As well as, the way to get a property collateral financing

- Current email address icon

- Twitter icon

- Twitter icon

- Linkedin icon

- Flipboard symbol

Predicated on analysis firm Black colored Knight, tappable household guarantee is at the a record higher, compliment of rising home prices. That’s leading some home owners to consider a house guarantee financing, which allows you to definitely borrow cash facing your house’s worthy of. These finance generally give repaired rates of interest that include less than bank card and personal mortgage cost. Indeed, certain home equity cost today hover as much as 4%.

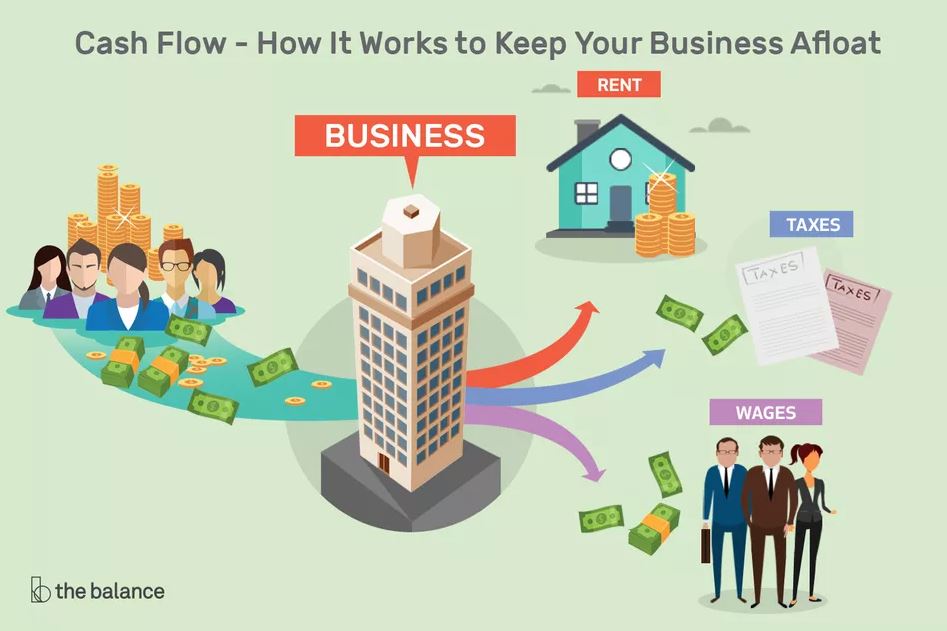

You always make this money in a lump sum payment, and you may pros suggest that family guarantee fund are typically suitable for pay for renovations, debt consolidating, crisis expenses and you may organization expenditures, in lieu of discretionary things such as a holiday. This informative guide, regarding MarketWatch Picks, can help you decide if property equity financing is great to you. And you will lower than, we requested professionals to your finest a means to begin providing a minimal prices towards family equity finance.

Get your credit rating right up

In case your credit history will not meet with the minimal criteria (that’s usually to 620), there are several actions you can take locate recognized having an effective re-finance. Earliest, you can search having a lender that has shorter strict borrowing requirements. Simply because you to definitely bank don’t agree your re-finance doesn’t mean every most other bank will perform the same, states Jacob Route, elder monetary specialist in the LendingTree. Just beware you to the lowest credit score usually affect the interest rates you pay into loan.

Even though you create qualify for a home equity financing, it’s highly possible that boosting your credit history often produce your a level most readily useful interest rate (to find the best prices lenders may look to own scores upwards of 740). To increase your credit rating, generate monthly obligations promptly and you can reduce financial obligation to minimize their borrowing from the bank utilization ratio, suggests Station.

Make sure you has actually a decreased personal debt-to-earnings proportion

Your debt-to-money ratio, or DTI, is actually the monthly debt payments (mortgage; mastercard costs; auto, student otherwise signature loans; boy help, etcetera.) split up by your gross monthly money. Thus, whether your month-to-month debt translates to $2,500 along with your disgusting month-to-month income try $seven,100, your DTI ratio means on the thirty-six% ($dos,500/$seven,000=0.357). DTI conditions differ by the lender, nonetheless usually see a good 43% or down DTI.

Greg McBride, master monetary specialist in the Bankrate, states because family collateral money are cost money, the place you obtain a set amount of money at once and pay back the borrowed funds over a predetermined quantity of costs, having a low loans proportion and you will enough income to consider brand new monthly installments is key. Almost every other crucial financial factors to consider whenever applying for a home equity mortgage become which have enough income, a reliable payment record and a good credit score.

The greater number of guarantee you have, the higher

The more security you’ve got, the greater off you will end up. Try to keep about an unexploited equity share regarding 20% and many more could possibly get websites your a much better bargain, says McBride. To determine how much security you have got of your property, deduct the quantity your debt on the every finance on the appraised property value them family.

Research rates to locate quotes of at the least step three-5 loan providers

Several blog post their property security loan cost on their other sites. You should know the house’s approximate value, how much cash we wish to acquire and how age you need certainly to pay it off, claims Holden Lewis, home and you may financial specialist from the NerdWallet. Dont neglect your current financial often, with a current membership there could mean you’re entitled to advertising or deals.

Fees and you will settlement costs can vary between lenders so it is important to do top-by-front testing off yearly commission rates (APRs) together with costs and one-time costs, claims Paul Appleton, direct away from user credit on Relationship Lender. Commonly, settlement costs for domestic security funds add origination charge, an assessment fee, a credit report fee, insurance costs, document and you can processing fees, title fees and you will fees, and therefore generally speaking start around dos% and you will 5% of one’s overall loan amount, based on LendingTree.

Choose a shorter title

Denny Ceizyk, elder group writer on LendingTree, claims an identical items you to perception HELOCs apply at household collateral fund, even if domestic guarantee loan providers can get lay new pub quite down to own credit ratings, particularly if you do have more security in your home. You likely will get a diminished price if you undertake a great quicker term, domestic collateral mortgage terms and conditions include four so you’re able to fifteen-ages, although some family security loan providers bring terms and conditions so long as 31 many https://paydayloancolorado.net/kim/ years, states Ceizyk.

Look into other kinds of money

In the event the a house equity loan is costing more than you happen to be prepared to blow, it might be worth taking into consideration a property equity line of credit (HELOC) otherwise a personal loan, based on how far you ought to acquire and you will what you are utilising the currency getting.

Guidance, advice otherwise rankings conveyed on this page are those away from MarketWatch Selections, and also have not already been examined otherwise supported because of the the commercial couples.