Pros and cons regarding FHA Financing

A keen FHA loan might sound glamorous while you are having problems rescuing a deposit or being qualified getting a conventional home loan, but it’s only a few a bed of roses.

Here are a few items that bring the life span right away from FHA loans

- Reduced credit rating standards. You could qualify for an enthusiastic FHA financing having a credit history only 500-which could be great apart from fico scores are completely made upwards! You truly don’t need a credit history in order to survive. And this brighten out-of FHA finance is not actually you to definitely helpful.

Check out issues that draw the life right off FHA finance

- Low down payments. You can aquire a keen FHA financing with as little as 3.5% down. Sometimes this new FHA will additionally assist a charitable organization or bank build your advance payment for your requirements-with constraints. So it helps you get into a property quicker than simply rescuing for an advance payment. (The fresh new not so great news: You will be alot more probably end up with a house your can not afford . . . and also to eradicate they if the something alter with your earnings.)

Here are a few points that bring living proper from FHA loans

- Possibility of secured closing costs. New FHA lets family vendors, realtors, designers or designers protection your settlement costs-up to 6% of conversion process rates. But keep an eye out! They may get this to promote in order to persuade that purchase a great money gap.

Listed below are some items that suck the life span right out of FHA money

- Bucks to own family solutions and you may updates. Should you decide to find property that needs works, an effective 203(k) can appear to be a great idea. Keep in mind, those funds actually totally free. You will have to pay it back as part of your mortgage.

Listed below are some items that suck the life span proper regarding FHA financing

- Assistance to prevent property foreclosure. If you be unable to build payments, this new FHA you’ll give you forbearance, meaning they may treat otherwise prevent your mortgage repayments-for those who be considered. 5 Obviously, that can easily be a pretty huge in the event that, so you should never confidence that it advice.

Here are a few points that bring the life proper of FHA loans

- Possibility of all the way down interest levels. Since the FHA guarantees these loans, loan providers see they will certainly receive money in either case. Thus they’re usually much more prepared to make you a lower notice rate into a keen FHA financing than simply a conventional financing.

Below are a few items that draw the life best regarding FHA finance

- Up-top and yearly MIPs. Put another way, MIPs increase the cost of your loan. And you’re purchasing thousands of dollars to benefit the lender, maybe not you.

Here are some things that draw living right off FHA financing

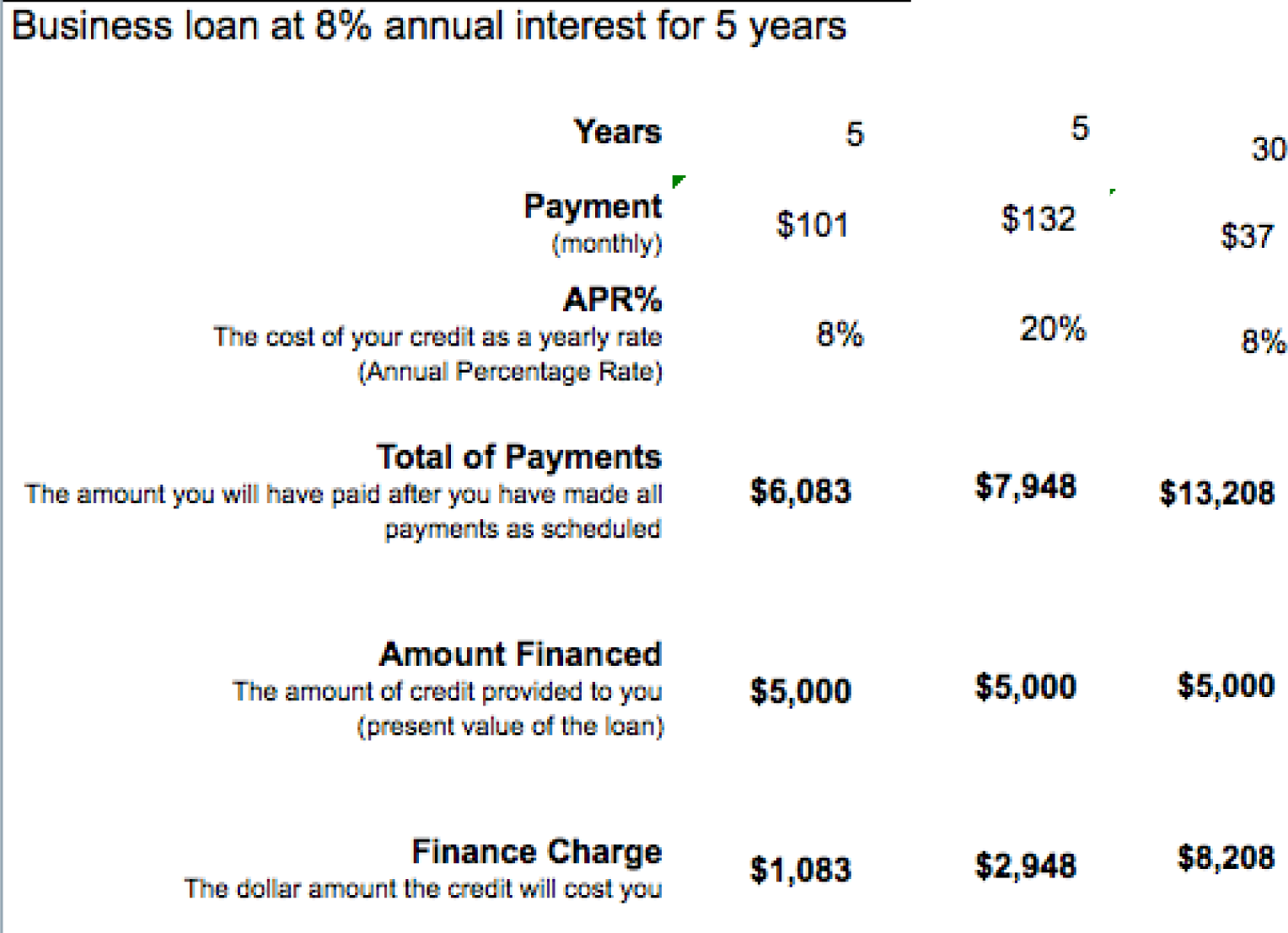

- Bigger ft finance. After you build a small downpayment, you get which have a massive honkin’ legs mortgage. And since your debt a whole lot more, it’s going to either take longer to settle the loan otherwise possible provides a more impressive monthly mortgage repayment. You will become investing so much more desire over the life of the borrowed funds-even though you get a low interest to begin with with.

Below are a few issues that suck the life span right away from FHA money

- Counting on the us government. Look, with a keen FHA financing, government entities is there to simply help lessen the lender’s risk-perhaps not your personal. The federal government is not the hero within this facts, and are generally not swooping into help save you out of a good longevity of leasing. You are the character on the tale, and you may save to have a property in the correct manner. As well as, the government has shown that they’re crappy that have money (take a look at the national obligations otherwise trust us), so why on earth is it possible you must grab its guidance how you really need to manage your debt?

Below are a few items that suck the life best out-of FHA finance

- Higher will cost you in the long run. FHA money are made to provide toward a home having as little money up front to. However, you’ve got to you can find out more look at the enough time-identity will set you back. In the long run, the extra MIPs together with large count overall appeal your pay make FHA funds far more high priced than just traditional money. (On one to in a minute.)