Sandy Smith out of Sure, I’m Cheaper put this problem to our appeal when she displayed us that have problematic via Fb:

Under-served, in reality. Just after a little research towards the several loan providers and you can a call in order to a Coldwell Banker’s financial representative (exactly who promised a real estate agent do follow up with me in this 24 hours, but don’t performed), I became remaining with no obvious solutions, however, way more calculated than before to obtain them.

Just who Need Instance Small Home loans Anyhow?

It was my basic imagine. Expenses the majority of living inside the expansive, densely-inhabited and excessive property ely, the new South Bay’s Seashore Urban centers – I often skip that half-mil dollar house commonly typical throughout the all nation. Considering Trulia, the newest average well worth to have an individual-home during the Los angeles, Ca today try $301,146.

Home owners residing in quick locations otherwise disheartened local economic climates, where assets opinions are quite lowest, don’t need to acquire thousands of bucks purchasing assets – they only you desire to people thinking of buying a beneficial higher-end the vehicle.

You will also have those people property owners who may have secure their loans 15 or twenty five years ago, features paid all dominating equilibrium on the mortgages, but really need certainly to benefit from today’s incredible financial pricing by the refinancing.

Unfortuitously, if we need to obtain otherwise refinance home financing out of only $fifty,100 or less, couple lenders are willing to approve it.

Why Loan providers Dislike Bringing Brief Mortgages

So why would it be so hard to track down a loan provider giving quick mortgage loans below $fifty,000 to start with? Generally, it isn’t worth it on lender (or even the debtor, most of the time).

This is because in case your home loan is for $50k otherwise $500k, mortgage origination and you may repair costs are about the same. A loan many hundred thousand dollars more few age comes with the lender an excellent make the most of focus, if you’re a significantly quicker financing demanding a comparable amount of cash and energy to pay for it output much less. Often, it is far from pricing-active to have a financial to incorporate for example a small mortgage.

If loan providers lose money bringing extremely small home loans, they may not be probably really take the time to advertise their access, way less the greater pricing of this this type of fund. That doesn’t mean, not, that there exists no loan providers on the market who will offer one.

Getting a little Mortgage and you may Choices for Whenever You cannot

Even though these types of brief mortgage brokers is actually uncommon doesn’t invariably suggest they will not exist. If you prefer money for property that does not rates extremely far, you might be capable of getting they if you are ready to make the functions.

Get in touch with Regional Finance companies and you will Credit Unions

Try not to anticipate to head into good BofA otherwise Chase financial place of work and start to become approved to possess a $50k financial. Locate quick lenders, you have got to head to brief organizations.

Very first loans in Danbury end is going to be the local lender; a preexisting connection with a residential area lender otherwise membership with a good borrowing from the bank connection is a fantastic directly into settling a tiny domestic financing. Loan providers are much alot more happy to focus on users which have proven the commitment and you will obligation with currency.

Or even lender which have a community facilities, although not, or if you do, but are denied for a financial loan, you will want to continue to talk with representatives regarding local finance companies and you may CUs close by as well as have him or her remark your debts (only don’t allow them all work with the credit!) to see if a small real estate loan are the possibility. Keep in mind, it may take some time before interested in a loan provider that is happy to work with you.

What you should do Whenever No one Will give you a tiny Real estate loan

If you have attempted calling local loan providers without any luck, it is time to discover alternative ways of resource your house pick.

In lieu of obtaining an interest rate, you can rather money your house buy having fun with a personal loan. There are numerous style of unsecured loans, between secured loans out of big banking institutions, to unsafe, quite high-attract payday loan. Obviously, when you decide towards the a personal loan, it is important that the terminology was manageable and rate of interest is reasonable.

An alternative choice will be to acquire the bucks regarding an individual happy so you’re able to give it out-of-pouch in return for attract from you. There are a few peer-to-peer lending internet that facilitate such purchases and you may tend to have confident reading user reviews: Do well and you will LendingClub.

P2P lending websites such as these are useful since the users (both people and you may borrowers) was pre-screened, just like the interest rates recharged tend to be more competitive than personal bank loan cost from the antique creditors. These two sites serve as the latest middlemen, matching investors with consumers who fulfill certification, as well as a credit check. Like any other financing, the pace billed having a personal bank loan depends upon things such as your credit score, loan amount and you will loan title. You will need to note that maximum loan amount desired by Prosper is $twenty five,one hundred thousand, if you find yourself Financing Bar money funds to $thirty-five,100000.

Why you should Wait Throughout the Short Mortgage brokers

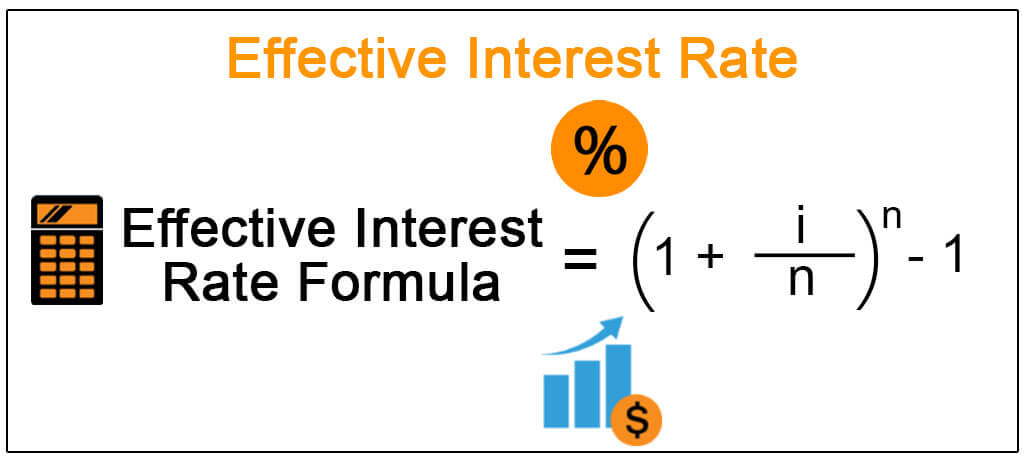

Keep in mind that should you choose manage to financing a home with an interest rate away from below $50k, the rate will likely end up being highest to pay to have the money the lending company are dropping into offer. Likewise, while you are settlement costs regarding, say, $5,one hundred thousand will be experienced very well sensible for the a basic financial, you to means 10% away from a great $50,100000 financing – not so practical more.

Therefore from inside the answer to Sandy’s challenge, financial institutions and you may rates available for mortgages not as much as $50k differ by the applicant, therefore wouldn’t locate them claimed. Certain loan providers outright dont render such quick mortgage loans, if you find yourself people who is going to do such-like a situation-by-situation base.

I would personally suggest people seeking to a mortgage so it quick to cease if you will and extremely remember be it worth it – it may turn out one protecting an interest rate regarding little doesn’t make sense economically. If you want that loan for less than $50k, think wanting an alternative source of investment, ily affiliate or friend, or simply waiting on your get to conserve the money you would certainly be spending on mortgage repayments and you may shell out dollars alternatively.