For eligible individuals with complete entitlement, there are not any limitations on loan amount they could acquire that have good 0% advance payment. This provides high liberty to have consumers just who qualify.

It is critical to note that such financing restrictions try at the mercy of change and could are different centered on standing on Federal Property Fund Company (FHFA)

However, individuals with reduced entitlement, known as impacted entitlement, have loan restrictions. The new Va financing restrict having impacted entitlement is determined by the new condition restrict, which is considering conforming mortgage restrictions.

Miami-Dade Condition – The mortgage limit for Miami-Dade County is actually $726,2 hundred. It conforming financing restrict pertains to most section regarding state.

- Duval Condition – Duval County uses the overall conforming loan restriction off $726,two hundred.

For certain loan constraints in other Fl counties or any latest transform, individuals are advised to talk to the Virtual assistant-approved bank otherwise see the FHFA website for right up-to-time suggestions.

Knowing the financing restrictions during the per state is crucial to possess individuals browsing incorporate good Va mortgage in the Florida, because it assists influence maximum loan amount offered as opposed to requiring a down payment.

Zero PMI – As opposed to conventional fund, Va money dont require personal financial insurance (PMI), leading visit this site to cost savings along side lifetime of the borrowed funds.

Closure Costs Exemptions – Va finance may provide exemptions otherwise constraints with the specific closing costs, reducing the initial costs for individuals.

Flexible Credit history and you will DTI Standards – Virtual assistant fund tend to have smaller stringent credit rating and you can financial obligation-to-earnings (DTI) criteria than the conventional money, getting even more flexibility to have consumers.

Numerous Entry to Va Mortgage Work with – Qualified consumers might be able to use the Va loan benefit many times, for as long as for each have fun with is for a first quarters.

- Post-Foreclosures and you may Personal bankruptcy Qualification – One may be eligible for a great Virtual assistant financing even though you have has just undergone new foreclosures processes otherwise case of bankruptcy. New waiting period is typically couple of years.

Alternatively, antique financing often need at least credit rating out of 620 otherwise large, making them much harder to qualify for, particularly which have less than perfect credit

Qualifications Requirements – Va financing is only open to solution people who satisfy certain standards. Its important to be sure to meet up with the required terms as a great potential borrower.

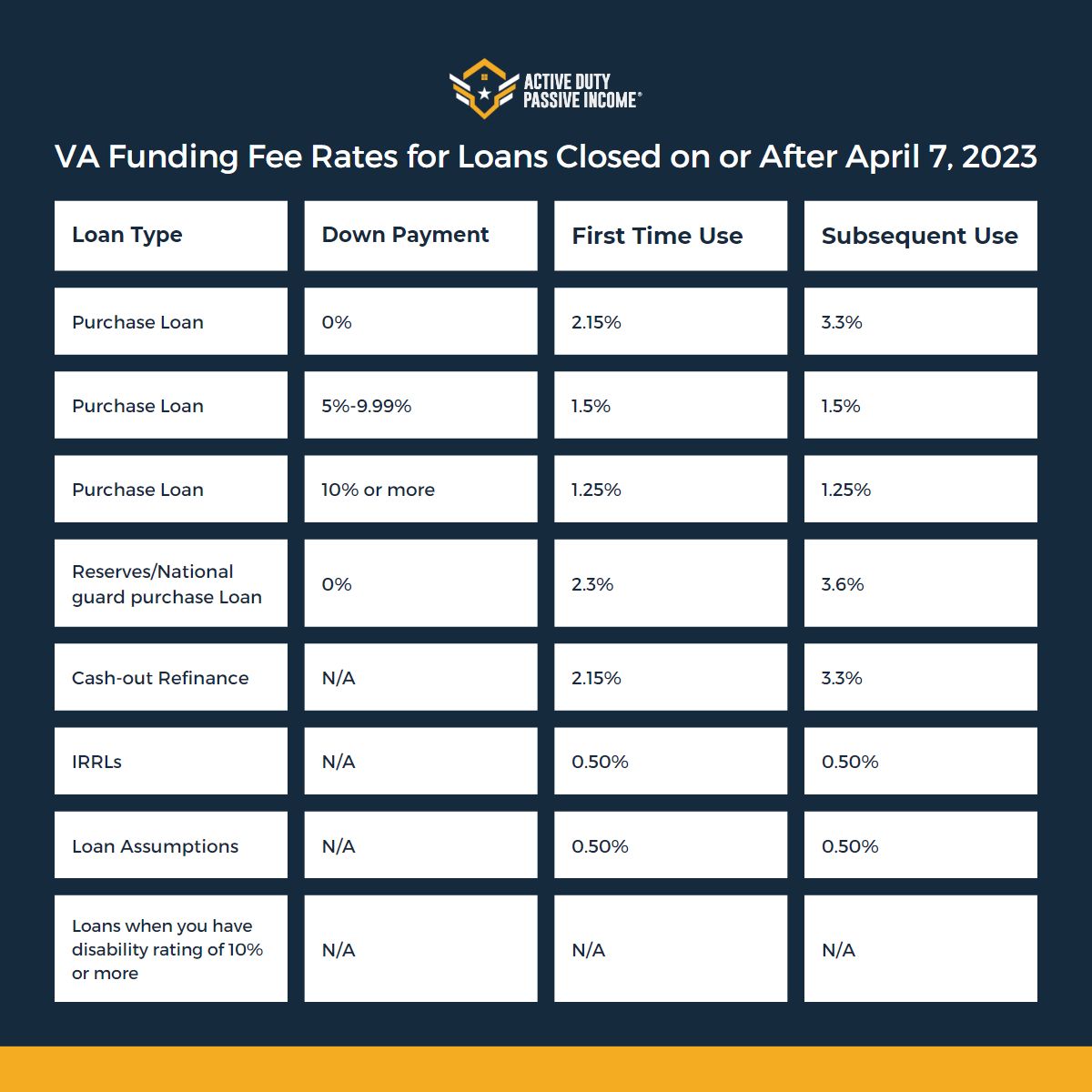

Virtual assistant Money Fee – While there is zero significance of personal financial insurance coverage, Virtual assistant loans bear a single-day Virtual assistant financing payment mandated because of the national. The fee leads to cutting charges for taxpayers and can feel financed or paid off upfront.

Top Household Requisite – Va fund can only just be employed to funds primary houses. They can’t be taken to have vacation land otherwise financial support characteristics.

- Misunderstandings and Vendor Wariness – You can find misconceptions encompassing Va fund, such as the faith which they take more time to close off otherwise get come upon difficulties inside the closing techniques. Even when speaking of misconceptions, they could generate suppliers careful of handling Va financing individuals.

Of the understanding the positives and you can considerations of Virtual assistant loans, possible borrowers from inside the Fl produces informed behavior and you will influence the latest professionals provided by so it financial system.

It is important to talk to an effective Va-approved financial like MakeFloridaYourHome to navigate the procedure and you will explore the brand new particular facts strongly related your circumstances.

With more than 50 years off mortgage globe sense, the audience is right here so you’re able to achieve the American think of owning a home. We strive to offer the top education before, during, and you may after you purchase property. All of our suggestions will be based upon experience in Phil Ganz and you can Group closure more You to mil cash and you can helping most family.

When considering an excellent Virtual assistant loan into the Fl, it is essential to know about the standard words of this that it bodies-backed home loan solution.