Residents try wearing checklist degrees of wealth. According to a recent declaration by the CoreLogic, House equity keeps soared almost twenty-eight% over the past year by yourself. That is the common obtain regarding $sixty,200 for each citizen. Today, the average resident presently has $3 hundred,000 home based guarantee a pretty much all-big date higher. Precisely what does this mean? How can you gain benefit from the guarantee of your property?

For the a surfacing interest rate environment, the fresh new amounts which you see will be daunting. Particularly if you might be always number-reasonable pricing. Delivering a fixed-price mortgage inside a premier-speed ecosystem will likely be overwhelming. A unique choice one that of a lot home owners and you will home buyers have not concept of in a while is actually a variable-speed mortgage (ARM).

Based debt desires, you can buy the refinance loan that fits yours demands a knowledgeable

Property owners was wearing listing quantities of collateral recently providing them with a lot more financial power than ever before. If you were given investing even more a property, now might be the for you personally to make your move having good cash-out re-finance.

Home loan credit made a great progress method in recent years. You no longer need a 20% down-payment and you may prime credit rating to help you secure financing. You will find some financial choice having low down percentage criteria and you will lenient credit score certification. What you do importance of a flaccid closure try sincerity, venture, and you can believe. There are many stages in the borrowed funds processes, but the the very first thing during the each one is providing your financial what we are in need of.

Buying a house can be the most significant capital of your own lifestyle. Whenever you are there are many things you can do to lessen brand new cost of your residence upfront, there are even methods for you to save money despite you have attained the brand new closure desk.

Even though many homebuyers think of a single day they can painting her structure, features their particular turf, last but not least possess a destination to call household, they have been neglecting one of the popular beneficial perk of the many. House collateral is one of the most worthwhile assets for the majority of homeowners. Not simply can it increase net worth while increasing the financial versatility, but inaddition it can improve your economic back-up.

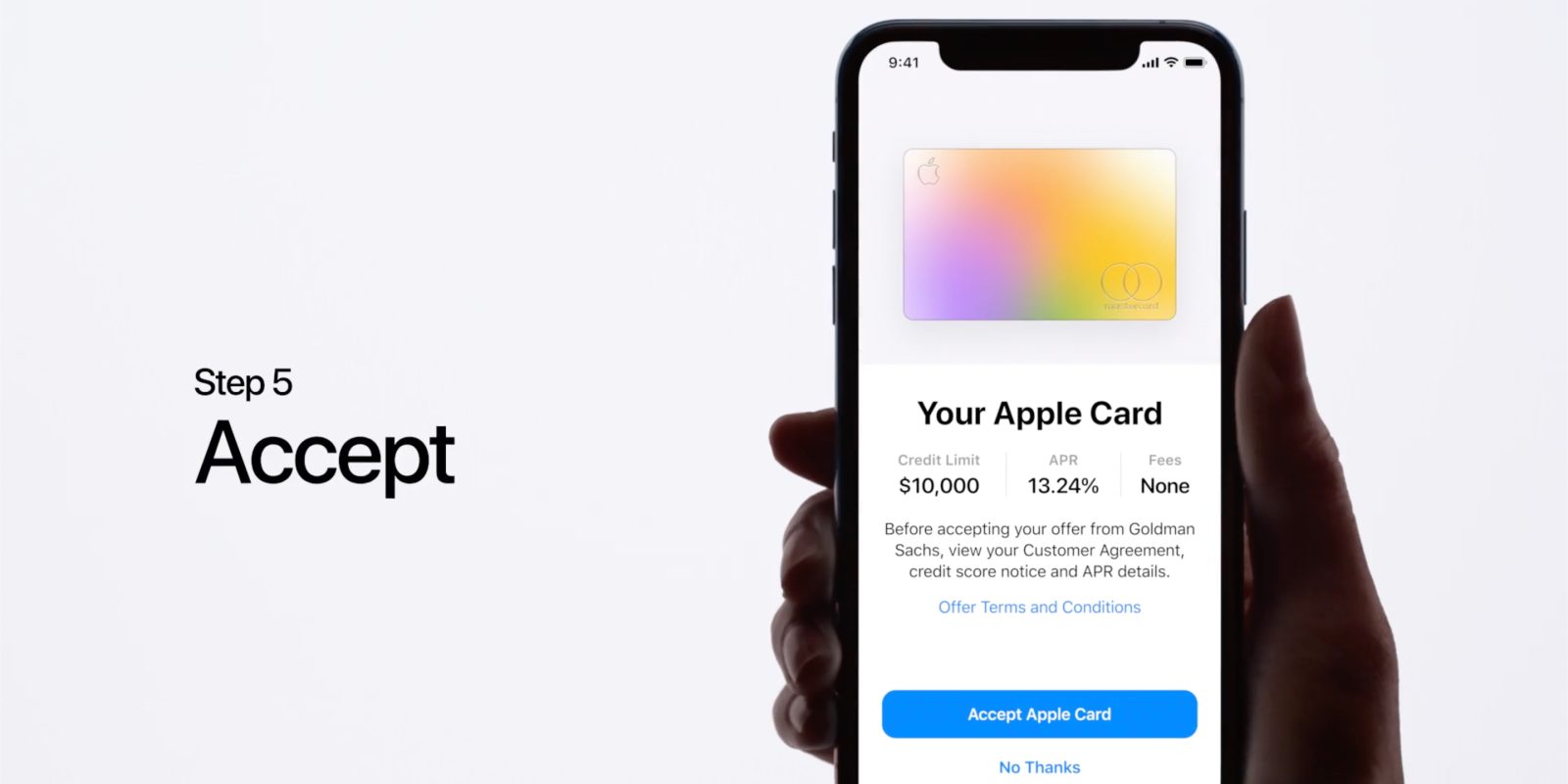

Playing cards are useful for quick payments and you will such things as monthly expense. Nonetheless normally have highest interest rates than just signature loans, which could make purchasing them from more challenging. If you find yourself thinking about and also make a giant get (house repair, household instrument, escape gift), then you may have to talk about the other options.

Refinancing their financial will save you several thousand dollars over the lifetime of the loan

For folks who haven’t refinanced your own financial, it should be for a valid reasoning. Perhaps you don’t think you would save your self sufficient or don’t believe might meet the requirements. No matter what need, its likely that you’ve regarded as they and you may started to a logical end. But not, it would be worth revisiting. Almost 14 million homeowners try missing out on billions out-of cash in the deals for one of your own after the misunderstandings.

not, it can have settlement costs which can add up quickly. Just before refinancing, be sure that you have a very good bundle which can shell out out of the closing costs along with your refinance deals. Discuss different choices which will help reduce the price of the settlement costs and save well on your current refinance.

Refinancing your house when you are rates of interest are lowest are an excellent higher economic solutions. There are many advantages to refinancing your house, before moving during the, it is preferable having a game bundle in the as to the reasons you are refinancing before everything else.