Editorial Assistance

Regarding personal loans, there are lots of legitimate lenders and you can properties offered. Sadly, there are even fraudsters seeking make use of people. In 2022, scammers stole almost $8.8 million out of Us americans, with respect to the Federal Trade Fee (FTC). To guard oneself of one future headaches, it is very important be on the lookout to possess well-known indicators out of personal loan scams.

Personal bank loan frauds might be challenging to identify since there are various kinds of scams you to target users. Have a tendency to, such cons endeavor to accessibility valuable personal information about you such as for example your own Public Shelter count or mastercard count. Scams can also are trying availability your bank accounts, recharging heavens-large rates and you can charge otherwise causing you to buy an effective personal loan you might never have access to.

step one. The lending company asks for fees initial

A reliable bank wouldn’t ask you to pay an upfront commission to access personal bank loan finance or to comment personal bank loan documents. When the a loan provider does request payment one which just supply the financing funds, this online payday loans California might be always a sign of a scam.

This is one way signature loans performs: After you pay off a consumer loan, you do thus when it comes to monthly premiums. You will generate constant advances for the repaying the main equilibrium and also the attention charges.

dos. The lender promises you’re approved before you apply

A publicity away from secured acceptance having a personal loan is an additional signal that a lender can be trying make the most of your. Essentially, consumer loan loan providers has a few standards that consumers you would like to fulfill to get approval getting a personal bank loan. Your credit history, earnings and other affairs need fulfill a certain peak away from standards to own a lender to feel comfy issuing you a personal bank loan.

You’ll find consumer loan activities in the business which make it easy for customers having reasonable fico scores to get your own mortgage, however, even those people fund enjoys conditions that must definitely be fulfilled. A vow off secured loan recognition is sometimes an indication of a subprime mortgage or a total con.

3. The lending company intends to obvious the debt

If a great deal musical too-good to be real, it is frequently. A common example of a personal loan scam comes to promising in order to obvious the debt. This is done of the claiming to get obligations repayments in order so you’re able to pay back a current supply of personal debt.

Keep away from these types of even offers and alternatively works yourself with your lender observe just what possibilities you really have to make less improvements on personal debt payment.

4. The lender isn’t really inserted on your own county

If the a lender actually entered on the state, they cannot legitimately present a consumer loan. They have to check in in the states in which it services their team. Ahead of agreeing to almost any loan even offers, double-make sure that the financial institution is entered on the state you reside.

This can be done from the contacting a state attorney general otherwise banking or economic services regulator. You will discover how exactly to contact your specific nation’s financial regulator right here.

5. The financial institution calls your having a deal

A reliable unsecured loan lender fundamentally will not promote its attributes by the cold-contacting people and leading them to financing offer on the spot. Incase a lender has reached over to you first, this really is a sign of good scammer trying to get access to a banking guidance.

It is best habit not to ever answer lenders otherwise loan providers who give you an offer of the cellular telephone, door-to-doorway solicitation otherwise via mail. It’s actually illegal for a loan issuer to provide that loan over the phone.

Where to find genuine personal bank loan also provides

An unsecured loan try a really of use monetary device, very do not let possible cons scare you off from credit currency for that gorgeous kitchen area remodel. When the time comes to try to get a personal bank loan, these are particular things you can do to acquire an established loan lender.

- Confirm the lending company was inserted on the county: You could potentially get hold of your state attorney standard and/or state’s banking or monetary properties regulator to confirm if a loan provider are joined in your condition. Remember – they can not legally material that loan if they are not registered to help you conduct business on condition you live in.

- Take a look at lender’s on the internet product reviews: When shopping for where you can rating a personal loan, views from other individuals helps you get a thought in the event the a loan provider try dependable or perhaps not. Below are a few Bbb (BBB) reports and other official critiques and study studies on the internet knowing more and more consumer enjoy.

- Take a look at the fresh lender’s on the web visibility: Really does the financial institution has actually an online site which is easy to access? Does you to definitely webpages without difficulty supply the information you need and then make a choice from the a lending tool? In case your lender has no a specialist web site which have exact contact all about it, that is a sign to walk out.

How to proceed if you feel you are are tricked

If you suspect you’re doing work in an unsecured loan ripoff or you to definitely good scammer made an effort to address you, you’ll find things you can do so you can declaration the non-public loan ripoff.

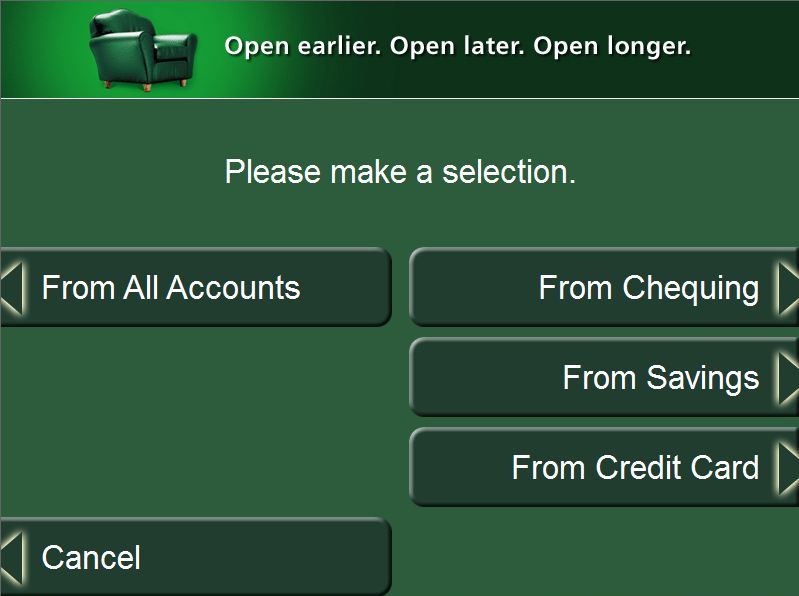

- Contact any people on it: First things earliest, if you gave currency into scammer rapidly get in touch with people enterprises your caused to really make the percentage such as your bank otherwise credit card organization. As much as possible, cancel people costs and ask for help securing your membership.

- Document an authorities declaration: Be sure to make contact with the authorities and you may file a study. You should request a duplicate of your own cops are accountable to continue hand having proof the latest experience.

- Be mindful of their borrowing from the bank: Should your scam artist keeps the means to access distinguishing facts about you you to capable used to unlock borrowing from the bank accounts on your term, this can seriously ruin your credit score. Sign up for borrowing keeping track of otherwise consider cold the borrowing to avoid deceptive behavior.

- Manage a study toward FTC: To assist prevent the scam artist out-of injuring most other users on the upcoming, file a writeup on one thought unsecured loan frauds on the FTC.