Conversely, if there is high demand for a particular type of asset, the salvage value may increase. Companies can also use industry data or compare with similar existing assets to estimate salvage value. For example, a delivery company might look at the value of its old delivery trucks for guidance. Suppose an asset for a business cost $11,000, will have a life of 5 years and a salvage value of $1,000. The fraud was perpetrated in an attempt to meet predetermined earnings targets.

How Is Salvage Value Calculated?

If you earn capital gains on the disposal of an asset, you’ll typically be required to pay tax on that amount. In the case of capital losses, they can often tax return copy can be downloaded form efile com order offset other capital gains or be carried forward to offset future gains. Enter the asset name, purchase price, purchase date, and expected useful life.2.

Example of salvage value calculation for a car belonging to a business for after and before tax

It is based on the value a company expects to receive from the sale of the asset at the end of its useful life. In some cases, salvage value may just be a value the company believes it can obtain by selling a depreciated, inoperable asset for parts. The salvage value calculator evaluates the salvage value of an asset on the basis of the depreciation rate and the number of years. The salvage value is calculated to know the expected value or resale value of an asset over its useful life. It uses the straight-line percentage on the remaining value of the asset, which results in a larger depreciation expense in the earlier years. At this point, the company has all the information it needs to calculate each year’s depreciation.

Estimate the Asset’s Current Market Value

With a 20% depreciation rate, the first-year expense is $800, and the second year is $640, and so on. The straight-line depreciation method is one of the simplest ways to calculate how much an asset’s value decreases over time. It spreads the decrease evenly over the asset’s useful life until it reaches its salvage value. Companies consider the matching principle when they guess how much an item will lose value and what it might still be worth (salvage value).

- You can use it for estimating the remaining value of an asset at the end of its useful life.

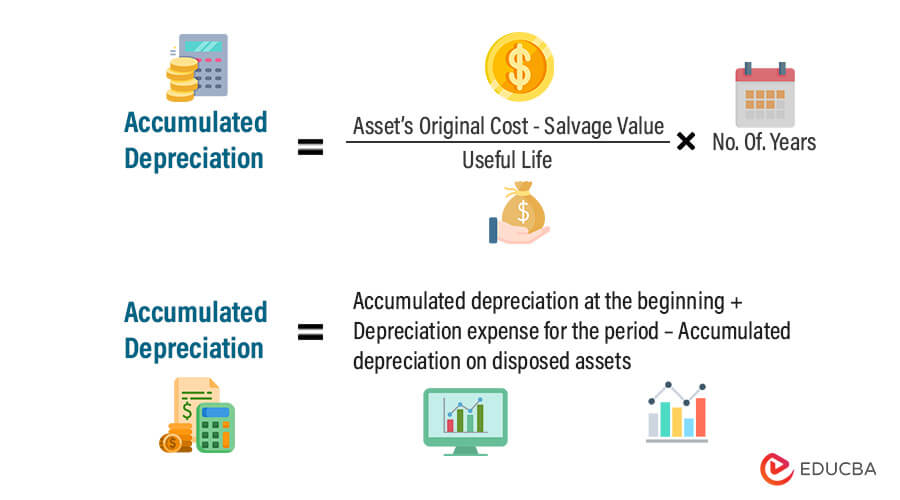

- As such, an asset’s estimated salvage value is an important component in the calculation of a depreciation schedule.

- With added benefits, this calculator also assists in calculating after-tax salvage value, a critical factor in assessing net asset value post-disposal.

- A tax rate of 30% is applicable to both income and gains and is not expected to change in 5 years.

The salvage or the residual value is the book value of an asset after all the depreciation has been fully expired.

How to Use the Salvage Value Calculator

Usually used in accounting, this calculator serves to find the scrap value or resale potential for various assets, including vehicles, equipment, and buildings. This value is significant in calculating depreciation, tax returns, and overall investment planning. In this fashion, it prepares you to understand the true cost of using an asset over time. With a large number of manufacturing businesses relying on their machinery for sustained productivity, it is imperative to keep assessing the equipment they own.

Management must periodically reevaluate the estimated value of the asset as asset deterioration, obsolescence, or changes in market preference may reduce the salvage value. In addition, the cost to dispose of the asset may become more expensive over time due to government regulation or inflation. First, companies can take a percentage of the original cost as the salvage value. Companies take into consideration the matching principle when making assumptions for asset depreciation and salvage value. The matching principle is an accrual accounting concept that requires a company to recognize expense in the same period as the related revenues are earned.

So resale value refers to the value of a purchased car after depreciation, mileage, and damage. While residual value is pre-determined and based on MSRP, the resale value of a car can change based on market conditions. Additionally, consider the example of a business owner whose desk has a useful life of seven years.

Start by estimating how long the asset is expected to be used before it becomes obsolete or unusable. This depends on factors like the type of asset, maintenance practices, and industry trends. Hence, a car with even a couple of miles driven on it tends to lose a significant percentage of its initial value the moment it becomes a “used” car. The carrying value of the asset is then reduced by depreciation each year during the useful life assumption. The salvage value is considered the resale price of an asset at the end of its useful life. The salvage or the scrap value is estimated when the useful life of an asset is over and can’t be used for its original purpose.