Confused about pre-degree and you may pre-recognition? You are not by yourself! Of several first-time homeowners rating set off on these types of financial terms and conditions; not merely create they sound equivalent he has a few comparable characteristics. Right here we falter the difference between pre-degree and you may pre-acceptance, describing exactly what for every relates to. In addition to discover the great benefits of delivering pre-approved, and exactly how it can make you a toes upwards in the current aggressive housing industry.

Pre-qualification: Evaluation this new Oceans

Think pre-qualification is like window shopping. You have made a broad concept of what you such and in which you might shop, however, you aren’t a bit ready to to go.

Pre-certification are a fast and simple procedure, tend to done on the web which have an excellent calculator. First respond to some elementary questions about your income, employment disease, and you can any debts you’ve got. Upcoming, predicated on these records (which you offer), a loan provider will give you a harsh estimate away from how much you’re in a position to use.

Brand new Advantages away from Pre-qualification:

- Easy and fast: You don’t need to assemble papers otherwise get your borrowing appeared (yet).

- Finances Compass: Get a broad notion of what you are able pay for, helping area you regarding the proper direction.

The fresh new Drawbacks away from Pre-qualification:

- Maybe not Devote Stone: The brand new guess is dependant on that which you let them know, and the bank have not confirmed your bank account but really, very vendors almost certainly wouldn’t take your pre-qualification absolutely.

- Are unable to look at house having an agent, yet: Exactly like a merchant, real estate agents discover you do not in reality manage to spend the money for homes do you consider you would want to look at and you can often encourage your own to obtain pre-approved very first.

Remember: Pre-qualification is a fantastic initial step, but it’s not genuine a good pre-acceptance is the perfect place anything rating significant.

Pre-approval: Getting Down to Company

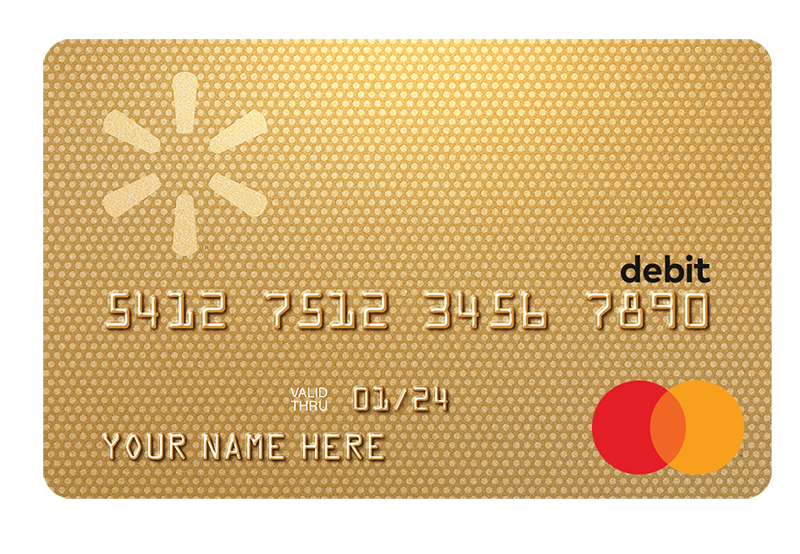

Pre-approval, at exactly the same time, feels as though indeed getting the bank card out and ready to swipe from the store. You understand exactly how much you could invest, and you will suppliers see you happen to be a significant visitors. This gives you the higher give for other screen customers when you’re find the correct set and want to build an offer instantly.

What bad credit installment loans direct lenders only Indiana takes place throughout a beneficial pre-recognition?

You are going to fill in home financing software and you will address certain inquiries concerning your funds, leasing or control history, and you will credit score. Then you will give data files to ensure your own:

- Money (imagine paystubs, W2s, an such like.)

- Assets (bank statements)

- People bills your debt (particularly vehicle payments, education loan repayments, playing cards, etc).

Second, we are going to eliminate your credit history observe your credit rating, examining to find out if there had been people red flags in the prior you to just weren’t shared. Things like bankruptcy proceeding, delinquency towards that loan, etc.

Predicated on which confirmed suggestions, you will get a beneficial pre-approval page claiming the count you might be pre-accepted to own, while the estimated interest rate.

The fresh pre-recognition page only be good to have 60-90 days. Funds changes, interest levels transform, and then we want to make yes subscribers nevertheless be eligible for just what these were to start with pre-approved having, or perhaps they be eligible for way more after even more remark!

It is possible to only need to give up-to-date (otherwise even more) records you might be required. We’re going to take latest interest levels under consideration and how the brand new action inside the rates can impact your affordability.

Benefits associated with Becoming Pre-Approved:

- Strong Amounts: You know simply how much domestic you can afford, not any longer speculating online game.

- Realistic Standards: Establishes obvious boundaries for your home look, you dont fall for an area you cannot pay for.

- Healthier Bring: A great pre-approval letter suggests suppliers you might be a serious, it’s qualified buyer, providing you with a leg through to the crowd.