Trick Takeaways

The group that is very disabled because of the these types of interest surprises is minorities. Black colored homeownership is still below 50% to possess black homes.

Offense is lower, natives are friendlier, and you will everyone’s property values increase when they inhabit a residential area away from citizens, perhaps not renters.

In boasting throughout the Bidenomics two weeks before for the Milwaukee, President Joe Biden erican fantasy. Then went towards his scary whispering mode and you will in hopes united states it’s doing work.

Actually a big aspiration of the Western fantasy owning a home? Biden keeps and work out very first-go out homeownership much harder having young families for 2 reasons. A person is that overall dive in rising cost of living plus the reduced boost in earnings and you can salaries means belongings become more costly. Large home values work with people who already own their homes, but much of the elevated really worth is due to standard rising cost of living, and therefore attained a leading out-of nine% a year ago and you can affects everyone.

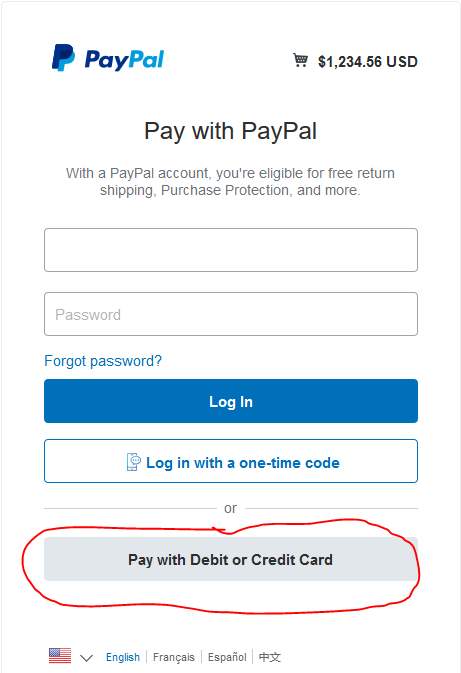

A bigger killer for basic-big date homebuyers could have been brand new regular rise in home loan cost around Biden. As he arrived to workplace, the loan rates try dos.9% nationwide. Now it is 7.1%, thank you so much from inside the no small-part towards the Federal Reserve’s eleven interest speed grows caused by the $six trillion Biden using and you will borrowing from the https://paydayloansconnecticut.com/georgetown/ bank spree into the 2021 and 2022.

Biden Is Eliminating the latest Western Dream about Homeownership

So now, depending on the mortgage company Redfin, just the rise in interest levels into the a 30-seasons home loan out-of 5% so you can eight% means a heart-money family members that’ll just after pay for an average-value home of $500,000 can only just pay for a house worth $429,000.

High, save money while rating less household. Or rather than a single-house, you can simply pay for an effective three-space condo otherwise a beneficial townhouse. If we examine the new rates now in the place of when Donald Trump are chairman, the typical homebuyer can just only pay for a home having an amount tag more than $100,000 lower than three years ago.

Just what a deal? Perhaps this might be that reasoning how big is a new house was smaller compared to in the past.

The following is a different way to look at the destroy done by Biden policies: If you wish to get good $500,000 family today, which is near the median rates in a lot of fashionable towns, your own full attract repayments would be at the very least $800 more a month. It means over 30 years from payments totaling at the very least $250,000.

However, rents are up nearly 20% also, very for many 20-somethings, it means sleep on the parents’ cellar.

Biden conversations much on connecting openings between steeped and you may poor and you may blacks and you can whites. However the group that is extremely disabled of the these types of interest rate shocks is actually minorities. Black homeownership is still less than fifty% to possess black properties. The Arizona Post calls which heartbreaking, nevertheless they fault racism, pretty good government principles.

There can be others obstacle in order to homeownership to have Age group X and you will millennials. Of numerous 31- and you may forty-somethings try hamstrung from the the current and you can growing debt. Credit card debt is becoming $step 1.03 trillion. 50 % of every group are expected to possess dilemmas settling this personal debt per month. Delinquencies is actually rising, that may indicate punishment rates of 20% so you can twenty-five%.

So, if the household can not afford its existing loans, how often they get a lender to accept a good $eight hundred,000 or more home loan?

Perhaps Biden possess a key propose to forgive trillions of dollars of home loan obligations, when he has already made an effort to create that have college loans. However, that just shifts the debt load in order to taxpayers-scarcely a remedy.

This new Biden administration’s violence towards the homeownership isn’t just damaging to the new group that are getting charged out of the field. It is harmful to groups and you may towns and cities within the nation. When families be people and place origins in an urban area, he or she is much more expected to value just improving their unique domestic and maintaining brand new servicing and you will riding a bike and slicing the newest hedges, nonetheless it gives them a stake from the schools and you will college students in the community plus the quality of the general public qualities. Simply put, homeownership gets Americans a feeling of Tocquevillian civic pride.

Offense is leaner, neighbors is friendlier, and you will everybody’s property values go up when they inhabit a community from owners, perhaps not tenants.

There’s you to definitely reason feeling the present volitile manner shall be corrected. Into 1980, whenever Jimmy Carter was president, mortgage prices weren’t eight%; it reached a lot more than 17%. Voters rebelled up against the economic mayhem and you can chased Carter out-of place of work. Ronald Reagan came into the fresh new White Domestic, and with smarter economic fiscal guidelines, mortgage cost easily decrease by 50 percent immediately after which lower still. It will occurs once again.