You are loving brand new liberty of being your own boss but during the the same time frame, what will this example indicate for your home application for the loan?

I see what, why, as well as how the latest mind-employed can obtain a mortgage sufficient reason for it, the good Australian Dream.

Exactly what are care about-functioning home loans?

However, there are mortgage alternatives a great deal more appropriate brand new self-operating staff member, and additionally ways and means to impress loan providers.

These loans are great for individuals who cannot find provide a keen mediocre, normal proof of money to loan providers, eg payslips.

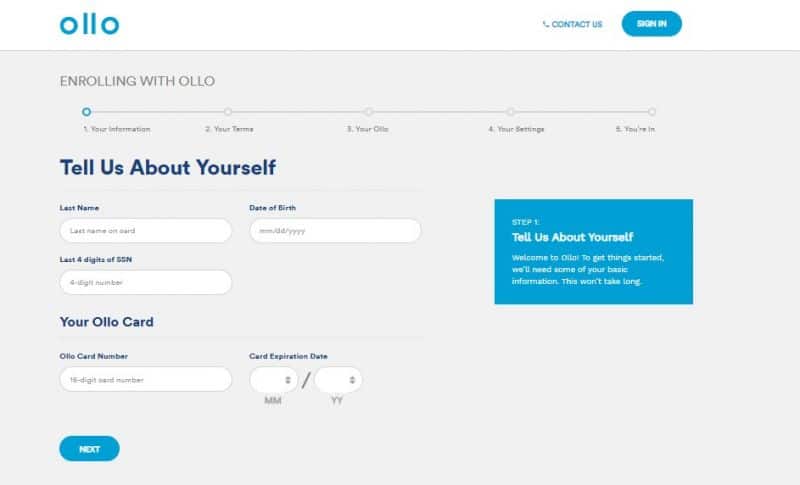

I’m thinking-employed: just what records must i make available to get approved?

To start with, ensure your lender either offers reduced doc lenders or is no less than a bit a great deal more empathetic with the worry about-working.

- Their ABN and you can/otherwise entered team term(NB: this would ideally were used constantly for a couple of age or longer)

- Current tax statements and you can find out-of examination(once more, preferably the two otherwise around three current records)

- Evidence of ID (web browser license, passport, otherwise equivalent)

- Full finances, listing your costs and you can income

- Details of one additional debts and biggest assets such as for instance personal finance

- A letter from the accountant clarifying debt updates

- Recent financial comments

- GST membership information

- Business Craft Comments (BAS)

How much time can i be notice-utilized to be eligible for a mortgage?

A standard principle was at minimum 2-3 ages regardless of if it’s still you’ll be able to to attain financing if you’ve started operating less than a year (on it a tiny later).

What if I was thinking-used in below annually?

You may still receive home financing nevertheless could well be trickier thus has actually more epic data to include with the financial.

When you’re working in a similar globe just like the that of your own former work when you was employed by others, was taking old payslips and you americash loans Hanceville can recommendations from all of these previous employers.

Its worthy of noting even in the event this 1 of one’s couple silver linings to come out of COVID is the fact there are other worry about-operating workers inside our world today, definition loan providers try viewing much more of these anybody.

What circumstances will i face that have a self-functioning financing?

Loan providers are doubtful and you will restrictive at the best of that time very if you are self-working that have an upwards-and-down, unpredictable money, anticipate to struck even more mistrust also the need for so much more constrictive requirements than the mediocre borrower.

Its value noting although this one of one’s couple gold linings to recover from COVID is the fact there are many more care about-functioning pros inside our community today, meaning lenders was viewing a great deal more of such anyone.

This was mainly in response on up coming suprisingly low appeal costs also quickly rising home costs, which APRA considered is placing questionable toward domestic personal debt.

APRA was also eager to rein within the lenders’ effortless borrowing curve, that has been causing too many currently highly with debt borrowers achieving mortgage acceptance.

Do you know the credit requirements and you will limits to own a home-operating loan?

After you have accepted one to lenders could well be more complicated on you than just to the mediocre debtor and that’s even although you earn more than simply one debtor! – you should also undertake the following may be required:

How have a tendency to loan providers estimate my money?

Loan providers want to see your own recent taxation statements and sees out-of analysis as they promote good complete proof your own business’ success over the years.

Various lenders mediocre out of the nonexempt money on the previous tax returns more a decade; although not, other loan providers can use different methods to assess a personal-employed’s income.