6. Fees_and you can_Costs__What_are_the_Fees_and you may_Costs_Associated_with_Reverse_Mortgage_and

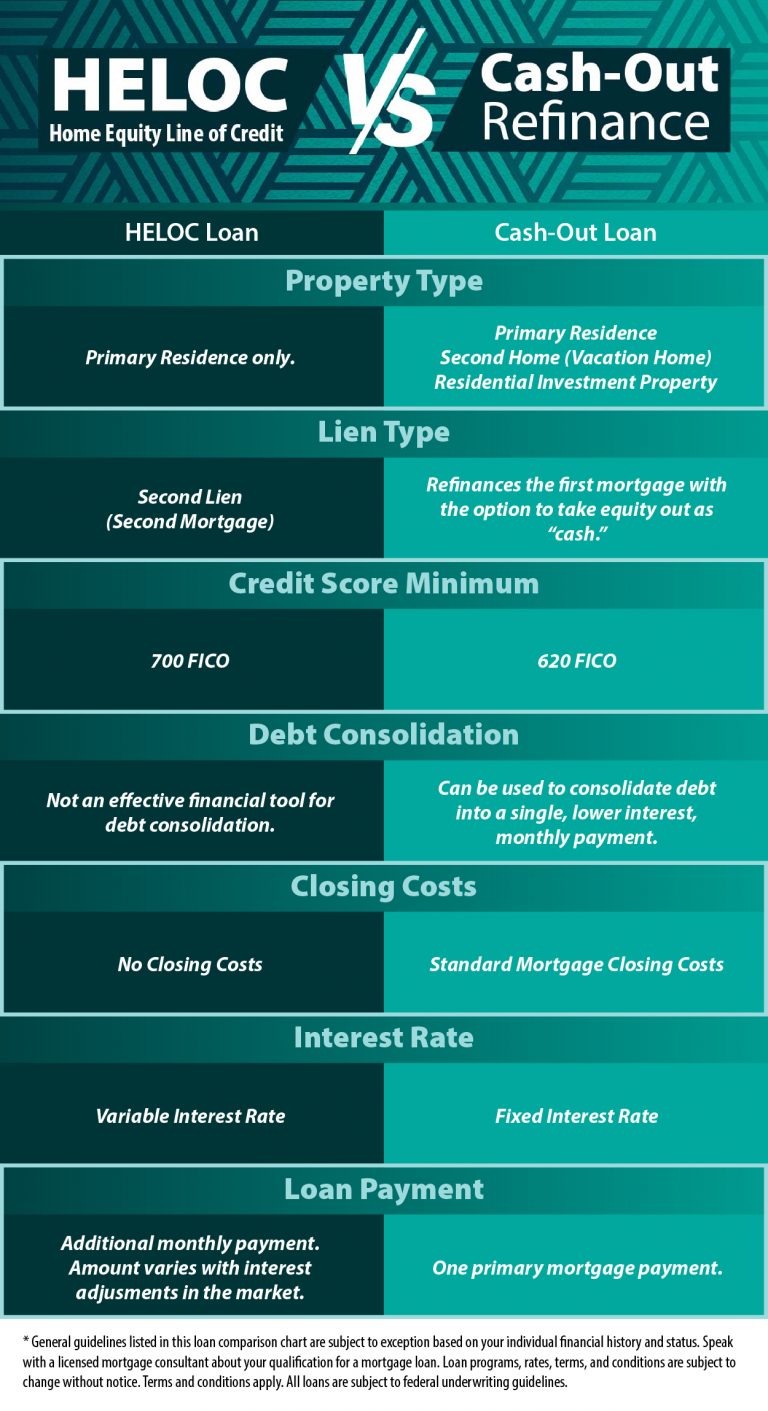

Regarding an other home loan otherwise domestic equity personal line of credit (HELOC), it is critical to see the charges and you may costs associated with per solution. Both choice have charges and will cost you that may are different according to the financial institution as well loan places San Diego as the certain regards to the mortgage. Contained in this area, we’re going to discuss the charges and you will costs associated with contrary mortgage loans and you can HELOCs.

Contrary mortgage loans are apt to have large charges and you will can cost you than simply HELOCs. A few of the costs and expenses associated with contrary mortgages were:

– home loan premium (MIP): Which percentage required by the Government Property Government (FHA) and will depend on dos% of your amount borrowed.

Closing costs can differ according to lender and location of the house

– Assessment fee: Which percentage covers the price of a specialist appraisal of property and certainly will be up to $500.

– Closing costs: These costs include many fees, instance term research costs, attorneys charge, and you will recording charge.

HELOCs tend to have all the way down costs and you will will set you back than contrary mortgage loans. A number of the fees and expenses associated with HELOCs tend to be:

Closing costs may vary with regards to the bank plus the venue of the property

– Appraisal percentage: So it commission talks about the price of a professional assessment of your possessions and can depend on $five-hundred.

– Settlement costs: Such will set you back can include a number of fees, like name research charges, attorney charges, and you may tape costs.

When you compare brand new charges and you may can cost you off contrary mortgages and you will HELOCs, you will need to consider the enough time-identity will cost you of any option. While you are opposite mortgage loans have highest initial can cost you, they do not want monthly obligations and certainly will offer a source of cash with the debtor. HELOCs provides all the way down upfront will cost you, however, need monthly payments and will be risky in the event the debtor is unable to generate costs.

The best option for each individual hinges on its particular financial predicament and you will specifications. In the event you you want an income source and don’t should make monthly obligations, an other mortgage may be the best choice. Just in case you require accessibility money having a particular mission consequently they are able to make monthly payments, an excellent HELOC will be the best choice. It is critical to carefully check out the costs and you will costs away from for each option and you may talk to an economic coach prior to a beneficial decision.

Contrary mortgages have existed for a long period today, and they have went on to gain prominence certainly seniors who are searching for ways to supplement its later years money. The idea of a reverse home loan is somewhat confusing, however it is essentially a loan which allows homeowners to convert a portion of their residence guarantee into bucks. It dollars are able to be employed to protection costs, pay back expenses, or maybe just enjoy life. Within section, we’ll discuss some of the great things about contrary mortgage loans and you may as to why they are advisable for your requirements.

One of the primary benefits of an other home loan is the fact you do not have while making any monthly payments. Rather, the mortgage try paid back when the debtor becomes deceased, offers our home, or motions away forever. This can be a giant rescue having elderly people who will be on the a predetermined earnings and can even not have the latest means to generate monthly installments.

Which have an other mortgage, you have lots of freedom when it comes to how obtain the bucks. You could potentially want to discovered a lump sum payment, monthly obligations, or a credit line that one can mark off while the needed. This provides you the versatility to make use of the cash as you discover fit and certainly will make it easier to most readily useful control your profit.