loan providers costs large rates and their increased cost out-of protecting loans in addition to greater risk on it.

Typically, consumers that if not qualified pays low-best lenders an increase which is one or more to a single and you will an one half commission issues large, also a single per cent fee – given he has got a solid borrowing from the bank character, at the least 20 per cent security and you can a marketable household. Shorter collateral you will force your own rate of interest upwards from the no less than a separate 31 in order to 50 foundation facts, whether your financial also agrees on bargain.

If you’ve missed several repayments over the last number of years, otherwise your house actually in the city otherwise burbs, or perhaps the home loan matter is over $one million, otherwise it is a residential property, expect to pay materially a lot more.

And you may about that security – it is crucial for low-primary loan providers. They really want a hefty collateral shield just like the insurance rates resistant to the highest default cost typical out of non-prime individuals. This is the only way they are able to be sure they will certainly recover their money when the one thing go bad in addition to debtor does not pay.

Generally, new sketchier the borrowing from the bank or wonkier your income problem, more equity you will want, possibly as much as thirty-five percent or more. Particular loan providers create 2nd mortgages trailing its very first to help you acquire much more, however you would not including the interest rate thereon second.

New takeaway is that there are lots of units inside the a great home loan broker’s toolbox to get a borrower recognized. If you fail to do it during the a financial but nevertheless want a mortgage, it basically comes down to that matter, How have you been thinking of to make their home loan repayments now, tomorrow and you will a-year from today?

However, simply because anyone can get acknowledged to own a home loan does not mean they must. Each one of these workarounds are intended for people who can pay their mortgage without a doubt. For those who have also a sign off value one, carry on renting.