As the Company out of Pros Circumstances backs Virtual assistant money, we are able to give you home financing that have high financial experts unrivaled of the other kinds of funds.

Purchase a home rather than a downpayment. It’s the greatest benefit of the fresh Va financing, particularly for first-big date homebuyers when home prices try rising. So it significant virtue enables you to very own a home instead of wishing ages to keep.

Never ever shell out mortgage insurance rates if you utilize a great Va mortgage so you can purchase property, regardless if your own advance payment is 0%. Therefore, the borrowed funds fee is lower, to help you manage a costly domestic.

The typical rate of interest to possess a beneficial Va financing is gloomier than a normal financial. Shortly after including your Va Loan Price Make certain off NewCastle Home loans, you can hold the lowest price on your financing and savor an enthusiastic sensible payment per month on the home.

Pay quicker getting settlement costs if you get the Virtual assistant financing that have NewCastle Home loans. First, the new Va limitations the expense loan providers may charge veterans. In addition, we waive the origination charge to have pros. As opposed to most other lenders, we don’t charges experts a fee for originating your own home loan. Consequently, you might rescue a supplementary $1,000 just for having fun with united states.

Even though the Virtual assistant makes the statutes to have Va money, individual lenders particularly NewCastle Lenders have additional criteria to have credit, loan numbers, and you can assets brands.

Your credit score have to be at the least 580 getting a Va mortgage that have NewCastle Home loans. A good 580+ get form you meet with the minimal basic. Nevertheless still need to use and give us your financial pointers in advance of we agree your loan. Thus begin immediately through getting pre-accepted so you might be willing to make the most of every possibility to pick a property.

Which have complete entitlement, you can borrow around $766,550 to acquire an individual-household members, condo, otherwise townhome. Or rating a much bigger financing for a multi-product property without needing a down payment. Virtual assistant fund let veterans and you will solution members purchase home to reside entirely-day. And so the assets should be their dominating residence, perhaps not a good investment or vacation household.

- The fresh Virtual assistant loan restrict is actually a cap toward number you is obtain instead a down payment. Therefore, you could acquire more than new limitation for those who have an effective down-payment.

- The new 2024 Va mortgage maximum is actually $766,550 when you look at the Florida, Illinois, Indiana, Michigan, and you can Tennessee. not, financing constraints is higher when you look at the Key West, Florida, and you can Nashville, Tennessee.

- Prominent house, second household, otherwise investment property?

- 2-to-4-Product House | Ideas on how to pick a multiple-unit possessions

- Vendor Credit | Can also be the vendor pay the homebuyer’s closing costs?

I’ve remedies for faqs.

A good Virtual assistant loan was a mortgage that’s protected by the the fresh new U.S. Company away from Pros Affairs (VA). It is accessible to army experts, active obligation participants, and you may spouses. Its designed to enable them to manage to pick a property.

One of the several benefits of a good Virtual assistant financing is the fact it does not wanted a down-payment otherwise financial insurance policies, making it easier to possess army consumers to cover a house. Va funds also provide alot more easy credit and you will income requirements than old-fashioned mortgage loans, making it simpler to possess military consumers so you’re able to be considered.

Concurrently, Virtual assistant finance keeps lower closing costs and interest levels than just many other types of mortgages, that will cut consumers currency along the life of the borrowed funds.

Keep in touch with a Va mortgage pro at NewCastle Lenders having upright answers, to see the direction to go on the home loan.

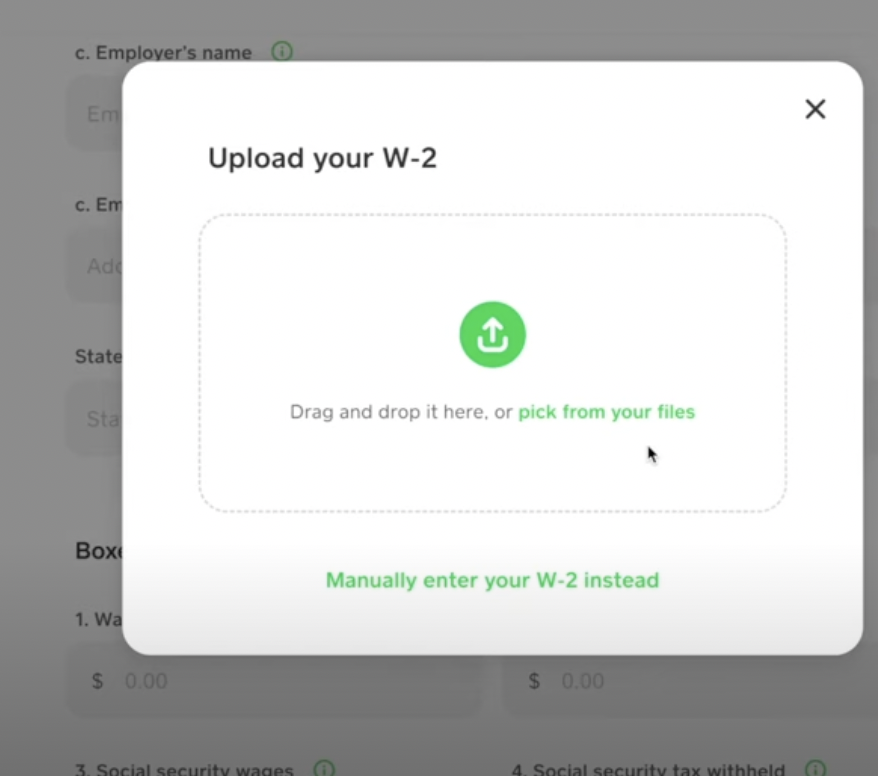

Basic, i prove you are qualified to receive an excellent Virtual assistant financing by the checking the Certificate out of Qualification (COE), appearing you meet the minimal solution criteria. Next, i ensure you be eligible for this new Virtual assistant loan.

Then, immediately following the loan underwriter, the person deciding to make the finally financing choice, verifies debt advice, you get a personalized pre-acceptance page on a single date.

Then, you happen to be willing to discover the finest house and feel convinced on and then make a deal. Isn’t it time to get going?

NewCastle Home loans also provides Va loans in order to army staff and you may veterans, and you may all of our lowest credit rating is actually 580. It means you can aquire acknowledged getting an easily affordable Virtual assistant loan in the event your credit score was 580 or more. Up coming, make use of your Virtual assistant financing to buy a house without down fee, and luxuriate in a minimal price and you can payment per month no financial insurance rates. Learn more about Virtual assistant loan credit scores.

The newest Virtual assistant capital payment are a portion of your own loan amount. The rate varies based a few things, including the brand of Va loan, regardless if you site web link are a primary-time or repeat debtor, as well as your downpayment count.

- dos.3%, in the event the deposit is actually less than 5%

- 3.6%, whether your deposit was below 5%