Make use of a housing mortgage, a variety of capital you to, eg an excellent RenoFi Loan, lets you borrow centered on the house’s upcoming worthy of. However, do not recommend they. As to why? Since the you might not only be forced to re-finance for the increased price, you’ll also face large settlement costs and just have to endure an intricate mark process to suit your company to find paid off. And also for this cause, some designers actually won’t focus on these mortgage completely.

Why don’t we including explain some thing; pools can not be financed playing with a keen FHA 203k Financing, due to the fact talking about thought luxury features among the list of restricted advancements that are not enabled.

An equivalent is not necessarily the case which have HomeStyle Loans, regardless of if, and is you can easily to utilize these types of as a means out-of pool financial support.

These types of fund have several cons, plus large rates of interest, a requirement so you can refinance, and you may a long and tricky procedure that commonly contributes to waits and higher charge.

You can often find that unsecured loans is actually offered on the home owners because do it yourself loans’ otherwise as more particular factors, including a pool loan.

But do not become conned towards believing that such fund are built particularly for the type of enterprise it is possible to embark on. Definitely not.

These types of choices are usually large attract unsecured unsecured loans sold getting a certain fool around with as opposed to getting one thing book or providing distinct gurus more than other choice.

And even though you may find said pond financing, do-it-yourself loans, or any other personal loans which claim to let you acquire upwards so you can $100,000 or higher, this can be an upwards to’ matter that’s just possible by a very small number of people.

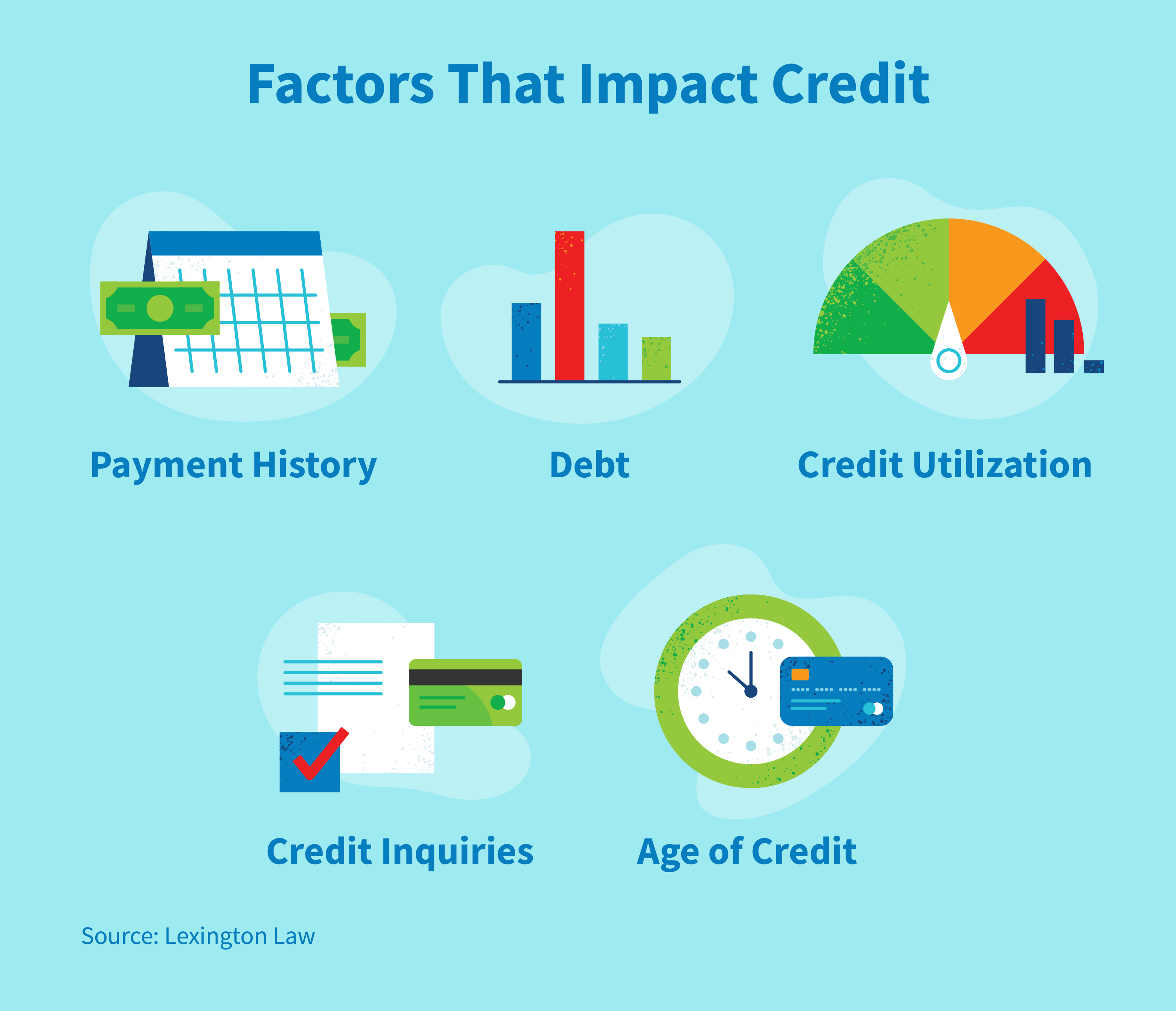

The thing is that, the quantity as possible acquire with your personal loans is actually usually according to your revenue, credit rating, as well as your obligations-to-income ratio. As a result of a lot property owners will get limited credit power that have these types of loan, and you can face shockingly large interest levels, usually more 15%.

In order to make it easier to comprehend the impression that these highest pricing might have, take a look at the difference between monthly premiums into the a great $50k mortgage borrowed more ten years at the those two prices – 15% and you will 8%.

Less interest loan places Sea Ranch Lakes function down monthly obligations, so it’s on the attract to discover the solution that gives you the credit capacity to use a full amount borrowed your need at low you can easily rates.

Basically, many people must not be having fun with a consumer loan to invest in their the fresh pond, neither is always to credit cards be considered for the very same reasons.

Interest levels to own Pool Fund

One good way to assist choose which financing choice is ideal for your try comparing loan rates – yet not, it is very important keep in mind that:

- Prices differ, and your own personal is based on your debts. The new costs your see on the web might not mirror your own individual selection.

- Do not take a look at interest rates in order to examine loan selection in the isolation. Per financing option might have additional conditions, possible closing costs or any other charge, pulls and you can checks, or any other tips.

Things to consider to own Pool Funds

Swimming pools are prompt getting probably one of the most common enhancements that people need to make to the home, hence appear given that no wonder.

Before provide their specialist the fresh wade-ahead, you should manage to buy the installation of your own the newest pool, and here will be items that you should kept in head in terms of the choices:

- What type of pool looking for and you will what is actually it likely to prices