It’s really no miracle it is perhaps not including inexpensive to borrow funds now. After all, the fresh Government Reserve has grown the benchmark rates eleven minutes more than the last eighteen months – although the latest Provided joined to not hike rates in the newest conference, its benchmark rate continues to be within an excellent twenty two-season high . That, therefore, keeps caused the pricing to own from handmade cards in order to mortgages to help you increase.

There can be you to probably sensible answer to obtain immediately, even if, which will be from the tapping into your residence’s guarantee . Credit against your property security will be a sensible option whenever you would like entry to loans, due to the fact pricing are typically lower than you can aquire that have other types of loans. And, the typical resident already keeps on the $200,000 inside the tappable house collateral , that’s a very important supply of loans for various financial desires, if or not you want to finance renovations, pay back high-attract expenses, buy a new business venture otherwise protection unanticipated expenses.

But are indeed there household collateral choices if loans in Chalkyitsik you’d like entry to your own money easily – and in case therefore, which are the quickest ways to do this? Prior to deciding with the property security borrowing from the bank station, here’s what you need to know.

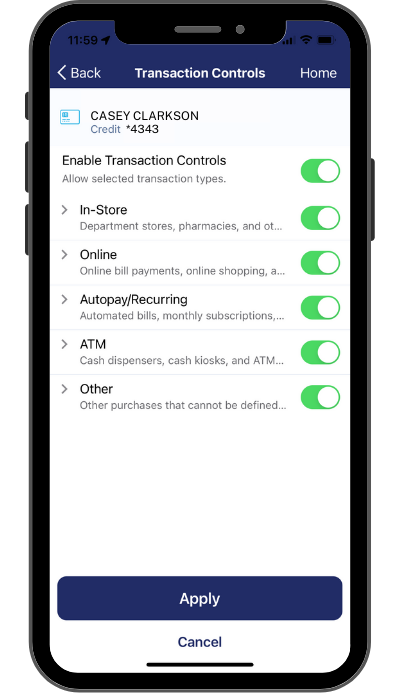

Family security line of credit

A home security personal line of credit (HELOC) try an adaptable and you may speedy means to fix availableness your house equity. Such domestic collateral loan qualities like a charge card, allowing you to borrow secured on your collateral when you you desire financing.

The application form and you may acceptance techniques getting an effective HELOC can generally feel completed in a few weeks, and when accepted, you have access to funds almost instantly. HELOCs typically offer down rates than other different credit.

At the time of , an average HELOC price try 9.09%, that is much lower than you would be incorporated with many other types of finance today, making it a fees-energetic option.

Cash-away refinancing

Cash-away refinancing pertains to replacing your existing mortgage with a brand new one to, within increased principal harmony. The essential difference between the new and you may dated mortgage are paid out for you during the dollars. This procedure offer a lump sum from fund, and it may become complete relatively rapidly, according to the lender’s efficiency.

Having said that, it is essential to just remember that , you happen to be swapping your home mortgage out with a new you to – and thus, the speed vary. For folks who bought otherwise refinanced your property when rates was basically hovering close 3% in the 2020 and you can 2021, it may not be the ideal relocate to prefer that one at this time. At all, financial rates are averaging better more than eight% currently, therefore it is likely that the monthly payment perform improve somewhat anywhere between the eye charge on household security loan additionally the large loan amount.

Household guarantee loan

A property collateral financing , called a moment home loan, enables you to use a lump sum payment making use of your home equity as guarantee. The new approval processes is often quicker than other domestic-relevant loan models, and you can receive the fund on time.

Rates for the home security financing are generally fixed , making it easier to arrange for fees. And you can, nowadays, home security financing incorporate costs that will be far lower to the average than the many other form of financial loans. The common complete price to have a property collateral mortgage is actually 8.94% currently.

Contrary mortgage

Reverse mortgages try an economic equipment open to people old 62 or earlier. These funds allow you to transfer your residence security for the income tax-totally free dollars without having to create monthly mortgage payments.

This option provide quick access so you’re able to money to own retired people and the elderly, but it is required to carefully understand the conditions and you may ramifications just before continuing. And you can, opposite mortgages may have a longer financing processes versus other variety of family security financing, therefore make sure the newest schedule suits you if the purpose is to make use of your own house’s collateral immediately.

Link mortgage

Bridge money is short-title loans that will help you availability domestic guarantee rapidly whenever you are in the procedure of promoting your existing home and buying an alternate you to. He or she is used for since the down-payment on your new house before you receive the arises from their old residence’s sale. Connection funds typically have higher rates of interest, therefore they have been ideal employed for short-name demands – even so they shall be an excellent augment if you are trying make use of their residence’s collateral to finance the purchase regarding a great new home.

House collateral sharing preparations

Equity-revealing preparations involve partnering with a trader who offers money in change to have a share of the residence’s future appreciation or collateral. This process enables you to availability your home equity instead of taking on loans.

But while this option will likely be fast and will not want monthly premiums, you will need to comprehend the prospective enough time-identity monetary implications of this type out of agreement. It’s adviseable to carefully take into account the conditions prior to making one decisions.

The conclusion

Cashing out your house guarantee can supply you with much-called for funds a variety of financial requires. Yet not, it is imperative to purchase the strategy that aligns ideal along with your specific need and you will issues. Just before experiencing your home equity, it seems sensible to be certain you are making the best decision hence you fully understand the fresh new ramifications of selected approach.

Angelica Einfach try elderly publisher to possess Handling Your finances, in which she writes and you may edits blogs on a variety of personal fund topics. Angelica in earlier times kept modifying opportunities on Simple Dollars, Appeal, HousingWire or any other economic courses.