Mediocre, by county

The main cause of the distinctions is likely associated with most other economic facts. The claims for the reasonable results are among the lowest money claims in the nation, Schulz states.

For instance, median household income for the Mississippi, Louisiana and you will Alabama was $52,985, $57,852 and you may $59,609, correspondingly, compared with new You.S. median from $75,149. For Minnesota – the official leader to possess Credit scores – the brand new median house income was $84,313.

Low income can mean that if you are able to get good bank card, such as for instance, this may keeps a smaller sized restriction than the others might receive, Schulz claims. That may succeed in an easier way in order to max out a credit credit, that may do actual damage to the borrowing from the bank.

Perfect 850 FICO Rating

The truth is, certain customers enjoys the best 850 FICO Score, symbolizing just step one.7% of your You.S. populace (at the time of ). Then again, which is over twice as much fee which achieved brilliance for the (0.8%), making it a beneficial milestone that more folks are interacting with.

The state and you can area for the higher part of perfect get owners within society try The state (2.6%) and San francisco (step 3.0%). 1%, given that mediocre age of their earliest membership try three decades old. That it complements the newest theme of men and women that have accessibility high levels of borrowing from the bank (and you can reasonable stability) and some years of self-confident credit rating (which earlier) acquiring the most useful threat of attaining the greatest credit tier.

Mediocre credit rating: VantageScore

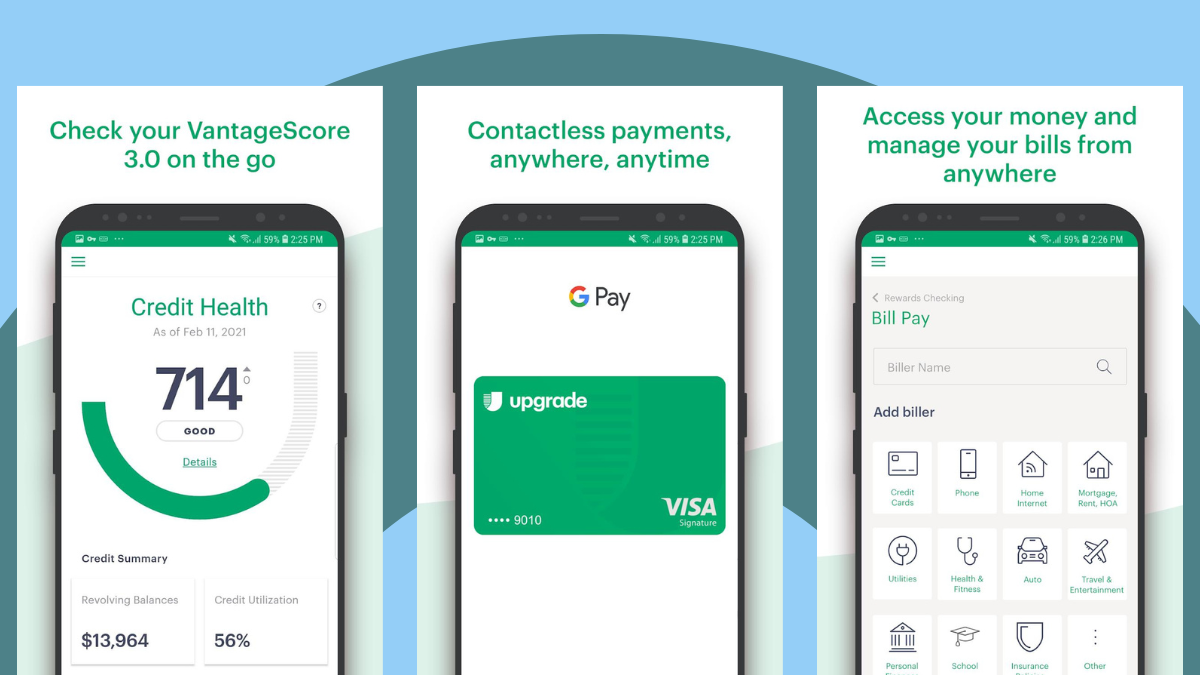

Given that FICO Rating is brand new undeniable gold standard for the majority of age, VantageScore makes biggest advances in earlier times ten years-and additionally, Schulz claims. VantageScore is like FICO in some indicates, however, you will find distinctions. For starters, the financing get range is also three hundred to help you 850, nevertheless the levels browse more:

A different secret differences would be the fact whenever you are FICO provides independent scores to possess each one of the credit agencies (Experian, Equifax and TransUnion), VantageScore is actually calculated having fun with data off every about three credit reports. In reality, VantageScore is made since a partnership involving the about three bureaus during the 2006.

One thing the newest results have in common is the fact that the average VantageScore in the You.S. is even regarding a beneficial diversity – 702 – since . The typical VantageScore also offers grown in recent times, bouncing 16 factors (of 686) as the .

Although not, only 61% of People in the us enjoys at least a great VantageScore (661 otherwise most readily useful), in contrast to 71.3% with at the very least a FICO Get (670 or best). Yet, brand new commission that have a great VantageScore – 23% – is higher than people who have an exceptional FICO Rating (21.2%). not, you will want to keep in mind that VantageScore has a broader rating assortment on the top.

Mediocre, by the age and you can race

Just as with FICO, go out is on the top with regards to VantageScore, even if middle-agers slightly boundary from quiet age bracket, 740 so you can 738. Although not, child boomers’ average is much ahead of Gen Zers’ (663), that’s simply a locks towards a beneficial range.

not, you’ll find big VantageScore disparities with respect to battle. With regards to the Urban Institute, this new average credit history in majority light organizations is 100 factors greater than inside the bulk Black colored communities – 727 (good) rather than 627 (fair). Vast majority Hispanic communities are in the guts, averaging 667, when you are vast majority Local American groups is at the base, averaging 612, according to the studies.

It is also an effective drip-off feeling regarding generations out of general economic traps. According to Combined Cardio to possess Property Education from the Harvard School, Black colored Americans was less inclined to getting people, that have a beneficial 41.7% homeownership rate across the nation – 29 payment products less paydayloansconnecticut.com/candlewood-isle than white homes. Paying book on time could be not reported due to the fact a positive pastime toward credit reports (if you do not proactively use a lease-reporting solution), whenever you are paying a mortgage becomes said.