Floating as opposed to repaired interest rates: Including deciding on the most appropriate variety of home loan for the facts, be sure to adopt drifting versus fixed interest levels.

A floating (variable) interest can go up or slide when, inside your payments. A predetermined interest rate (to possess anywhere between you to definitely and five years) means that the pace you have to pay on your own loan is fixed on the totality of these months. The interest part of your instalments does not changes before the repaired-rates period ends.

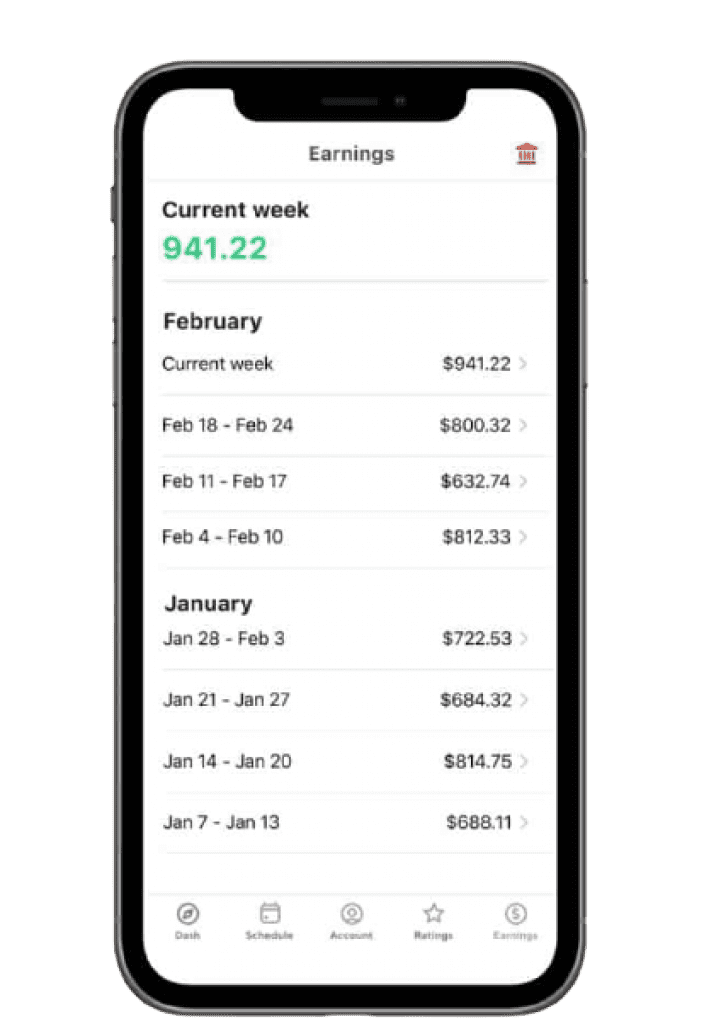

How big their mortgage is dependent on the kinds of qualities you are looking at. Photographs / Getty Photo

They’re able to leave you an obvious picture of what to anticipate from your own bank before you sign the borrowed funds documents

A familiar strategy to own homebuyers is to try to split a mortgage more than several fixed-speed identity, in order to remain a portion toward a drifting price, that allows extra money, paying down your house mortgage smaller.

If you’re not knowing from the and therefore mortgage choices are perfect for your, your own home loan adviser (broker) otherwise mobile director may help choose the most appropriate to suit your monetary things.

It doesn’t matter if you are going head in order to a bank since your lender or going right through a home loan adviser you’re need the following:

It can cost you an equivalent to-do the application that have a home loan agent and/or bank’s mobile financing movie director since doing it on line.

If the going straight to the bank in place of through home financing agent, make sure you inquire the financial institution about the rate of interest, the charge, what you can do to make change on mortgage shortly after created, and you will what will happen for many who break a predetermined-price term.

You’re not limited to borrowing from the bank from your bank. Research rates. When battle was higher anywhere between banking institutions, you could potentially often discuss the rate off or obtain the application for the loan charge shorter.

For folks personal loans for bad credit Illinois who curently have a house in line, then it’s a good idea to ensure you get your KiwiSaver withdrawal app within the right now.

Usually from flash, Very first Domestic Detachment can take between 20 days and you may four days to work through. So get the documents to one another meanwhile once the opting for a loan provider. While not knowing in regards to the apps you’ll need for you to access your KiwiSaver financing for selecting your first domestic, or if you have questions about the qualifications, click the link for more information.

Normally you would like 2 weeks to 3 weeks into lender to assess and you can accept your residence application for the loan. Get back to the bank or financial agent far earlier than you to.

Whenever you are making an application for a home loan when you are mind-operating, you’re going to require pursuing the on top of the simple help documents:

It will be more challenging discover home financing if you are self-operating while the practical eligibility requirements is much more ideal for team. If not be eligible for a home loan out of a lender, home loan advisers can place your providers having alternative low-financial lenders. That always appear at the cost of a high interest.

Homebuyers tend to apply at rating pre-approved by a bank locate a concept of the possible to buy fuel and you may budget. Thus giving your much more confidence to buy around for property. They reveals to help you realtors and you will vendors that you will be a serious client.

Pre-acceptance are a sign of what you could use whether your bank approves of the home we wish to purchase. If rates of interest increase, loan-to-value rates (LVRs) and other guidelines alter, or you dont have the ability to accept for the pre-acceptance period, you’ll probably must re-apply having pre-approval. That is one thing to getting really careful of if buying at the public auction, heading unconditional towards the one property, or to get regarding-the-bundle if build might take longer than expected.