Beyond the facts their financial considers when pre-giving you to possess a mortgage number, thought how much money you’ll have for the-hands when you make the deposit

- Rate of interest: This is exactly fundamentally just what financial are charging so you can acquire the money. Your interest try indicated since a share and might feel fixed otherwise variable. The latest RBA might have been raising prices compliment of most of 2022, spelling the conclusion Australia’s typically reasonable dollars rate, and that at the beginning of 2022 sat at .1% It was not uncommon getting individuals to help you safe funds beginning with a two.

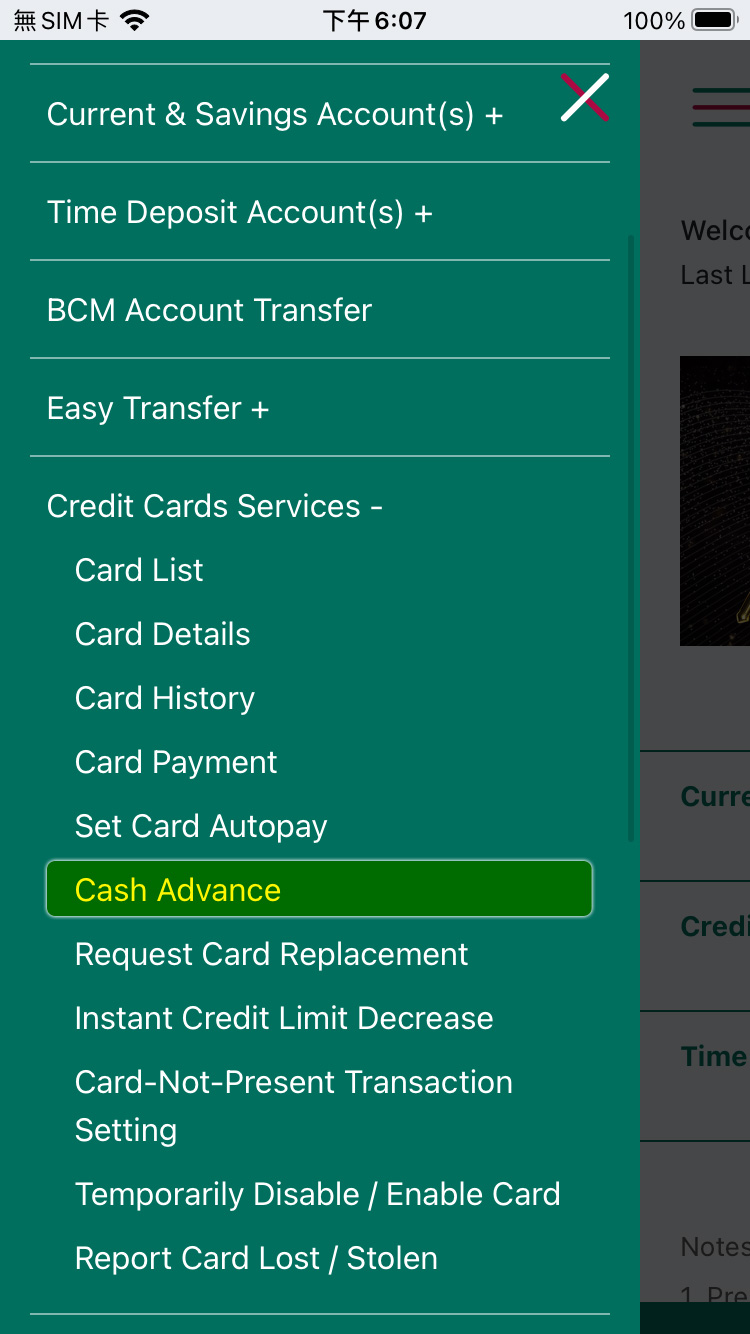

- Package charge: Particular financing may come with a great deal payment, especially if there are certain special features attached, for example a through-lay otherwise charge card.

- Upfront charge: Applying for home financing and purchasing property will be high priced. Make sure to cause for software charges, conveyancing costs, people bodies charge, and financial registration fees.

- Lingering fees: It is possible to need certainly to reason behind charge for many who option to a different bank, pay back the mortgage too soon, redraw or miss a repayment.

- Home and you will content material insurance rates: House and you may content material insurance rates handles you and your financial on the matter-of harm to your house. Speak to your regional insurance professional to get a bid or access a variety of free estimates on the web.

- Home loan insurance: Known as lenders financial insurance coverage, otherwise LMI, this handles the lending company in case you standard in your financial, and you may must foundation it inside the in the event your put is actually below 20%. Stay away from it if you can just like the insurance policies can merely create thousands, either countless amounts, for the cost of your loan.

- Stamp obligation: Finally, i reach stamp responsibility, a good levy which is imposed by for each and every condition since a portion of cost of the home. Such as for example, into the Victoria, it is calculated on the a sliding scale and begins during the step one.4% should your house is appreciated at $twenty five,000 and you will has reached around 5.5% if your house is cherished on or a lot more than $960,000-that is extremely features from inside the Melbourne. Stamp obligation is actually a debatable taxation, including tens and thousands of bucks to state coffers with each get, and NSW has while the extra an alternative selection for property owners to help you shell out an annual land tax instead of the large up-front side slug.

Estimating Just how much You can afford

Just how much you can afford hinges on several points, including your month-to-month income, current loans solution and just how far you have saved getting a put. Whenever deciding whether to accept your getting a specific financial number, loan providers seriously consider your credit rating, your possessions along with your liabilities.

Bear in mind, not, that simply since you may manage a home in writing will not mean your budget can manage this new payments. You need to has actually at the very least 90 days off payments when you look at the savings in the event you sense monetaray hardship.

In addition to calculating just how much you expect to blow from inside the repair and other family-associated expenditures every month, you should also consider your almost every other monetary wants. Particularly, if you are intending to retire very early, determine how far money you will want to save otherwise invest for each and every few days right after which calculate how payday loan companies in Hanover Alabama much cash you should have leftover to help you purchase so you can a mortgage cost.

At some point, our home you can afford utilizes what you are more comfortable with-because a financial pre-approves your for home financing does not mean you really need to increase your borrowing from the bank electricity.

A home loan name is the length of time you have got to pay your home loan. The most popular mortgage words are anywhere between 20 and you can 30 years. Along your own financial terms and conditions dictates (partly) how much it is possible to spend per month-the brand new prolonged the title, the lower your own payment per month. That said, you are able to pay so much more for the desire across the lifetime of a thirty-year mortgage than a great 20-seasons one.