Government Put aside rules enjoy a pivotal character in shaping financial prices across the housing market, also to possess mobile house. Rates of interest is actually yourself affected by the newest Fed’s financial coverage choices, particularly the mode of your government finance speed, and this has an effect on financing cost on bank system. In the event the Fed develops this rate, it generally causes higher home loan cost, as the loan providers boost its pricing to maintain profits.

At exactly the same time, new Fed’s monetary mind-set and you will rules adjustments as a result so you can rising cost of living and you may work rates may also impact mortgage prices. Such, from inside the episodes out-of highest rising cost of living, the brand new Fed can get improve interest rates so you’re able to stabilize new cost savings, resulted in improved home loan pricing. However, in services to help you trigger financial development, the newest Provided might straight down interest rates, and then make borrowing from the bank lesser and potentially reducing home loan costs.

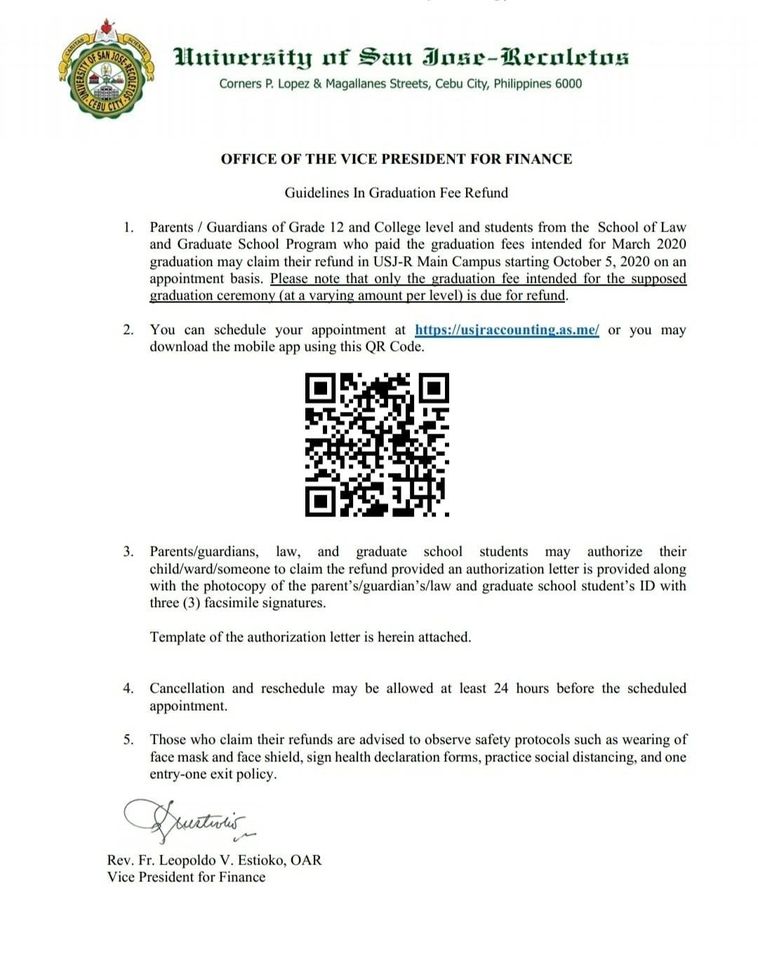

Cellular homebuyers will be stand told from the Federal Put aside rules and you can monetary indicators can be expected alterations in financial cost. Understanding these exterior situations will help people day their purchases smartly to profit out-of all the way down pricing, at some point affecting the affordability and you can timing of buying a cellular family.

How Variable Speed Mortgages Connect with Cellular Home buyers

Variable Price Mortgage loans (ARMs) provide an initial several months which have a fixed interest, then the speed adjusts within durations that will be predetermined considering a certain list. For cellular homebuyers, these types of home loan can also be initially create monthly obligations inexpensive considering the typically straight down undertaking costs compared to fixed-rate mortgages. So it initially lower commission can be such as glamorous having people expecting to improve its earnings over the years or planning to re-finance ahead of the rate adjusts.

But not, this new suspicion regarding upcoming rates improvements presents a critical chance. After the fixed months, in the event the interest levels improve, thus have a tendency to the new monthly obligations, possibly considerably. This will strain the new client’s cash or even effectively planned having. It’s crucial for cellular home buyers to evaluate their long-title financial stability and you will think whether they can handle possible grows within the money.

Customers should glance at this new volume out-of rates alterations together with terminology about how much the rate can change at every adjustment part. Understanding these records helps in contrasting the overall chance and value regarding an arm. Financial advisors can provide valuable wisdom for the if or not an arm perform align really that have a consumer’s economic requires and you can newest economic climates.

Benefits associated with Refinancing Your Mobile Real estate loan

Refinancing a mobile mortgage provide several benefits, particularly in a great rate loans in New Haven of interest ecosystem. One of the first professionals is the possibility to safer a beneficial straight down interest rate, that can reduce the monthly mortgage payments in addition to full interest paid back across the longevity of the borrowed funds. This can take back money for other expenses or financial investments, boosting economic liberty.

Another type of benefit of refinancing is the possible opportunity to adjust the mortgage term. Shortening the loan title increases monthly obligations but notably get rid of the interest cost. Having said that, stretching the word can all the way down monthly premiums, which could assist carry out immediate financial demands, although it advances the overall interest reduced.

Refinancing together with makes it possible for the brand new combination off debts or the tapping towards the house security having requisite expenses instance renovations or crisis finance. Although not, it is necessary to possess people to consider the fresh new closing costs on the refinancing and learn perhaps the much time-name coupons exceed these types of very first costs. Talking to a mortgage expert can provide quality to the if or not refinancing is a sensible monetary flow not as much as newest facts.

Feeling from Financial Race to the Cellular Home mortgage Cost

The amount of battle certainly one of lenders can have a significant feeling towards the mortgage prices accessible to mobile homebuyers. Within the places with high battle, lenders you are going to render more desirable costs and words to capture an excellent huge express out of customers. So it aggressive ecosystem will likely be very theraputic for buyers because will bring a variety of choices in addition to possibility to negotiate most readily useful terms and conditions.