You reside even more than a ceiling more your head. It may be also an excellent supply of lowest-cost investment. In the Suffolk Federal, we are able to make it easier to turn your house guarantee toward cash your are able to use so you’re able to renovate your property, combine obligations, get a secondary, shell out tuition, and so much more.

Bucks when it’s needed: Home Equity Range-of-Borrowing from the bank

Pay just desire with the currency make use of. Mark out of this credit line as needed to fund a great a number of home improvements, pay playing cards, manage crisis expenditures, and more.

Bucks upfront: Repaired Home Equity Financing

Have the full amount of the mortgage upon closure and rehearse it to cover a massive unmarried expenses, instance property recovery.

House Security Range-of-Borrowing (HELOC)

- Intro Annual percentage rate as little as 5.24% getting fifteen days, followed closely by a competitive varying speed (as little as 6.25% APR). *

- Zero settlement costs**.

- Borrow money as required and also make notice-merely payments towards earliest 10 years (this new draw period).

- Outlines out-of $20,100 to $step one,five hundred,000. **

Family Equity Money

- Terms as much as 10 years for a predetermined Domestic Equity Loan & Fixed Home Guarantee First-mortgage.

- High fixed prices and you may predictable monthly premiums.

- Zero settlement costs into the loans as much as $250,one hundred thousand. **

- Use doing 80% of your house’s appraised really worth (quicker a good home loan, if appropriate).

Faqs

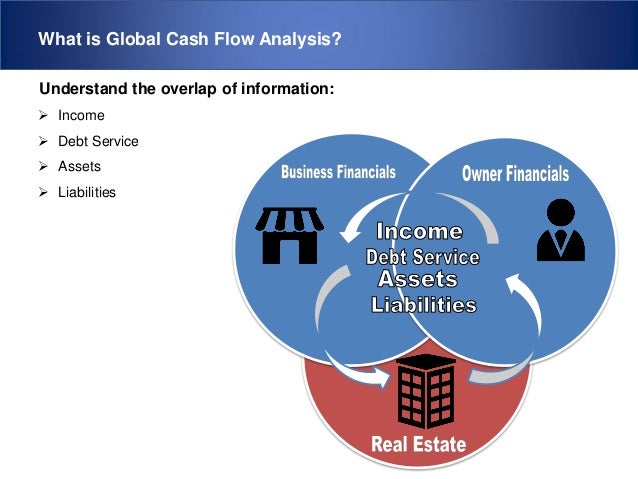

One another style of funding is secured by guarantee on your own household, which is the worth of your residence minus the number your are obligated to pay on the home loan. Because your assets serves as collateral, one another choice also provide larger mortgage amounts and lower rates than the unsecured selection for example signature loans and you will playing cards.

A good HELOC are a good rotating personal line of credit you to definitely allows you to obtain simplycashadvance.net school loan bad credit over and over again. You could mark out of this personal line of credit any kind of time part during the the 10-season draw months (the brand new borrowing from the bank period). Because you lower your debts, your available borrowing from the bank dates back doing enable you to use significantly more. Immediately after your own mark months ends up, your pay back all the dominant and you will interest in monthly installments (based on how far you owe). Of numerous people prefer a beneficial HELOC whilst provides them with the flexibleness so you can borrow cash when needed, such as for example a credit card, as well as only pay desire with the fund they use. Most HELOCs provides a varying rate of interest, that will increase otherwise down according to the markets.

A fixed Home Collateral Mortgage, on the other hand, will bring all fund simultaneously. Although this mortgage provides quicker freedom than simply a great HELOC, it gives a predetermined interest that’ll not rise, including predictable money, so you will be aware ahead of time how much money you will want to invest straight back.

Enough time it will require to close off with the a great HELOC may vary, but some individuals get theirs in only a few weeks. Only at Suffolk Government, we processes programs to make mortgage choices in your neighborhood, which will help you render a quick, much easier procedure for the participants.

When your Home Collateral Line-of-Credit might have been accepted, your HELOC look as a merchant account within this Suffolk Government On the internet Financial. It’s easy to mark from your own line of credit by simply making a keen Account-to-Account import out of your HELOC into the Suffolk Government family savings. You could buy things right from their HELOC utilising the comfort monitors that people gives.

An abundance of conditions might possibly be regularly determine the acknowledged amount borrowed, including your income, a career reputation, and credit score.

One important element could well be how much security you have got within the your house. On Suffolk Government, you have access to doing 80% of your own appraised property value your residence, minus their a great mortgage.