Adjustable-rate: The pace towards a variable-rate financing is actually susceptible to transform, that has upsides and you can drawbacks. Possible typically have a lowered price once you begin and also make loan costs than just you might keeps with a predetermined-speed financing, your speed is also climb later on and possibly cause you particular economic imbalance in the event it expands your own payment number.

Downpayment

The downpayment-just how much you pay towards the the initial domestic get-can also https://cashadvanceamerica.net/personal-loans-nm/ alter your interest. A much bigger downpayment makes it possible to secure less interest speed since it decreases the amount of the borrowed funds and, subsequently, reduces chance for the lender.

Loan label and you may size

Even though a thirty-year home loan is one of prominent, particular lenders give home loan terms of 20, 15 otherwise 10 years also. Shorter-identity money routinely have all the way down rates of interest, however the monthly installments was high.

Domestic venue

Where you happen to live, or want to, plays a factor in home loan pricing. Research your preferred market, although some you could thought, to compare cost.

When looking for a home loan, envision all the above activities. Opting for a different sort of loan may end upwards helping you save currency, given that you are going to and come up with more substantial downpayment. When you find yourself a primary-big date homebuyer plus don’t keeps a number of throw away bucks, you might opt for a thirty-year FHA that enables you to receive a property in what you can afford now, even although you need to pay a slightly higher level to help you take action.

Before you begin considering belongings, think inquiring a loan provider so you’re able to preapprove your for a financial loan. This will let you know the size of of financing your be considered for, and is a primary reason behind your residence lookup. Home loan preapproval would not apply at your credit ratings.

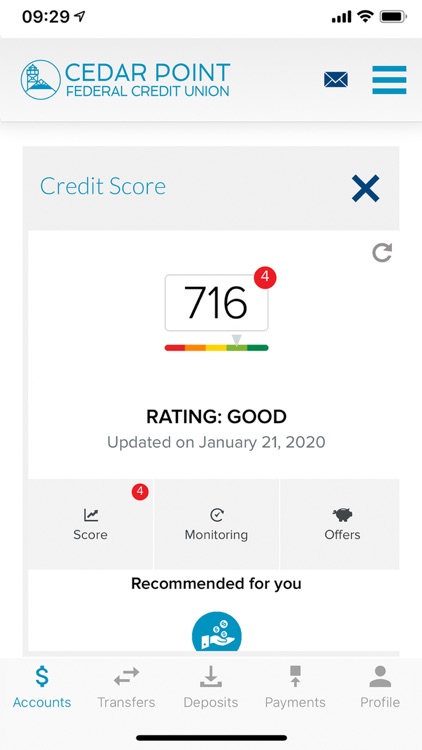

When bringing a beneficial preapproval, loan providers commonly look at your credit or any other aspects of your finances observe what you could afford. If not know already what your credit history try, it is advisable to test they oneself earlier in order to conversing with a loan provider.

Loan providers look throughout your report cautiously, which have an eye fixed away having an eye on on-time money and you may whether or not you have got one derogatory marks on your own profile. Your credit use proportion may also be a button foundation, since it says to the financial institution how much of one’s readily available borrowing you happen to be currently using.

Having a great preapproval is not constantly called for, but some manufacturers doesn’t accept has the benefit of regarding customers who have perhaps not been preapproved. In the an active market, you can damage the possibility to get our home need if you don’t have one to.

For those who look at your credit and find your score isn’t really where you want it to be, devote some time to alter it before talking to a lender.

How exactly to Alter your Credit history Before you apply to have a home loan

There are several ways you can boost borrowing seemingly quickly. Bringing a few basic steps in advance of trying to get home financing could help improve your probability of recognition that can help you protect a great low interest.

- Reduce existing obligations. Loan providers can look at your debt money once the a ratio of your revenue whenever calculating simply how much you can acquire. This really is titled the DTI, or financial obligation so you’re able to money ratio, and you can paying bills today might help improve this ratio to own when you sign up for a mortgage. Along with, repaying rotating expense-including bank card stability-can help replace your borrowing use proportion that assist you increase your own rating into the a short period of your time.

- Keep using expenses punctually. Their percentage background is a vital part of the credit score. Loan providers consider late and you may skipped repayments once the signs you will possibly not manage your funds really, that may affect their comfort level when it comes to delivering your toward due to the fact a debtor.